Polkadot faces bearish strain because it struggles to take care of essential help ranges, signaling potential additional declines in its value motion.

The objective of the evaluation is to evaluate Polkadot’s bearish promoting strain, utilizing Key Assist and Resistance Ranges, Market Sentiment, and Future Worth Actions.

Polkadot Faces Bearish Strain: Key Ranges and Market Sentiment Evaluation

Polkadot (DOT) has been experiencing a bearish pattern, evident from the current value motion the place it fell beneath essential help ranges. The rejection from the Ichimoku Cloud and testing of decrease help ranges additional emphasize this downtrend.

Following Bitcoin’s value drop to $64,700 yesterday, the value of DOT reached the necessary help stage of $5.46. Subsequently, the value of DOT bounced upward, stabilizing round $5.80, as noticed within the 4-hour chart.

DOT’s value has dropped 25% from its native excessive recorded on June 7

Learn Extra: 5 Finest Polkadot (DOT) Wallets To Contemplate In 2024

At present, Polkadot faces a number of key help and resistance ranges. Following our insights shared on BeInCrypto evaluation, the DOT value managed to interrupt beneath the $6.23 value stage yesterday. This prompted the value to drop 12% in 2 days, underscoring and highlighting the significance of monitoring this value stage. This value stage ought to now act as a resistance stage for DOT.

The Ichimoku Cloud evaluation reveals that the value motion is clearly rejected from the cloud, indicating bearish sentiment. On the every day chart, the value is at present beneath the Ichimoku Cloud, suggesting robust bearish momentum. The baseline and conversion traces are trending downwards, which confirms the bearish outlook.

Equally, on the 4-hour chart, the value is beneath the cloud, reinforcing the short-term bearish sentiment.

A breakdown beneath the present help at $5.46 may result in additional declines in the direction of the subsequent main help at $4.88. On the upside, the primary main resistance to look at is $6.81. Reclaiming this stage may point out a possible reversal of the present downtrend.

To verify a bullish reversal, increased resistance ranges at $7.12 and $7.41 may even must be damaged via.

The shifting averages additionally help the bearish outlook. The worth is buying and selling properly beneath the 200 EMA, indicating a long-term bearish pattern, and the 100 EMA can also be above the present value, appearing as a resistance stage.

The Relative Energy Index (RSI) is trending in the direction of the oversold territory, at present hovering round 30. This means rising promoting strain. If the RSI drops beneath 30, it may sign potential additional declines. Conversely, if it bounces off this stage, it may point out a short-term reduction rally.

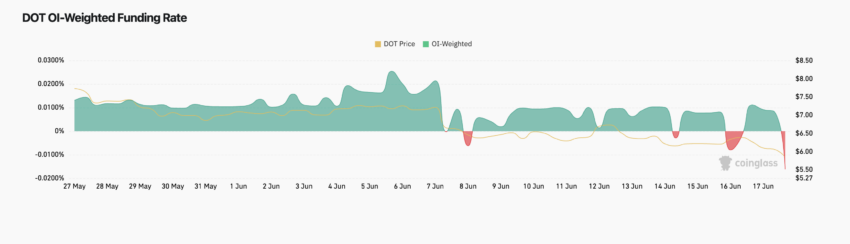

OI-Weighted Funding Fee Displays Cautious Market Sentiment

Open Curiosity (OI) is the full variety of excellent by-product contracts, similar to futures or choices, but to be settled. Greater OI signifies elevated market participation and speculative exercise, whereas decrease OI suggests lowered dealer engagement.

The funding fee is the periodic fee between merchants holding lengthy and brief positions in perpetual futures contracts. Optimistic charges imply lengthy positions pay shorts, indicating bullish sentiment, whereas destructive charges imply shorts pay longs, indicating bearish sentiment.

The OI-weighted funding fee combines the funding fee with open curiosity, providing an in depth view of market sentiment. It reveals whether or not sentiment is pushed by many individuals or just some, serving to to gauge the power of market tendencies.

Throughout June, the funding fee remained comparatively secure and optimistic, indicating a bullish sentiment amongst merchants. This era coincided with DOT’s value stability across the $7 mark. Nonetheless, the market sentiment shifted round June 8 when the funding fee briefly turned destructive, suggesting elevated brief positions or a discount in lengthy positions.

From June 9 to June 15, the funding fee returned to optimistic territory, although with some fluctuations, reflecting a blended however typically bullish sentiment. Notably, throughout this time, DOT’s value confronted resistance round $7, experiencing a number of rejections. This implies that whereas merchants had been prepared to take care of lengthy positions, the value struggled to interrupt via this key resistance stage, indicating potential exhaustion amongst consumers.

Learn Extra: Polkadot (DOT) Worth Prediction 2024/2025/2030

Essentially the most vital change occurred between June 16 and June 17, when each the funding fee and DOT’s value skilled sharp declines. The funding fee turning destructive once more displays a bearish strain, aligning with Polkadot dropping from round $6.50 to roughly $5.4. This era of heightened volatility and elevated buying and selling quantity suggests panic promoting or intensified shorting, reinforcing the bearish outlook.

Total, the evaluation of the OI-weighted funding fee signifies that merchants have gotten extra cautious, anticipating additional declines. The lowered speculative exercise, as evidenced by the reducing funding fee, factors to a market sentiment that’s hesitant to take lengthy positions at present ranges.

Monitoring this indicator alongside key help and resistance ranges can present essential insights for future value actions and market sentiment.

Strategic Suggestions

If Polkadot’s value continues to fall beneath the $5.45 stage, it may set off a big cascade of liquidations and bearish promoting strain, doubtlessly driving the value right down to $4.88. The truth that Bitcoin stays above the $65,000 stage suggests it’s experiencing solely a minor correction.

Nonetheless, if Bitcoin’s value continues to say no and reaches $60,000, this could possibly be very bearish for Polkadot and incentivize additional value drops beneath $4.88.

A reversion again to $67,000 for Bitcoin may positively impression Polkadot, doubtlessly driving its value again as much as $6.23. If this stage is damaged, it may sign a doable reversal, permitting for additional upward motion.

Disclaimer

According to the Belief Challenge tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.