At present, we’re happy to current a visitor contribution written by Luisa Carpinelli, Filippo Natoli, Kevin Pallara, Luca Rossi, Sergio Santoro and Massimiliano Sfregola; Financial institution of Italy, DG-Economics, Statistics and Analysis, Superior Economies and Macroeconomic Insurance policies Division. The views offered on this column characterize these of the authors and don’t essentially mirror these of the Financial institution of Italy or the ESCB.

| This evaluation critically evaluates the forecasting efficiency of Fed fund futures (FFF) and that of the Federal Reserve’s Abstract of Financial Projections (SEP) within the context of predicting Fed Fund charges. Regardless of FFF being a extensively used market-based measure, its reliability has been questioned resulting from frequent forecasting inaccuracies. In early 2024, a big divergence between FFF and SEP projections reignited these considerations. FFF quotations mirror each market expectations and a threat premium, which may distort predictions, particularly for long-term forecasts. Utilizing the Survey of Main Sellers (SPD) and by taking a look at easy model-free measurements of threat premia, this evaluation means that whereas FFF can information current-year forecasts, SPD median forecasts ought to be most well-liked for longer horizons. Visible comparisons by way of “spaghetti charts” point out that each the Fed and markets typically miss out on predicting future coverage charges. Relative Imply Absolute Forecast Errors present that the Fed’s forecast errors are, on common, solely marginally higher than the markets’. Nevertheless, particular episodes, comparable to 2019-Q2 and post-SVB collapse in 2023-Q1, reveal that market misjudgments had been primarily influenced by threat premia. This evaluation gives a sturdy comparability between the Fed’s and markets’ forecasting skills, highlighting the need of complementing FFF with SPD forecasts to higher perceive divergences. |

Expectations concerning the path of Fed Funds charges are monitored and analyzed worldwide, as US financial coverage is a key driver of the macroeconomy, each domestically and in different jurisdictions.[1] Monetary markets are an essential supply of expectations on Fed Funds, additionally resulting from their excessive frequency availability. Essentially the most generally used metric by far are quotations from 30-day Federal Funds Futures (FFF) traded on the Chicago Board of Commerce. These futures are settled based mostly on the month-to-month common of the day by day efficient Federal Funds Price, thereby offering a pure market-based measure of what traders imagine the Fed will resolve within the following months. A downside of this indicator is that its out-of-sample forecasting efficiency is questionable, as many instances it fails to foretell precisely what the Fed will do.[2]

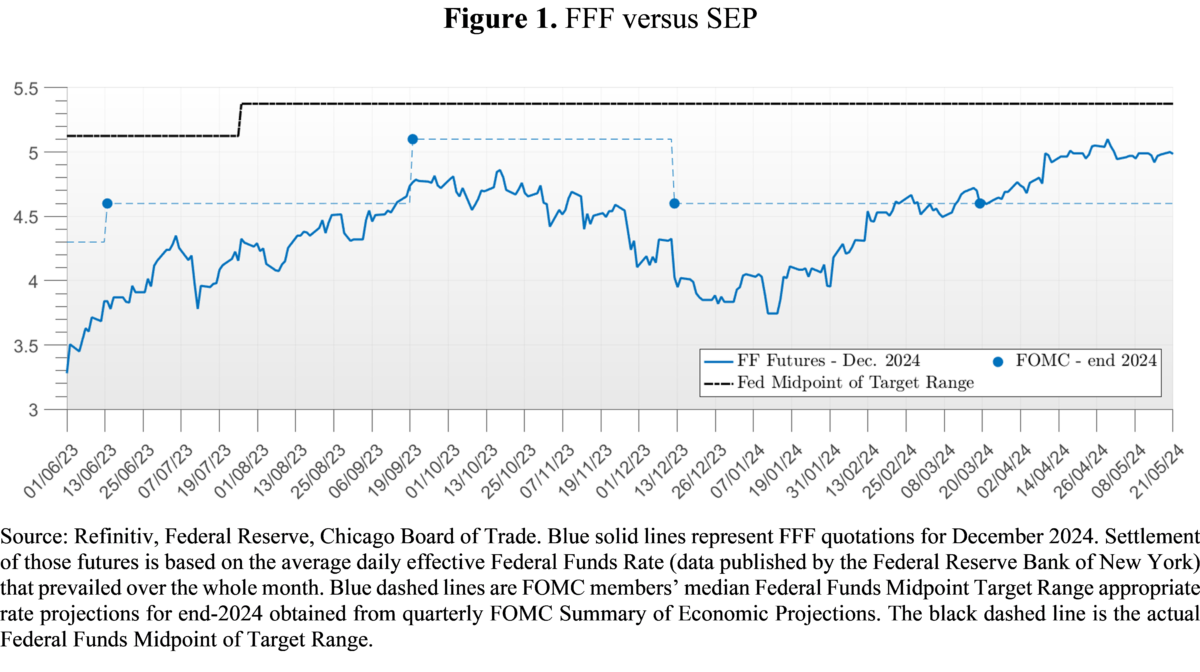

Doubts on the reliability of FFF resurfaced firstly of 2024, when a really massive divergence between median coverage charges projections reported by the Fed in its Abstract of Financial Projections (SEP)[3] and FFF quotations emerged. As of mid-January, FFF had been suggesting the Fed would have minimize charges by about 150 foundation factors, twice as a lot what the Fed itself was reporting a couple of weeks earlier within the December SEP (see Determine 1).

Supply: Refinitiv, Federal Reserve, Chicago Board of Commerce. Blue strong strains characterize FFF quotations for December 2024. Settlement of these futures relies on the typical day by day efficient Federal Funds Price (information revealed by the Federal Reserve Financial institution of New York) that prevailed over the entire month. Blue dashed strains are FOMC members’ median Federal Funds Midpoint Goal Vary acceptable charge projections for end-2024 obtained from quarterly FOMC Abstract of Financial Projections. The black dashed line is the precise Federal Funds Midpoint of Goal Vary.

Critics of markets’ forecasts absolutely have a legitimate level: FFF have many instances missed what the Fed would have carried out by a large margin. Nevertheless, earlier than discarding markets’ forecasts, we should always look deeper into some associated points. Can we take as a right that FFF are at all times a legitimate proxy for market expectations? Has the Fed been good at envisaging the long run course of coverage charges? Extra broadly, are markets or rate-setters higher at forecasting coverage charges?

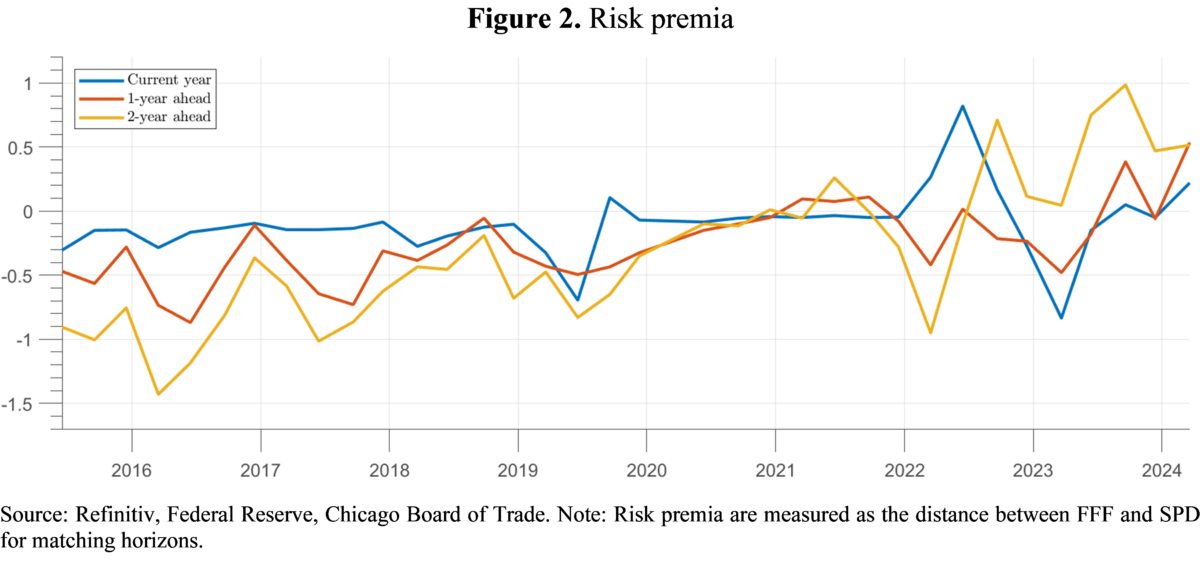

Earlier than digging in a full-blown horse race, let’s begin by tackling the primary of the above questions, that’s, can FFF at all times be interpreted as markets’ expectations of the Fed Funds charge? The rationale for the query stems from the truth that FFF quotations, like these of many different derivatives, could be seen because the sum of expectations relating to the underlying variable of curiosity and a threat premium required by risk-averse traders. To judge the potential relevance of the second element we quantify it in a quite simple method, exploiting the Survey of Main Sellers (SPD) maintained by the New York Fed. The survey is performed earlier than every FOMC assembly and – amongst different issues – gathers forecasts on the end-year coverage charge, GDP development, the unemployment charge, and inflation identical to the SEP, making it a pure choice to match markets’ and Fed’s views round FOMC conferences.[4] We then take the straightforward distinction between FFF quotations on the final day main sellers can fill within the SPD and median expectations reported by main sellers to the Fed within the SPD, acquiring model-free measures of the chance premium for current-year, 1-year forward, and 2-year forward forecasts (see Determine 2).

Danger premia are comparatively low for current-year forecasts (with some exceptions) whereas they have an inclination to sit down at sizeable ranges for one- and two-year forward forecasts. This suggests that FFF can present biased and deceptive estimates of market expectations for horizons that most of the above spaghetti charts embody. Thus, the rule of thumb we propose is to enhance FFF with SPD median forecasts by counting on the extra well timed FFF for current-year forecasts, and to as a substitute have a look at SPD for longer horizons. As will probably be seen later although, additionally current-year FFF fluctuations could be dominated by threat premia throughout notably turbulent instances.

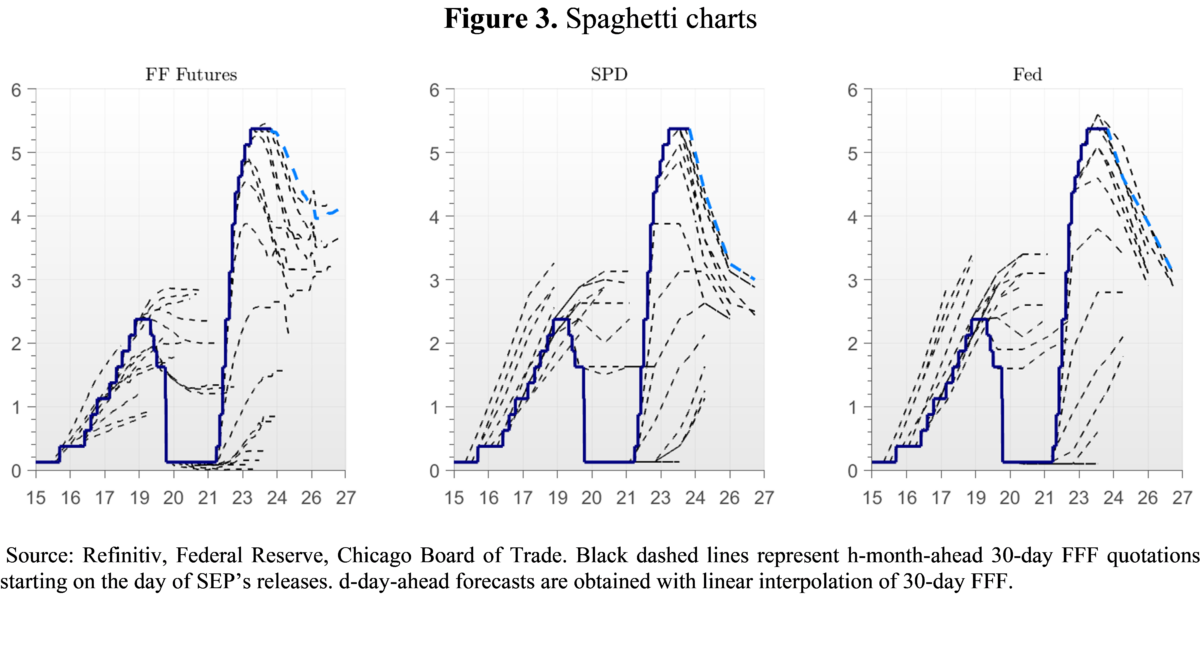

As what regards the primary query on the validity of FFF as a proxy for market expectations, we suggest the favored “spaghetti charts” reported within the above analyses additionally for FOMC median projections (see Determine 3). From a fast visible inspection, it’s evident that many instances the Fed foresees its future choices additionally with relatively unsatisfactory outcomes. Spaghetti charts nevertheless are solely a really qualitative first step to gauge the relative efficiency of Fed versus markets. A extra analytical method is required.

Let’s now give attention to a proper comparability between the typical forecast accuracy of markets versus the SEP. As a metric, we have a look at the Relative Imply Absolute Forecast Errors (MAFE), computed because the Fed’s common MAFE minus markets’ common MAFE; we discover that Fed’s forecast errors are on common at most solely 3 foundation factors decrease than these of the markets. Thus, the Fed doesn’t constantly outperform markets on common, which means that FOMC forecasts are unconditionally simply nearly as good as these of the markets.

However, even when on common there are not any significant systematic discrepancies, variations emerge in a couple of episodes. First, in 2019-Q2 FFF quotations for end-year lowered from 2.3% to 1.7%, pricing a 60 foundation factors charge minimize. Throughout 2019 the talk revolved round worries about when one of many largest expansions in US historical past would have come to an finish, with materials world dangers threatening to place a brake on the US enterprise cycle. Inflation was additionally recording fairly low figures on the time. Despite markets bets, the FOMC maintained its forecast at 2.4% on the June assembly. Throughout the 12 months nevertheless, the Fed certainly determined to decrease charges right down to 1.6%. At first sight, this thus seems to be one case the place markets had a greater view of the trajectory of Fed Fund charges.

Quite the opposite, after Silicon Valley Financial institution (SVB) collapsed in March 2023, FFF dropped from 5.6% on March 8 to 4.0% in three buying and selling days, however in its March FOMC assembly the Fed maintained its end-2023 forecast at 5.1%. Throughout the remainder of the 12 months, the Fed raised charges by 1 p.p. to five.4%. Judging from FFF alone, this turned out to be a spectacular failure of markets’ evaluation.

However, in each 2019-Q2 and 2023-Q1 SPD forecasts had been similar to these of the FOMC, thereby implying that in these two particular instances these divergences had been primarily resulting from threat premia. But, many analysts attributed the drop in FFF to an equal drop in markets’ expectations of coverage charges.[5] Subsequently, the above examples present that in turbulent instances, even inside comparatively brief time durations (lower than one 12 months) FFF also can show to be an unreliable measure of market expectations, and analysts ought to use SPD as a substitute. Basically, we deem smart to match FFF towards pure expectations (not distorted by threat premia) at any time when obtainable, to have a tough concept of whether or not in any given second FFF could be trusted to start with.

Our work additionally leverages data on further macro variables obtainable within the SEP and within the SPD to make clear the underlying the reason why the Fed and markets can diverge. As an example, throughout 2022 markets had been repeatedly forecasting a milder cumulated end-2023 tightening than the Fed was making an attempt to convey. We discover this was at the very least resulting from i) markets forecasting decrease inflation and weaker GDP development, and ii) markets estimating a barely decrease r*. Furthermore, we discover {that a} additional chunk of the divergence between Fed and markets can generally be ascribed to durations of comparatively excessive uncertainty as judged by the central tendency obtainable within the SEP, the interquartile vary within the SPD, or Treasury volatility implied by the MOVE.

To conclude, we offer a complete and constant comparability between Fed’s and markets’ views and forecasting performances, and our framework could possibly be used going ahead to evaluate additional divergences. We produce proof that FFF alone could be a severely biased measure of market expectations, due to the presence of a considerable threat premium at longer horizons or throughout turbulent durations. We then recommend to enhance FFF with SPD forecasts. On common, we discover that the Fed isn’t higher than markets in foreseeing its personal choices, however throughout particular episodes marked variations emerge, which may at the very least partly be defined by exploiting further forecasts obtainable each within the SEP and within the SPD.

[1] See, for instance, Miranda-Agrippino, Silvia and Hélène Rey (2020) “U.S. Monetary Policy and the Global Financial Cycle,” The Evaluation of Financial Research, 87 (6), 2754–2776, and Degasperi, Riccardo, Seokki Hong, and Giovanni Ricco (2020) “The global transmission of US monetary policy.” CEPR Dialogue Paper No. DP14533.

[2] See, for instance, “Investors May Be Getting the Federal Reserve Wrong, Again”, The Economist, January twenty fourth 2024; “Investors are Almost Always Wrong about the Fed”, The Wall Road Journal, February eighth 2024.

[3] SEP are quantitative data collected at quarterly frequency on the expectations on inflation, development, and unemployment of particular person members of the Board of Governors and every Federal Reserve Financial institution president. Additionally they embody expectations on future Federal Funds charge related to these macroeconomic projections: surveyed members are additionally requested which path of the Federal Funds charges deem acceptable given their very own financial forecasts.

[4] The drawbacks of the SPD are that i) it’s obtainable solely eight instances per 12 months, specifically, the identical frequency as FOMC conferences; ii) it’s revealed three weeks after the FOMC assembly; iii) the survey is stuffed round ten days earlier than every FOMC assembly, subsequently the data set of Main Sellers is much less full than that of FOMC members as essential macroeconomic releases could be revealed in that point span. Nevertheless, the crucial benefit is that it supplied clear markets’ expectations of the Fed Funds Price. A caveat to this reasoning is that we implicitly assume expectations of main sellers to coincide with these of brokers investing in FFF; evaluating SPD expectations with these within the Survey of Market Individuals (SMP) additionally maintained by the New York Fed we famous that the 2 are very related, thereby giving help to our assumption.

[5] See for instance “US bank stocks tumble and Treasuries rally amid SVB collapse”, Monetary Occasions, 13th March 2023.

This put up written by Luisa Carpinelli, Filippo Natoli, Kevin Pallara, Luca Rossi, Sergio Santoro and Massimiliano Sfregola.