Crypto investments outflows elevated final week to document thresholds final seen in March. The turnout got here as a response to the Federal Open Market Committee (FOMC) assembly.

The upside potential for the Bitcoin worth stays restricted as buyers’ danger urge for food drops.

Crypto Investments Outflows Hit $600 Million

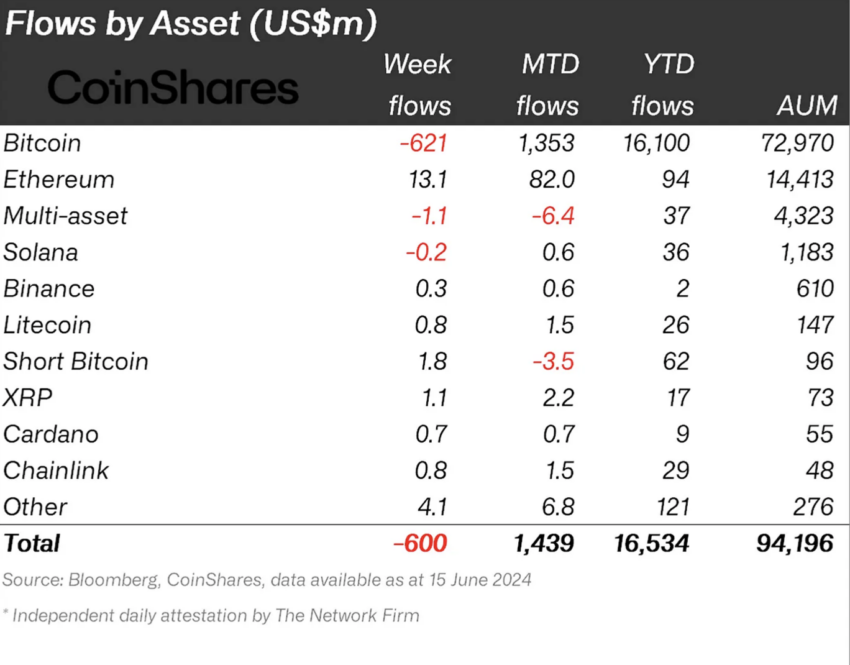

Digital asset funding merchandise noticed outflows of $600 million final week, ranges final seen on March 22, in response to a CoinShares report. Bitcoin accounted for many of the damaging flows with $621 million in outflows. Conversely, altcoins like Ethereum (ETH) and Ripple (XRP) recorded web optimistic inflows, with $13 million and $1 million respectively.

“These outflows and recent price sell-off saw total assets under management (AuM) fall from above $100bn to $94bn over the week. The outflows were entirely focused on Bitcoin, seeing $621m outflows; the bearishness also prompted $1.8m inflows into short-bitcoin,” CoinShares analysts reported.

CoinShares analysts attribute the damaging flows to the US Federal Reserve taking a “more hawkish-than-expected” stance in final week’s FOMC assembly. After cheering the softer US Shopper Worth Index (CPI) print on June 12, which allowed digital property to recoup some losses, tables turned ultra-fast because the Fed put out hopes of a extra accommodative coverage within the close to time period.

Learn extra: Crypto vs. Shares: The place To Make investments Your Cash in 2024

The Fed’s up to date dot plot urged one price minimize for the yr, down from three in its earlier model. For the layperson, the prospect of fewer price cuts is damaging for cryptocurrencies. The FOMC conferences are essential occasions the place key choices on the rate of interest at which banks lend to one another and financial coverage are made.

From a regional perspective, the US noticed essentially the most outflows, reaching $565 million. Nevertheless, Canada, Switzerland, and Sweden additionally recorded web negatives, with their respective outflows reaching $15 million, $24 million, and $15 million, respectively.

Ethereum Amongst Altcoins With Constructive Flows

As indicated, Ethereum managed as much as $13 million in optimistic flows, sidestepping the damaging outlook within the BTC market. Sentiment within the Ethereum market stays bullish amid hypothesis that ETH spot ETFs will launch quickly. Bloomberg analyst Eric Balchunas expects the monetary instrument to launch on July 2.

“UPDATE: we are moving up our over/under date for the launch of spot Ether ETF to July 2nd, hearing the Staff sent issuers comments on S-1s today, and they’re pretty light, nothing major, asking for them back in a week. Decent chance they work to declare them effective the next week and get it off their plate bf holiday weekend. Anything possible but this is our best guess as of now,” famous Balchunas.

Balchunas’ optimism got here after US Securities and Trade Fee (SEC) Chair Gary Gensler confirmed that ETH spot ETFs would launch “over the course of this summer.”

Learn extra: Ethereum ETF Defined: What It Is and How It Works

In a Senate listening to final week, Gensler highlighted that the 19b-4 varieties permitted in Might have been from the inventory exchanges anticipated to record the ETFs. He additionally indicated that the registration course of for issuers was nonetheless underway. Nonetheless, Gensler hoped the issuers would conclude them throughout the summer time.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.