The launch of Bitcoin exchange-traded funds (ETFs) in January marked a big milestone. Nevertheless, monetary advisors are approaching these new funding autos with warning.

BlackRock’s Chief Funding Officer of ETF and Index Investments, Samara Cohen, offered insights in the course of the Coinbase State of Crypto Summit in New York Metropolis.

Why Monetary Advisors Shun Bitcoin ETFs

Cohen defined that about 80% of Bitcoin ETF purchases are at present made by self-directed buyers utilizing on-line brokerage accounts. In accordance with final quarter’s 13-F filings, hedge funds and brokerages have additionally been lively consumers. Nevertheless, registered funding advisors stay hesitant.

Cohen said, “I would call them wary… That’s their job.” She emphasised the fiduciary accountability that advisors need to their shoppers, noting that Bitcoin’s historic worth volatility, which has reached 90% at instances, necessitates thorough threat evaluation and due diligence.

Monetary advisors meticulously consider knowledge and threat analytics to find out Bitcoin’s applicable function in funding portfolios, contemplating elements comparable to threat tolerance and liquidity wants.

“This is a moment, in terms of really putting forward important data, risk analytics [and determining] the role Bitcoin can play in a portfolio, what sort of allocation is appropriate given an investor’s risk tolerance, their liquidity needs. That’s what an advisor is supposed to do, so I think this journey that we’re on is exactly the right one and they’re doing their jobs,” Cohen added.

Learn extra: How To Commerce a Bitcoin ETF: A Step-by-Step Method

Whereas monetary advisors stay cautious, some analysts maintain a bullish outlook on Bitcoin’s future.

Bernstein, a serious asset supervisor with $725 billion in property, predicts that Bitcoin’s worth might attain $1 million by 2033. The brand new forecast suggests a cycle-high of $200,000 by 2025. This prediction is pushed by unprecedented demand from spot ETFs and Bitcoin’s restricted provide.

Bernstein’s earlier estimate was $150,000 for 2025, reflecting their rising optimism about Bitcoin’s potential.

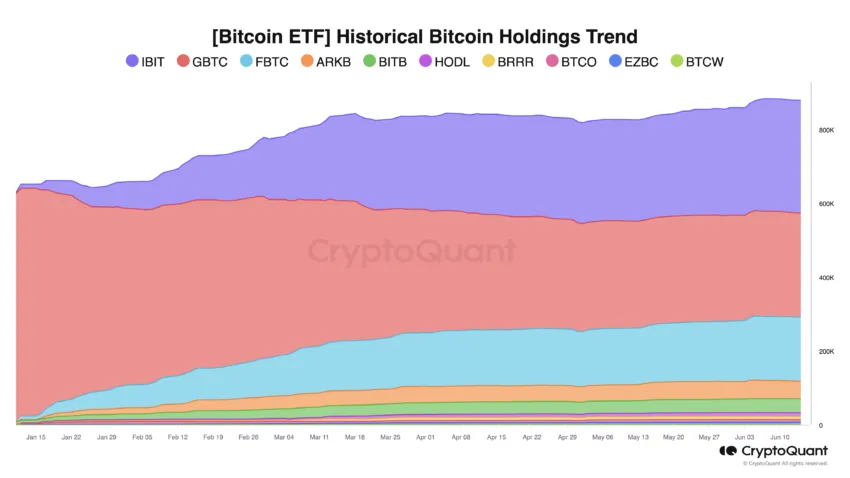

“Around $15 billion of net new flows have been brought in by the ETFs combined. We expect Bitcoin ETFs to be equivalent to approximately 7% of Bitcoin in circulation by 2025 and nearly 15% of Bitcoin supply by 2033,” Bernstein analysts wrote.

Learn extra: Bitcoin (BTC) Worth Prediction 2024 / 2025 / 2030

WAX co-founder William Quigley additionally commented on the proliferation of ETFs for different cryptocurrencies like Solana. “Wall Street is greedy,” Quigley mentioned, suggesting that the success of Bitcoin ETFs will spur comparable merchandise.

Nevertheless, he cautioned that if the momentum slows, ETF suppliers may shift focus or shut down underperforming ETFs attributable to a scarcity of demand.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.