A obvious subject throughout the cryptocurrency market is turning into evident. The proliferation of altcoins, with over 2.52 million created, is suffocating the trade.

This unprecedented progress in new tokens, whereas initially an indication of a booming market, now poses vital challenges.

2.52 Million New Tokens Created

Again in 2020, the crypto market skilled a frenzy. Liquidity surged as retail traders and enterprise capitalists (VCs) poured cash into the trade. VCs, specifically, invested closely, contributing to the event of quite a few initiatives.

Will Clemente, the co-founder of Reflexivity Analysis, mirrored on how the technique was simple again then. Traders wanted to allocate capital in high-beta altcoins and benefit from the trip as they outperformed Bitcoin.

“In 2020, you go out on the risk spectrum, those things are going to have higher beta to Bitcoin and you just get long all the vaporware and all that stuff goes up,” Clemente defined

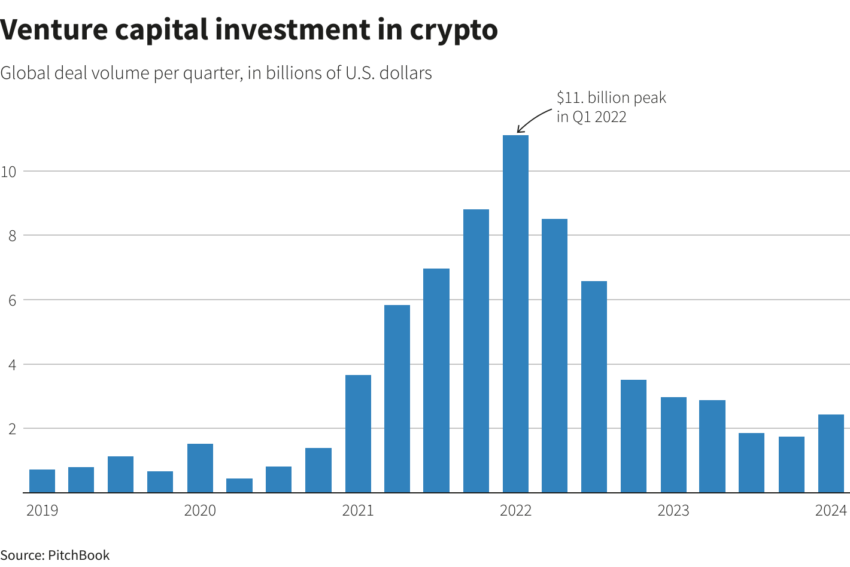

This pattern continued in 2022 when VC funding reached a file $11.1 billion within the first quarter alone. Nonetheless, this flood of recent capital led to an unsustainable improve within the variety of altcoins.

The variety of tokens tripled between 2020 and 2022, however the subsequent bear market hit onerous. Excessive-profile failures, such because the collapses of LUNA and FTX, induced widespread market turmoil. Tasks that had raised substantial funds selected to delay their launches, ready for extra favorable market situations.

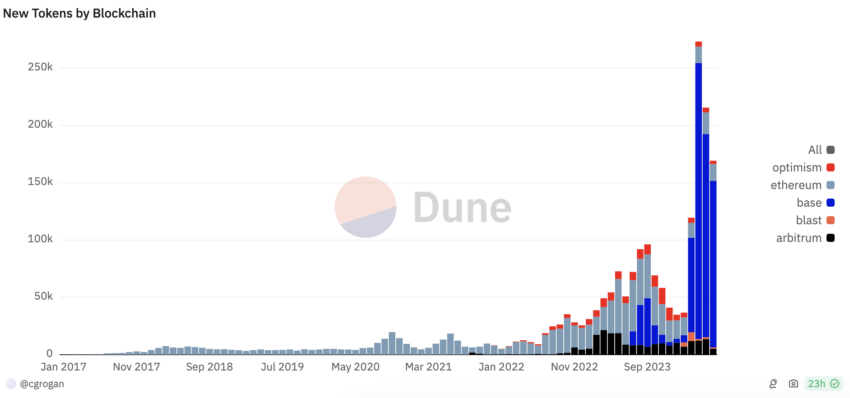

By late 2023, market sentiment had improved, sparking a surge in new altcoin launches. This resurgence carried into 2024, with over one million new tokens launched since April. Consequently, the overall variety of altcoins reached 2.52 million throughout completely different blockchains.

“There were nearly 1 million new crypto tokens created in the last month, a number that is 2x the total number ever made on Ethereum from 2015-2023,” Coinbase director Conor Grogan mentioned.

Learn extra: 7 Scorching Meme Cash and Altcoins which can be Trending in 2024

Though these numbers may be inflated as a result of ease of making meme cash, the sheer quantity of recent tokens is staggering.

How Altcoins Are Hurting Crypto

This deluge of recent tokens is problematic. The extra altcoins that flood the market, the higher the cumulative provide stress.

Estimates recommend an extra $150 million to $200 million price of recent provide enters the market every day. This fixed promote stress depresses costs, akin to inflation in conventional economies. As extra altcoins are created, their worth relative to different currencies diminishes.

“Think of token dilution as inflation. If the government prints US dollars, this, in turn, reduces the dollar’s purchasing power relative to the cost of goods and services. It’s the exact same in crypto,” crypto analyst Miles Deutscher defined.

Many of those new tokens have low Absolutely Diluted Valuations (FDV) and excessive float, exacerbating provide stress and dispersion. This surroundings can be manageable if new liquidity was getting into the market.

Nonetheless, with inadequate new capital, the market is left to soak up the fixed inflow of recent tokens, main to cost suppression.

Learn extra: Which Are the Greatest Altcoins To Put money into June 2024?

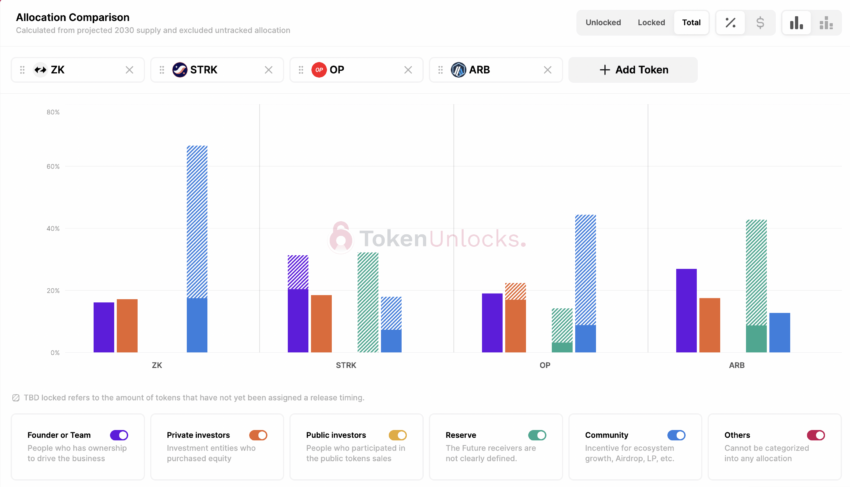

This might be one of many explanation why retail traders are reluctant to interact, feeling deprived in comparison with VCs.

In earlier cycles, retail traders may obtain vital returns. Now, tokens usually launch at excessive valuations, leaving little room for progress, and subsequently bleed as their unlock schedules start.

“The skew towards private market is one of the biggest issues in crypto, especially compared to other markets like equities and real estate. This skew becomes an issue because retail feel like they can’t win,” Deutscher concluded.

Addressing this subject requires concerted efforts from a number of stakeholders. Exchanges may implement stricter token distribution guidelines, and mission groups would possibly prioritize group allocations. Moreover, increased percentages of tokens might be unlocked at launch, probably with mechanisms to discourage dumping.

Learn extra: 10 Greatest Altcoin Exchanges In 2024

The market’s present state displays a necessity for higher pragmatism. Exchanges ought to contemplate delisting defunct initiatives to unencumber liquidity. The purpose must be to create a extra retail-friendly surroundings that advantages everybody, together with VCs and exchanges.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.