The XRP worth faces notable downward strain as extra buyers select to money out their earnings. At the moment buying and selling at $0.56, the token has dropped almost 10% over the previous week.

The profitability of current every day transactions has prompted many XRP holders to promote, contributing to the continuing decline.

Ripple Merchants Lock in Their Positive factors

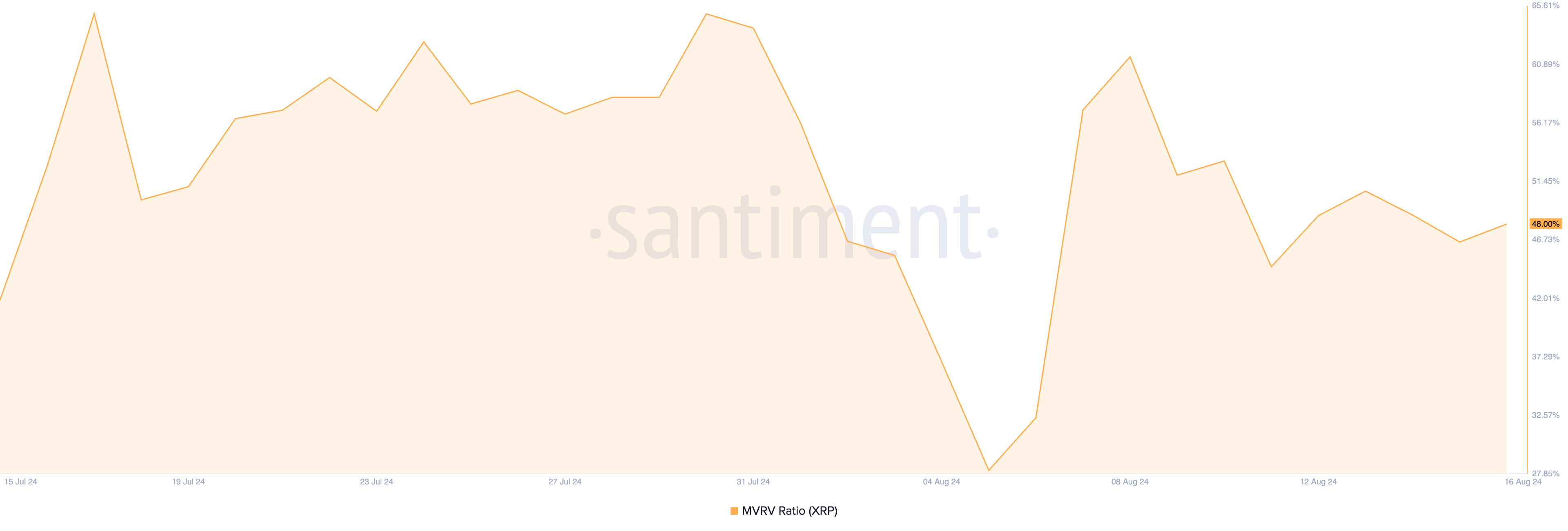

Readings from XRP’s market worth to realized worth (MVRV) ratio present that the altcoin is at the moment overvalued. As of this writing, the token’s MVRV ratio is 48%.

The MVRV ratio measures the distinction between an asset’s present market worth and the common acquisition value of its circulating provide. A worth above one signifies the asset trades increased than its common buy worth, typically main holders to promote for revenue when it’s deemed overvalued.

With XRP’s MVRV ratio at 48%, a big portion of holders are in revenue, driving the present wave of token distribution.

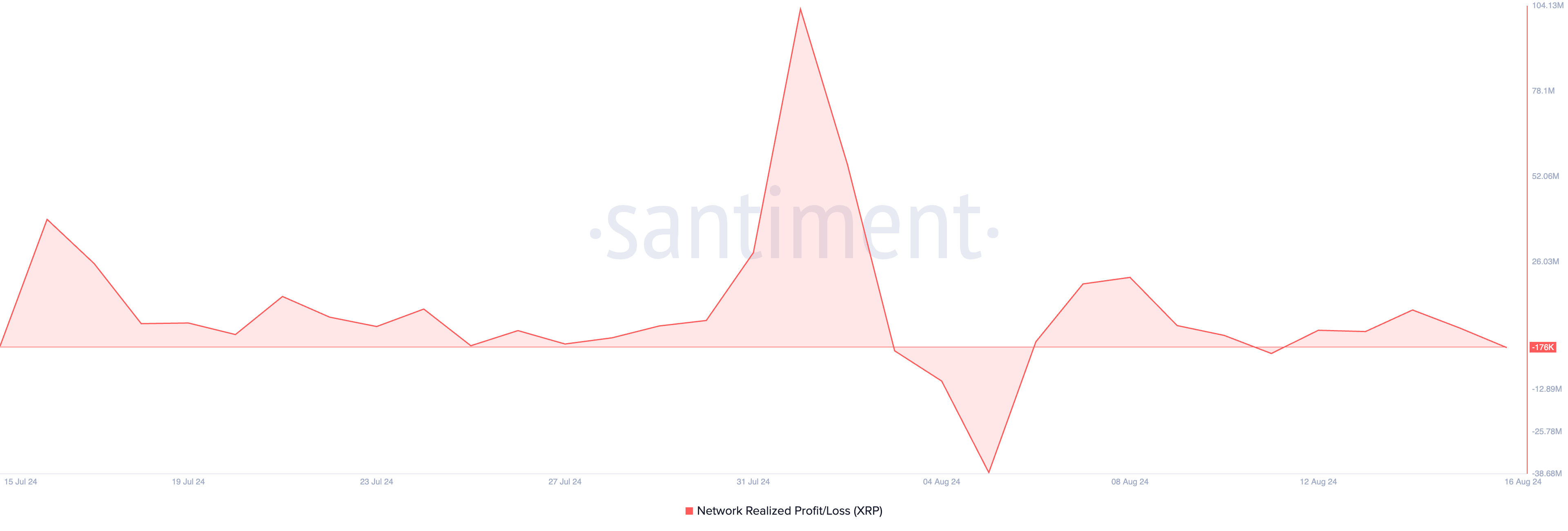

Moreover, because the begin of the month, XRP’s Community Realized Revenue/Loss (NPL) metric has constantly proven constructive values, confirming that almost all XRP merchants are promoting their holdings at a revenue.

Learn extra: How To Purchase XRP and The whole lot You Want To Know

tracks the general revenue or loss realized by merchants or holders inside a selected timeframe. Optimistic NPL values point out that, on common, merchants are closing their positions with positive factors, whereas destructive values counsel losses.

It’s well-known {that a} spike in profit-taking exercise creates downward strain on an asset’s worth. When promote orders surge with no matching enhance in purchase orders, a supply-demand imbalance happens, resulting in a worth decline.

XRP Value Prediction: Liquidity Exit Equals Falling Costs

The liquidity exit from the XRP market is mirrored in its destructive Chaikin Cash Circulate (CMF). As of this writing, the indicator rests beneath the zero line and has been so positioned since August 11.

An asset’s CMF measures how cash flows into and out of its market. A destructive CMF is an indication of market weak point. When accompanied by a worth fall, it alerts a possible extension of the decline.

Learn extra: Ripple (XRP) Value Prediction 2024/2025/2030

If XRP doesn’t see a notable spike in new demand to counter the surging selloffs, its worth could drop to $0.52. Nevertheless, it could reclaim the $0.60 worth stage and alternate palms above it if this occurs.

Disclaimer

In step with the Belief Venture tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.