Industrial and Industrial Financial institution of China (ICBC), the most important Chinese language financial institution, lately revealed a report highlighting Bitcoin (BTC) and Ethereum’s (ETH) potential. Notably, the report refers to Ethereum as “digital oil,” emphasizing its function within the digital economic system.

This endorsement by such a distinguished monetary establishment highlights Ethereum’s rising significance and potential for future technological developments.

ICBC Spotlights Ethereum’s Important Function in Digital Economic system

In a report extensively circulated by Matthew Sigel, Head of Digital Property Analysis at asset supervisor VanEck, ICBC acknowledges the potential of varied digital currencies. These embrace BTC, ETH, stablecoins, and central financial institution digital currencies (CBCDs).

Whereas ICBC notes that Bitcoin retains gold-like shortage, the financial institution additionally praises Ethereum for its steady safety, scalability, and sustainability upgrades. ICBC analysts say these features present technical energy for the digital future.

Learn extra: How one can Purchase Ethereum (ETH) and Every part You Have to Know

Moreover, the report highlights Ethereum’s distinctive benefit of introducing Turing completeness with its Solidity programming language and Ethereum Digital Machine (EVM). This functionality permits advanced sensible contracts and purposes.

“Its flexibility has been widely recognized in the fields of decentralized finance (DeFi) and non-fungible tokens (NFT) and is gradually extending to the physical infrastructure network (DePin),” the report reads.

Nonetheless, ICBC factors out that this flexibility presents challenges. ICBC emphasizes safety considerations come up as a result of Turing completeness permits arbitrary code execution, together with doubtlessly malicious code. Moreover, advanced sensible contracts are liable to vulnerabilities, complicating safety audits.

Scalability is one other problem, because the computational calls for of sensible contracts may cause community congestion and enhance transaction charges. Regardless of these challenges, ICBC acknowledges the efforts of builders repeatedly in search of technological breakthroughs.

ICBC’s report is especially noteworthy given China’s stringent stance on Bitcoin and crypto-related transactions. Conventional banks sometimes undertake a cautious strategy towards digital belongings, making ICBC’s perspective much more vital.

The financial institution’s view aligns with a current report from VanEck, which additionally mentions Ethereum as “digital oil.” They liken Ethereum to “digital oil” as a result of it’s consumed throughout Ethereum community actions. Furthermore, they take into account this asset “programmable money” as a consequence of its automated financialization with out intermediaries.

Learn extra: Ethereum (ETH) Value Prediction 2024/2025/2030

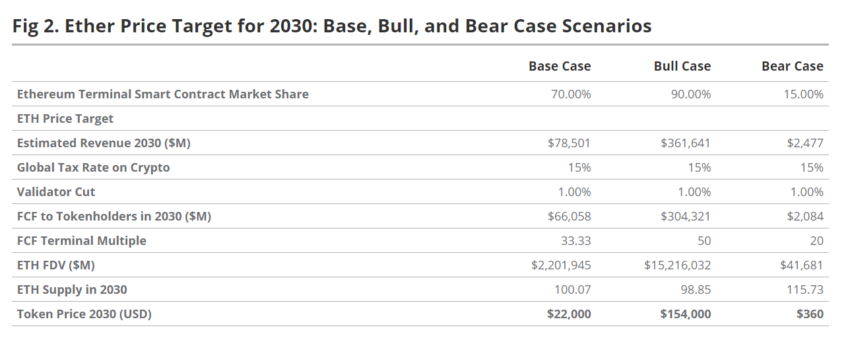

Primarily based on this evaluation mannequin, VanEck’s analysts are bullish on Ethereum’s future, predicting its value may attain $22,000 per token by 2030.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.