That’s the title of a Timoros/WSJ article three days in the past:

Sometimes within the restoration from a downturn, households are extra cautious about spending and are more likely to save. When charges are low, borrowing helps spending. Excessive charges choke off that spending.

This time, financial exercise has been supported extra by wealth and incomes than by credit score. The pandemic altered spending habits which, along with greater asset costs, strong job prospects and authorities stimulus, left extra households feeling flush.

As I famous in a earlier recounting enterprise cycle indicators for Could/April, the reply to the above query might be: (1) the recession is right here and we simply don’t see it within the preliminary knowledge, (2) the recession remains to be coming, because the timing between time period unfold inversion and recession onset is variable, (3) the mannequin we used is unsuitable, (4) it’s simply luck of the draw (earlier estimates primarily based on shorter samples nonetheless didn’t point out 100% possibilities, e.g. right here).

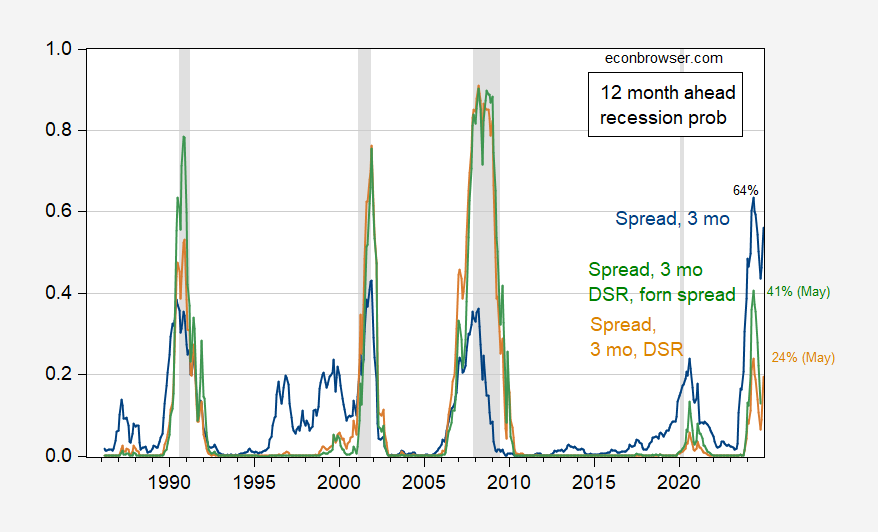

Right here is an up to date evaluation of recession possibilities (for 12 months forward), together with knowledge via Could 2024, and assuming no recession has arrived as of June 2024.

Determine 1: Probit estimated recession possibilities for 12 months forward, utilizing 10yr-3mo unfold and three month charge (blue), 10yr-3mo unfold, 3 mo charge, and debt-service-ratio for personal nonfinancial sector (tan), and 10yr-3mo unfold, 3 mo charge, debt-service-ratio for personal nonfinancial sector, and overseas time period unfold (inexperienced). Pattern for estimation 1985M03-2024M06. NBER outlined peak-to-trough recession dates shaded grey. Supply: Creator’s calculations, and NBER.

Notice that the overseas time period unfold augmented specification (an Ahmed-Chinn specification stripped of oil costs, fairness returns/volatility, and monetary situation index, augmented with debt service ratio) solely peaks at 41% for Could. The DSR augmented specification (following Chinn-Ferrara, omitting monetary situations index) produces a 24% peak recession chance for Could 2024. This latter specification incorporates the concept of sturdy client steadiness sheets, and the insulation of mortgage holders by way of fastened charge mortgages, to the extent that the debt service ratio stays comparatively low.

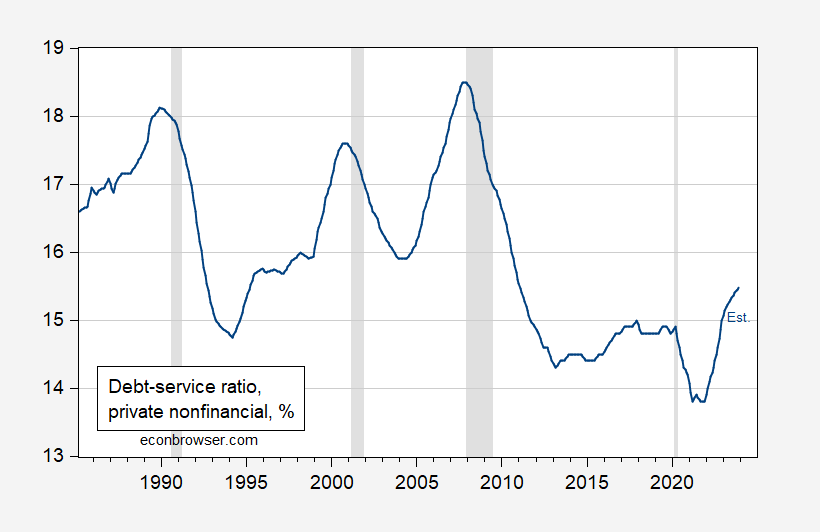

Determine 2: Debt-service ratios for nonfinancial personal sector, % (blue). 2023Q4 is estimated utilizing rates of interest (see right here). NBER outlined peak-to-trough recession dates shaded grey. Supply: BIS, Dora Fan Xia, NBER, and writer’s calculations.

Peak estimated possibilities are for Could 2024; we’ve got solely employment knowledge for Could (on the month-to-month frequency).

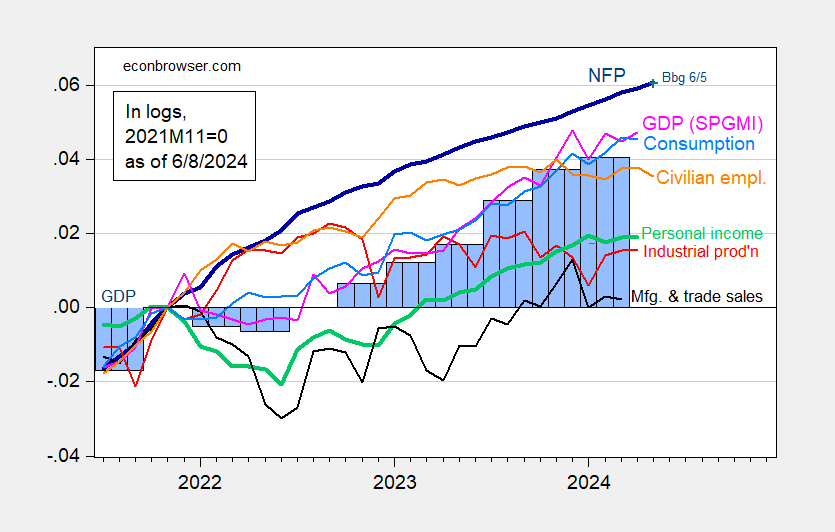

Determine 3: Nonfarm Payroll (NFP) employment from CES (daring blue), civilian employment (orange), industrial manufacturing (pink), private earnings excluding present transfers in Ch.2017$ (daring inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (mild blue), and month-to-month GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Supply: BLS by way of FRED, Federal Reserve, BEA 2024Q1 second launch, S&P World Market Insights (nee Macroeconomic Advisers, IHS Markit) (6/1/2024 launch), and writer’s calculations.

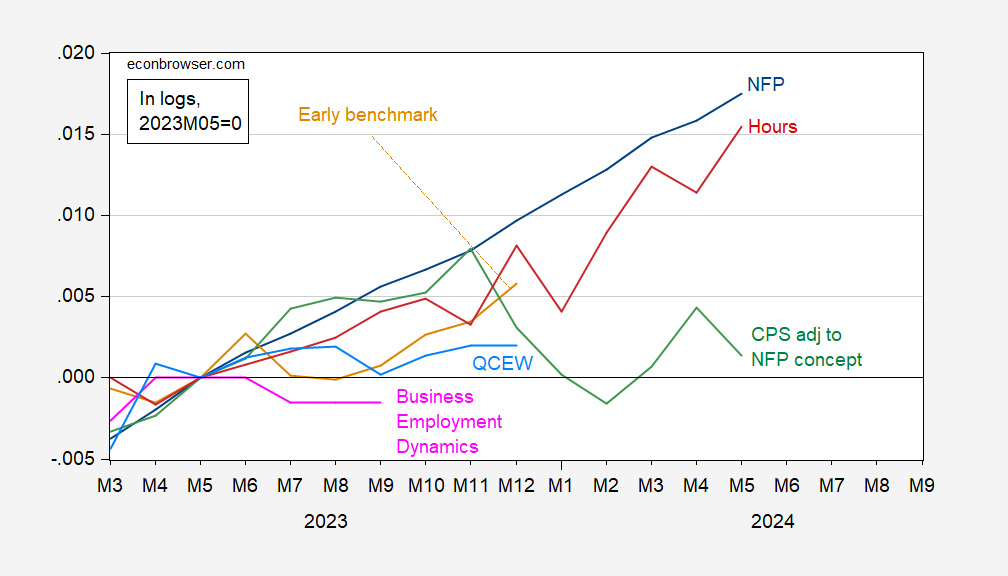

And different extra dependable indicators counsel much less strong development, at the very least via finish 2023.

Determine 4: Nonfarm payroll employment (blue), early benchmark, calculated by adjusting precise utilizing ratio of early benchmark sum of states to CES sum of states (tan), CPS measure adjusted to NFP idea (inexperienced), QCEW whole lined employment seasonally adjusted by writer by utilizing geometric transferring common (sky blue), Enterprise Employment Dynamics web development cumulated on 2019Q4 NFP (pink), and combination hours (pink), all in logs, 2023M05=0. Supply: BLS, Philadelphia Fed, and writer’s calculations.