Pascal Michaillat (UCSC) and Emmanuel Saez (UC Berkeley) say 40% chance, sure. From the summary to the paper:

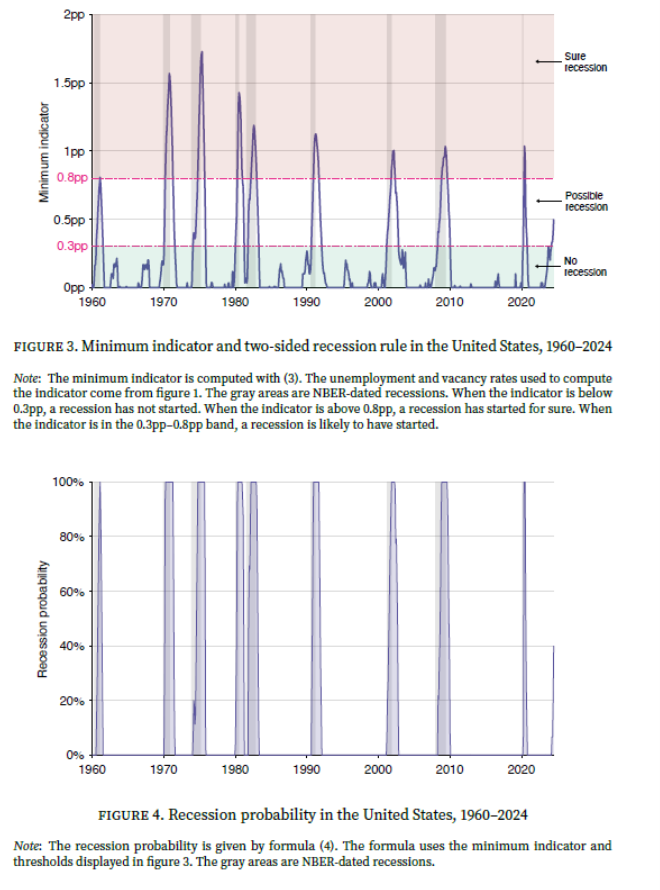

To reply this query, we develop a brand new Sahm-type recession indicator that mixes emptiness and unemployment knowledge. The indicator is the minimal of the Sahm indicator— the distinction between the 3-month trailing common of the unemployment price and its minimal over the previous 12 months—and an identical indicator constructed with the emptiness price—the distinction between the 3-month trailing common of the emptiness price and its most over the previous 12 months. We then suggest a two-sided recession rule: When our indicator reaches 0.3pp, a recession might have began; when the indicator reaches 0.8pp, a recession has began for certain. This new rule is triggered sooner than the Sahm rule: on common it detects recessions 1.4 months after they’ve began, whereas the Sahm rule detects them 2.6 months after their begin. The brand new rule additionally has a greater historic observe document: it completely identifies all recessions since 1930, whereas the Sahm rule breaks down earlier than 1960. With July 2024 knowledge, our indicator is at 0.5pp, so the chance that the US economic system is now in recession is 40%. The truth is, the recession might have began as early as March 2024.

Supply: Michaillat and Saez (2024).

So far as I can inform, the authors use closing revised knowledge, not realtime. It might be good to see if the outcomes had been strong to the usage of realtime knowledge, given the large impact of inhabitants controls particularly lately.

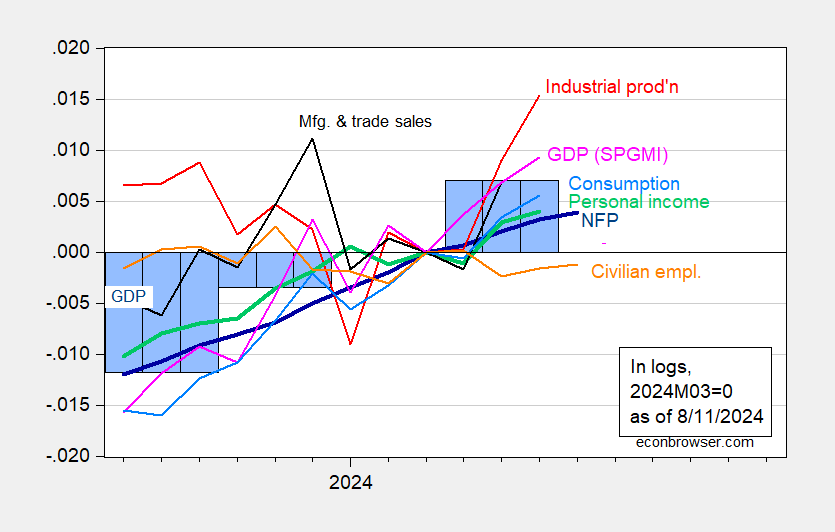

Normalizing NBER indicators to 2024M03 as a peak, we have now Determine 1:

Determine 1 [corrected 8/13]: Nonfarm Payroll (NFP) employment from CES (daring blue), civilian employment (orange), industrial manufacturing (crimson), private revenue excluding present transfers in Ch.2017$ (daring inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (mild blue), and month-to-month GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2023M04=0. Supply: BLS through FRED, Federal Reserve, BEA 2024Q2 advance launch, S&P International Market Insights (nee Macroeconomic Advisers, IHS Markit) (8/1/2024 launch), and creator’s calculations.

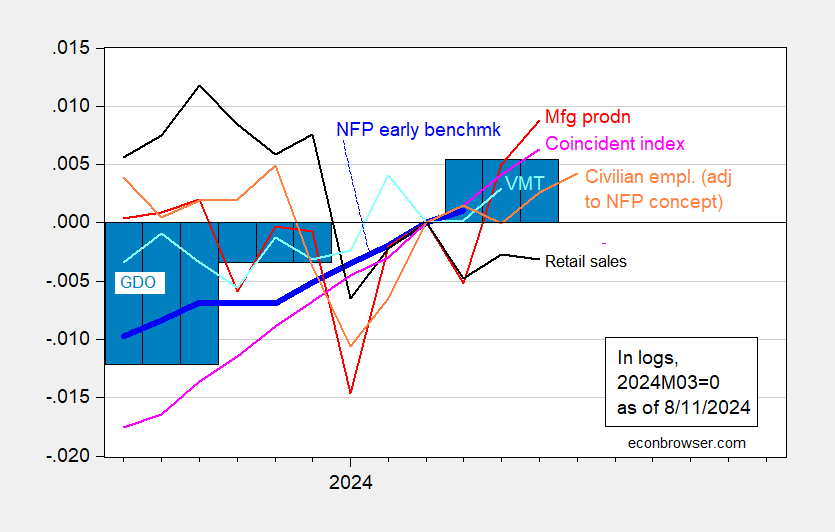

And different indicators:

Determine 2: Nonfarm Payroll (NFP) employment Philadelphia Fed early benchmark (daring blue), civilian employment adjusted to NFP idea (orange), manufacturing manufacturing (crimson), retail gross sales (black), car miles traveled (mild blue), and Coincident Index (mild pink), GDO (blue bars), all log normalized to 2023M04=0. GDI utilized in calculating GDO for 2024Q2 estimated by predicting 2024Q2 internet working surplus utilizing GDP, lagged surplus, lagged differenced surplus, 2021Q1-2024Q1.Supply: BLS through FRED, Federal Reserve, BEA 2024Q2 advance launch, Philadelphia Fed, and creator’s calculations.

After all, all these collection can be revised to various levels, with GDP being the collection at biggest danger — which is why NBER’s BCDC doesn’t put major weight on it.