Bakkt Holdings Inc., the crypto buying and selling and custody platform launched by the New York Inventory Change (NYSE) dad or mum, is reportedly exploring potential sale or breakup choices.

This consideration emerges amid a spike in crypto-related takeover exercise.

Evaluating Bakkt’s Monetary Well being and Future

The corporate has engaged a monetary advisor to judge varied strategic paths, together with a possible breakup. Nevertheless, a closing resolution has but to be made, and Bakkt might stay unbiased. A consultant for Bakkt declined to touch upon the matter.

This growth follows important management modifications at Bakkt. In March, Bakkt appointed a brand new CEO and president amid going through the danger of being delisted from the NYSE for failing to fulfill itemizing necessities.

Learn extra: The 7 Hottest Blockchain Shares to Watch in 2024

Andy Major, a board member since Bakkt’s public itemizing in 2021, took over from Gavin Michael. Michael stepped right down to pursue different alternatives however will function an advisor via March 2025.

“Andy has the expertise to lead the company forward from this inflection point, with a focus on broadening our institutional crypto capabilities, growing our client base, expanding internationally, and driving towards adjusted EBITDA breakeven,” Michael mentioned.

In February, Bakkt confronted liquidity difficulties and sought permission from the US Securities and Change Fee (SEC) to extend capital by as much as $150 million over three years. The corporate additionally plans a reverse inventory break up to enhance monetary efficiency. Bakkt raised $40 million via a non-public placement to institutional buyers and a further $10 million to bolster its capital.

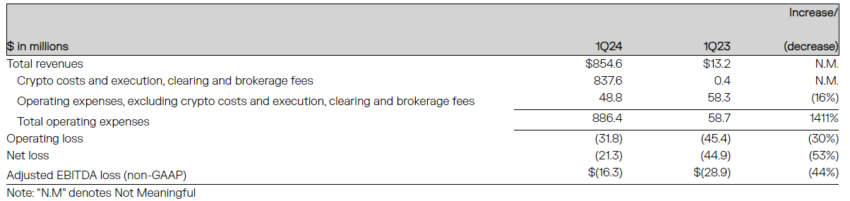

Regardless of these efforts, Bakkt reported a first-quarter lack of $1.86 per share, higher than the anticipated lack of $2.08. The corporate posted a first-quarter lack of $21 million on $855 million in income. These monetary challenges spotlight the urgency for Bakkt to discover strategic options.

Learn extra: High 5 Crypto Corporations That May Go Public (IPO) in 2024

Bakkt’s resolution to think about a sale or breakup comes as some firms increase after recovering from the crypto business’s widespread downturn in 2022. The multi-asset buying and selling platform Robinhood just lately introduced its acquisition of the European crypto change Bitstamp. Moreover, crypto miner Riot Platforms proposed taking on its rival Bitfarms.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.