Actual-world asset (RWA) tokenization has turn out to be the top-performing crypto sector, outperforming main sectors like Ethereum (ETH) and Bitcoin (BTC).

Important developments, together with high-profile asset tokenizations and constructive regulatory discussions, drive this surge. It additionally highlights the sector’s rising potential and significance within the monetary trade.

Excessive-Profile Use Circumstances and Rules Enhance the RWA Tokenization Sector

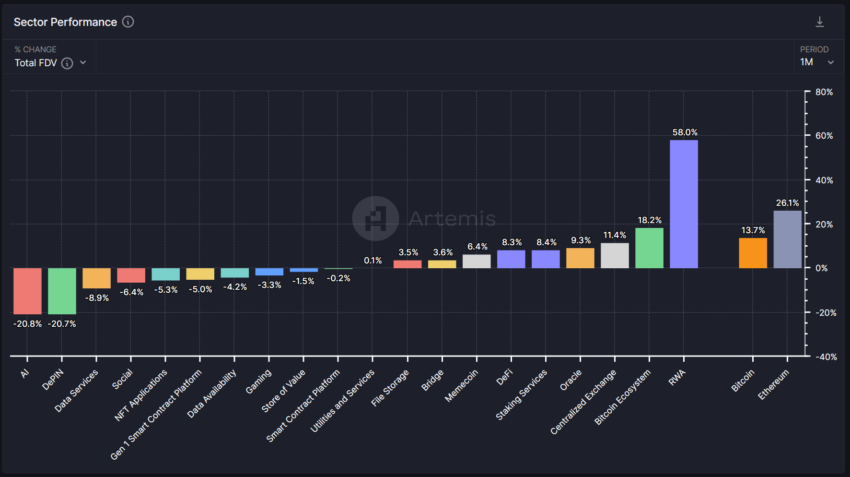

In response to knowledge from the crypto analytics platform Artemis Terminal, real-world asset tokenization was the best-performing crypto sector final month, with a 58% efficiency in comparison with the opposite 21 sectors. Ethereum and Bitcoin ecosystems adopted, with 26.1% and 18.2% efficiency, respectively.

Learn extra: RWA Tokenization: A Take a look at Safety and Belief

RWA tokenization has seen important development just lately, pushed by key developments within the sector. On June 4, Galaxy Digital issued a multimillion-dollar mortgage secured by a 316-year-old Stradivarius violin.

The mortgage makes use of the Stradivarius violin and its digital illustration as a non-fungible token (NFT) as collateral. This technique ensures sturdy safety for Galaxy Digital whereas offering asset administration flexibility. The bodily violin stays below custodianship in Hong Kong, with stringent necessities for its removing.

On the identical day, Watford Soccer Membership (Watford FC) additionally initiated a digital fairness sale. Partnering with digital funding platform Republic, the sale affords roughly 10% of its shares. This fairness sale can be out there on Republic’s platform and Seedrs, its European counterpart.

Moreover, regulatory developments supported the sector. On June 7, the US Monetary Companies Committee held a listening to titled “Next Generation Infrastructure: How Tokenization of Real-World Assets Will Facilitate Efficient Markets.” The listening to assessed the necessity for extra laws to assist tokenizing real-world property and by-product merchandise.

Notable trade figures participated within the listening to. Carlos Domingo, Co-founder and CEO of Securitize, and Robert Morgan, CEO of the USDF Consortium, represented the real-world asset tokenization trade. Lilya Tessler, Accomplice at Sidley Austin LLP, and Nadine Chakar, International Head of Digital Property on the Depository Belief and Clearing Company, contributed from the monetary markets sector. In the meantime, Prof. Hilary Allen from the American College Washington School of Legislation offered an instructional perspective.

Regardless of different views from witnesses and lawmakers, the listening to highlighted the continued debate about blockchain know-how in conventional finance. Regulatory readability from such discussions might pave the best way for broader adoption of tokenization.

The long-term trade outlook stays constructive. BlackRock CEO Larry Fink has expressed optimism about tokenization.

He famous its means to allow custom-made methods and instantaneous settlement of bonds and shares. In response to Fink, these talents can considerably cut back settlement prices.

Jenny Johnson, Franklin Templeton CEO, additionally highlighted the transformative potential of tokenizing real-world property. She cited examples similar to Rihanna’s NFT royalties and loyalty packages at St. Regis in Aspen.

“It’s this combination of loyalty programs with real-world assets, and I think that you’re going to see more and more companies do this combination. It’s simply that the technology is enabling you to do it,” she opined.

Moreover, Johnson famous that tokenizing property, like Franklin Templeton’s tokenized cash market fund, affords decrease entry factors and operational prices, making skilled asset administration extra accessible to youthful traders. She believes holding investments in a digital pockets can encourage youthful folks to save lots of for retirement by permitting smaller, extra manageable investments.

Learn extra: What’s Tokenization on Blockchain?

General, Johnson envisions conventional finance establishments more and more leveraging blockchain know-how. This integration into mainstream funding practices goals to foster larger monetary inclusion and encourage financial savings habits amongst youthful generations.

Disclaimer

All the knowledge contained on our web site is revealed in good religion and for normal data functions solely. Any motion the reader takes upon the knowledge discovered on our web site is strictly at their very own threat.