As BeInCrypto highlighted in a earlier evaluation when MATIC was buying and selling at $0.74. The value motion stays bullish because the help ranges haven’t been damaged to the draw back.

By analyzing important indicators such because the EMA 100, the Ichimoku Baseline, and the Ichimoku Cloud, we are able to discern the potential for a major bullish breakout.

Polygon (MATIC) Technical Outlook

Let’s analyze the value actions of Polygon (MATIC) utilizing the 1-day chart, specializing in the EMA 100, the Ichimoku Baseline, and the Ichimoku Cloud.

The EMA 100, represented by the blue line, is a major resistance stage.

Over the previous two months, Polygon’s worth has persistently traded beneath the EMA 100, depicted by the blue line. This sustained buying and selling beneath the EMA 100 underscores a bearish pattern. Notably, the final vital try to interrupt above the EMA 100 occurred on April 9. Nevertheless, this try was met with substantial promoting stress, additional reinforcing the bearish sentiment.

The Ichimoku Baseline, illustrated by the crimson line, is a dynamic help stage. The value has repeatedly approached however did not maintain beneath this baseline, indicating constant shopping for exercise at these worth ranges.

The value has entered the Ichimoku Cloud. The decrease boundary of the cloud, at the moment appearing as help, seems to be a difficult stage to interrupt. The value’s entry into the cloud suggests a rise in volatility. A breakout throughout the cloud is anticipated to intensify this volatility additional.

Moreover, the 0.618 Fibonacci retracement stage throughout the cloud is a important resistance level.

Polygon’s worth has been testing this stage, and a sustained breakout above the 0.618 Fibonacci stage might propel it greater.

This breakout can push the value in direction of the higher boundary of the cloud and doubtlessly greater resistance ranges, such because the EMA 100 and the 0.5 Fibonacci retracement line, located across the $0.78 to $0.80 vary.

Learn Extra: How To Purchase Polygon (MATIC) and Every part You Want To Know

Regardless of the prevailing bearish pattern indicated by the EMA 100 and the Ichimoku Baseline, the latest entry into the Ichimoku Cloud introduces the potential for elevated volatility and potential bullish actions.

Polygon Provide Shifting to Good Contracts: A Constructive Indicator

A wise contract is a self-executing contract with the phrases of the settlement immediately written into code. They run on blockchain networks like Ethereum and Polygon. When circumstances specified within the code are met, the contract executes robotically.

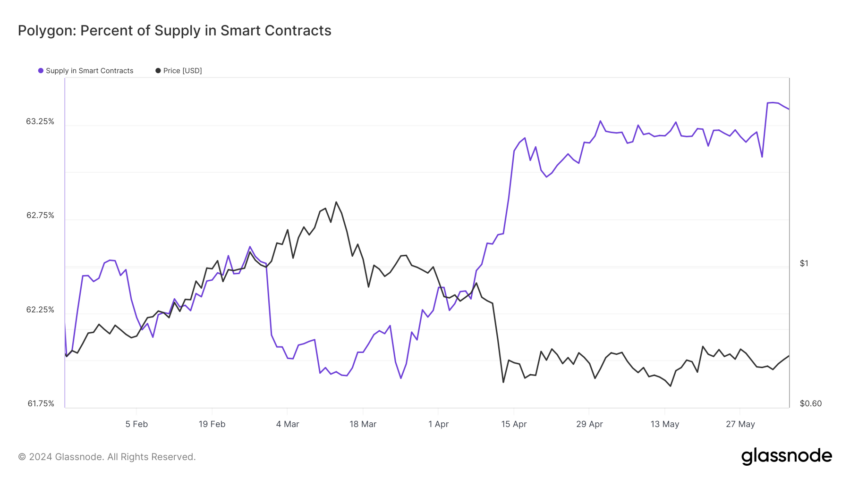

The purple line represents the proportion of the whole MATIC tokens at the moment locked in sensible contracts. These contracts might be associated to decentralized finance (DeFi) purposes, staking, or different blockchain-based companies.

Over the given interval, the proportion of MATIC in sensible contracts fluctuates. There was a dip firstly of the interval, adopted by a gradual improve. Round mid-April, there’s a vital soar within the share, suggesting a surge in sensible contract exercise on the Polygon community.

A better share of MATIC in sensible contracts signifies extra energetic community use. This might imply extra individuals use MATIC for DeFi, staking, or different purposes, showcasing the token’s utility and demand.

Over the previous two months, almost 2% of the whole provide has been allotted to sensible contracts.

Fewer can be found available in the market when extra tokens are locked in sensible contracts. This will cut back provide and, relying on demand, doubtlessly result in a rise in worth.

Strategic Suggestions

The bullish to impartial outlook might shift to bearish if the value exits the cloud to the draw back and breaks beneath the baseline at $0.70. Inserting stops on this area might be a prudent technique.

A breakout throughout the cloud will doubtless improve constructive volatility. Pay shut consideration to how the value behaves across the 0.618 Fibonacci retracement stage. A sustained transfer above this stage might point out a shift in momentum.

Learn Extra: Polygon (MATIC) Worth Prediction 2024/2025/2030

If the value breaks above the EMA 100, it could sign a possible bullish reversal. This stage has been a robust resistance, which might result in vital upside potential.

Over the previous two months, almost 2% of the whole provide has been allotted to sensible contracts. This improve in sensible contract exercise suggests extra energetic community use, which might positively impression the value. Monitoring this metric can present insights into the community’s well being and potential demand for MATIC.

Disclaimer

Consistent with the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.