Kraken’s strategic acquisition of CF Benchmarks in 2019 has confirmed immensely profitable in a market more and more embracing spot Bitcoin ETFs.

Because the world’s largest crypto indices supplier, CF Benchmarks performs a vital position as a certified benchmarks administrator within the Bitcoin ETFs market. This place has enabled Kraken to capitalize on the rising demand for Bitcoin ETFs, translating into tens of millions in licensing charges.

Kraken Thrives In The Introduction of Bitcoin Spot ETFs

Cryptocurrency buying and selling platform Kraken is producing tens of millions in license charges from its subsidiary, CF Benchmarks, acquired in 2019. Though Kraken didn’t disclose the precise determine, the acquisition was for a nine-figure sum. In 2022, pseudonymous researcher Conceal Not Slide predicted Kraken’s important earnings potential via CF Benchmarks.

“Kraken doesn’t have the most crypto market share, but it does have an asset I think will become a top money maker over time — CF Benchmarks. Thi is the index provider for CME’s crypto futures products. If CME crypto futures keep growing Kraken will hold significant market power,” he wrote.

This forecast got here true with the approval of 11 spot Bitcoin ETFs on January 10, 2024. CF Benchmarks CEO Sui Chung mentioned the brand new ETFs have been a giant step for each the asset class and his firm.

“The spot ETFs have been a huge step forward for the asset class and, by extension, a huge milestone for CF Benchmarks as a business, given our role as the leading index provider for the asset class. This has allowed us and our parent, Kraken, to grow our offerings to institutions that are in, and entering the space,” Chung advised BeInCrypto.

Learn extra: What Is a Bitcoin ETF? All You Have to Know

Chung revealed that inflows in February had topped $1.4 billion, surpassing his one-year income goal inside a month. Main funds issued by BlackRock, Ark Make investments, and Franklin Templeton, amongst others, make the most of the BRR index, solidifying CF Benchmarks’ market affect.

“By the time I’d done all the maths it was 1 AM,” Chung mentioned, referring to numbers as of February, the place inflows had topped $1.4 billion. “In one month, the Bitcoin ETFs had hit my one-year target, and the Bitcoin ETF boom was just getting started.”

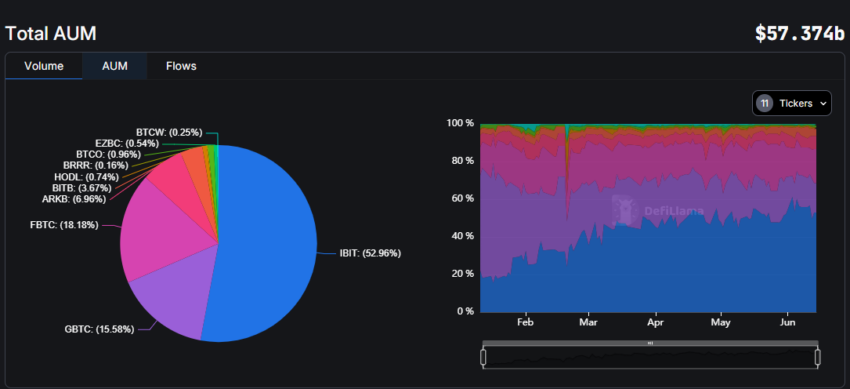

In accordance with DefiLlama, traders have poured over $57 billion into Bitcoin ETFs, enabling CF Benchmarks to earn substantial licensing charges. Though CF Benchmarks doesn’t disclose its earnings, it’s anticipated to proceed producing important sum of money for the foreseeable future.

Learn extra: How To Commerce a Bitcoin ETF: A Step-by-Step Method

For instance, S&P Dow Jones costs shoppers about 3 foundation factors, or 0.03%, on property primarily based on its S&P 500 indexes. Contemplating State Road’s ETF manages $541 billion, S&P earns $162 million in charges from this single fund. With Ethereum ETFs anticipated this summer season, CF Benchmarks seems to be set for sturdy development.

CF Benchmarks enforces strict guidelines to make sure their indices are reliable. Exchanges should stop fraud and observe strict KYC and AML checks to be listed within the index. The BRR gathers pricing information from a number of platforms, together with Kraken, Coinbase, and Gemini, however excludes Binance as a consequence of regulatory points. This dedication to transparency and reliability bolsters the sturdy reputations of each CF Benchmarks and Kraken within the crypto market.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.