Latest trade insights recommend that the way forward for crypto is bullish. Steady developments in blockchain know-how and favorable regulatory developments are contributing to this optimistic outlook.

Analysts are noting the numerous potential for cryptocurrencies to rework financial and social buildings globally.

Consultants Keep Bullish on Crypto

Jeremy Allaire, CEO of Circle, expressed heightened optimism about the way forward for crypto. He attributed this confidence to the continual development of open Web protocols, which have traditionally reworked industries and economies.

He believes that crypto represents the following evolution in Web infrastructure, addressing the vital want for a belief layer.

The emergence of Bitcoin marked the start of this transformation, introducing the potential for digital tokens, public blockchains, and good contracts to revolutionize financial and social buildings. He famous the speedy progress in blockchain know-how, highlighting the event of third-generation public blockchains able to supporting large-scale functions.

“Digital tokens, issued on public blockchains, intermediated by smart contracts could unleash a trusted environment on a global scale that would be the foundation of how nearly all of the building blocks of society and the economy could become Internet-native,” Allaire mentioned.

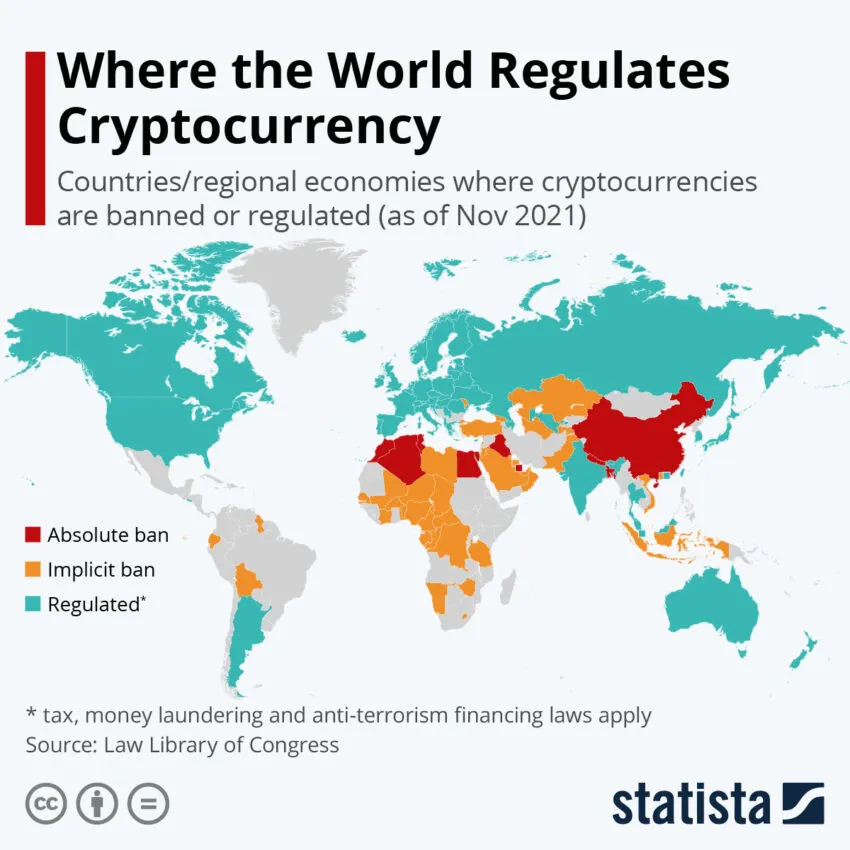

The worldwide acceptance of digital belongings additional fuels Allaire’s bullish outlook. Certainly, governments worldwide are establishing regulatory frameworks for cryptocurrencies, and main monetary establishments are integrating blockchain know-how into their providers.

QCP Capital analysts echoed Allaire’s optimism. They highlighted the current rebound in Ethereum costs and the optimistic influence of regulatory developments. The SEC’s determination to shut its investigation into Ethereum 2.0 and the potential launch of Ethereum exchange-traded funds (ETFs) have bolstered market sentiment.

Analysts famous elevated exercise within the choices market, suggesting sturdy investor confidence in ETH’s future efficiency.

“The options market has also reflected this optimism, with the desk observing heavy buying activity of top-side calls across various tenors. Despite uncertainty around the reception of the Ethereum ETF, capturing 10% to 20% of Bitcoin ETF flows could propel ETH above $4,000,” analysts at QCP Capital wrote.

Learn extra: Ethereum (ETH) Worth Prediction 2024 / 2025 / 2030

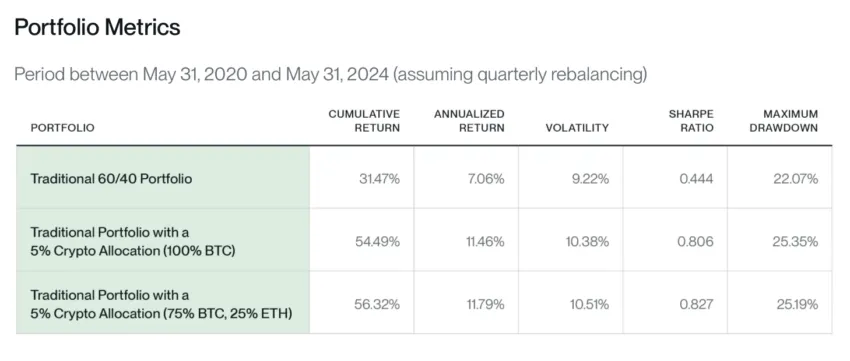

Matt Hougan, Bitwise’s Chief Funding Officer, additionally shared a optimistic outlook. He highlighted the potential advantages of including Ethereum publicity to funding portfolios. Subsequently, he offered three compelling causes for this technique: diversification, distinct use instances, and historic efficiency.

Hougan acknowledged that some traders may desire a Bitcoin-only method, notably these targeted on issues about fiat foreign money devaluation and inflation. Bitcoin’s established market place and regulatory readability make it a powerful selection for such methods.

Nevertheless, for different traders, the introduction of a spot Ethereum ETF will provide an opportunity to increase their funding in crypto.

“Today, the market cap for ETH, the crypto asset that powers the Ethereum blockchain, is about $420 billion. That’s about one-third the size of Bitcoin’s $1.3 trillion. The starting place should therefore be about 75% Bitcoin and 25% ETH,” Hougan defined.

These insights recommend a promising future for Bitcoin and Ethereum, driving the following wave of innovation and adoption within the monetary system regardless of the current value motion.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.