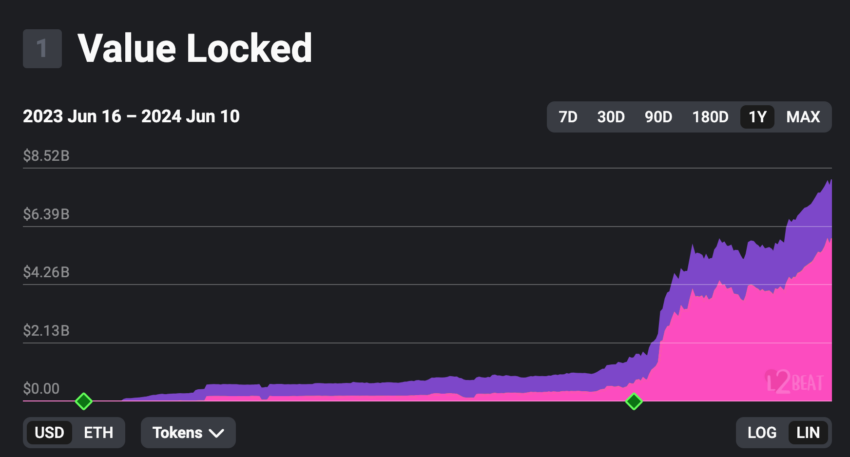

Coinbase’s layer-2 (L2) Base has reached a brand new milestone. In only a few days, the platform’s whole worth locked (TVL) rose to over $8 billion, surpassing certainly one of its main rivals—Optimism.

This achievement presents Base’s fast ascent within the competitors amongst Ethereum-based L2 options. It additionally solidifies its place as a key participant within the blockchain ecosystem.

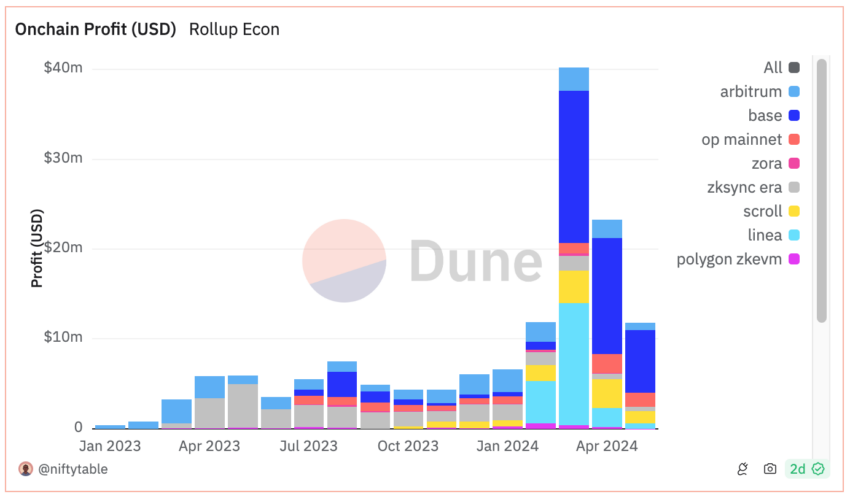

Base Leads in Transactions and Earnings Amongst Ethereum L2s

In keeping with L2Beat knowledge, Base reached $8 billion TVL as of June 10. This contains $2.14 billion in bridged worth and $5.92 billion in native tokens minted on the blockchain. The latest achievement places Base simply behind Arbitrum One, which has a TVL of $18.27 billion.

Learn extra: A Newbie’s Information to Layer-2 Scaling Options

Since its launch in August final 12 months, Base has seen spectacular development. By February 27, the platform reached the $1 billion mark in TVL, which has elevated eightfold within the final 104 days.

With a median of 30.36 transactions per second (tps) over the past month, Base leads all Ethereum L2 options. For comparability, Arbitrum One averages 23.52 tps. In whole, Base processed 64.86 million transactions within the earlier 30 days.

Base additionally leads in earnings. Over the previous three months, the platform generated the very best on-chain earnings, in response to Dune Analytics, together with a file $16.9 million in March. Though earnings fell 58.6% to $6.98 million in Might, Base remained properly forward of Optimism, which solely took in $1.57 million over the identical interval.

Nonetheless, Base’s fast development and recognition additionally deliver challenges. In the course of the meme coin increase within the first months of 2024, the community noticed an 18-fold enhance in funds stolen via phishing scams. This problem aligns with a latest remark from Ryan Lee, Chief Analyst at Bitget, relating to the safety and vulnerabilities of sensible contacts.

“With the development of the encryption field, more complex smart contracts will be developed to meet the increasing number of user requests. The vulnerability risk associated with highly complex code is also gradually increasing, which can lead to the loss of funds,” Lee informed BeInCrypto.

Learn extra: Layer 1 vs. Layer 2: What Is the Distinction?

Moreover, Lee thinks that regulatory challenges continuously evolve on account of Ethereum’s steady technological development and the widespread adoption of Layer-2 options.

Disclaimer

All the data contained on our web site is revealed in good religion and for common info functions solely. Any motion the reader takes upon the data discovered on our web site is strictly at their very own danger.