The tokenization of real-world property (RWA) has seen a surge in curiosity, with monetary giants like BlackRock, Constancy, and JPMorgan taking the lead.

This development indicators a big shift within the monetary trade, showcasing the rising adoption of blockchain expertise to reinforce effectivity and accessibility in capital markets.

BlackRock, Constancy, JPMorgan Tokenizing Actual-World Belongings

Constancy Worldwide’s current announcement of becoming a member of JPMorgan’s tokenized community marks a big milestone. As per Kaiko analysts, this transfer positions Constancy alongside different main gamers within the tokenization sector. This collaboration highlights the rising curiosity in leveraging blockchain for real-world functions.

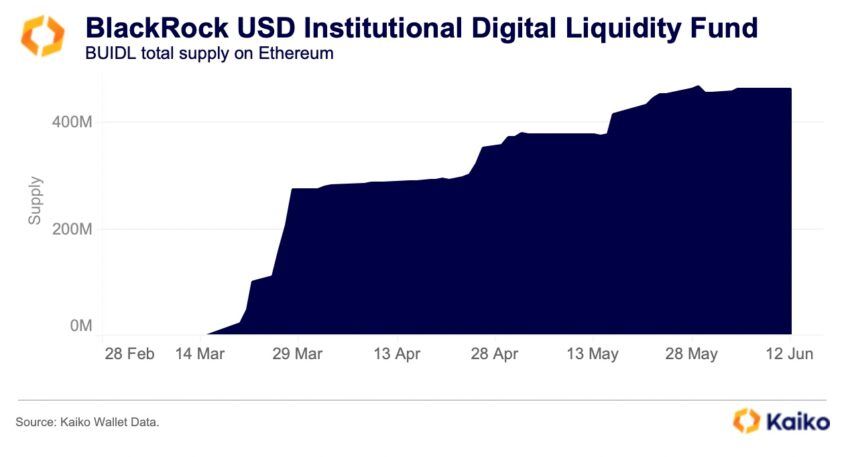

BlackRock’s BUIDL, a tokenized liquidity fund, exemplifies this development. Launched in March, BUIDL has amassed over $460 million, surpassing a number of crypto-native corporations like Maple Finance. Regardless of Maple’s restoration from the 2022 crypto lending collapse, its Money Administration Fund lags with round $16 million in property, highlighting BUIDL’s success.

“Since its launch in March, BlackRock’s BUIDL has outpaced several crypto-native firms, including Maple Finance’s Cash Management Fund, which focuses on short-term cash instruments,” Kaiko analysts wrote.

Learn extra: How To Spend money on Actual-World Crypto Belongings (RWA)?

The attraction of blockchain expertise lies in its potential to rework capital markets. Maredith Hannon, Head of Enterprise Improvement at WisdomTree, emphasizes this, noting that blockchain can deal with infrastructural challenges and unlock new funding alternatives. The expertise’s capability to streamline workflows and enhance settlement instances is especially compelling.

Central to this transformation are good contracts, which automate transactions by executing predefined circumstances with out intermediaries. These self-executing contracts guarantee transparency and effectivity, recording actions on a blockchain. For example, in securities lending, good contracts can automate operations, scale back errors, and create standardized id credentials.

“Smart contracts offer opportunities to streamline and systematize many transactions that are multi-step or manual in today’s traditional financial markets. They can be used for sharing of identity and use credentials across financial firms, to eliminate counterparty risk and to validate whether an investor can hold a specific private equity fund based on their location or investor status,” Hannon wrote.

Learn extra: What’s The Impression of Actual World Asset (RWA) Tokenization?

Collaborations, corresponding to these between Citi, Wellington, and DTCC Digital Belongings on the Avalanche Spruce Subnet, exhibit the sensible functions of good contracts. These initiatives showcase how tokenization can improve operational effectivity and scale back counterparty threat.

Nevertheless, transitioning to digital infrastructure entails challenges. Authorized concerns, id requirements, and knowledge privateness require cautious analysis in collaboration with regulators. The monetary companies trade should work collectively to construct an id infrastructure that helps broader tokenization adoption whereas guaranteeing safety and compliance.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.