This week, Bitcoin and the broader crypto market skilled a pointy decline following the discharge of US Client Value Index (CPI) information.

Hypothesis about BlackRock launching its personal blockchain has additionally surfaced. Moreover, Binance’s delisting of a number of altcoins triggered important market reactions.

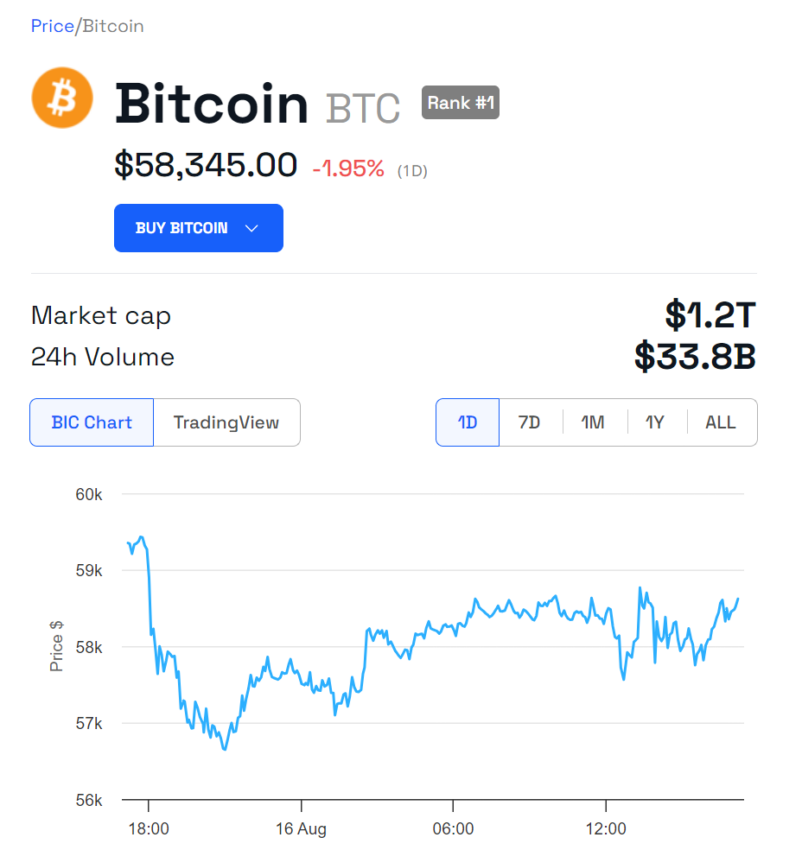

Bitcoin’s “Fakeout” Following CPI Information Launch

On August 14, the US Bureau of Labor Statistics (BLS) launched July’s Client Value Index (CPI) information. The determine was decrease than the earlier month, resulting in hypothesis that the Federal Reserve may lower charges in September, probably by 25 foundation factors.

Bitcoin initially reacted positively to the information, buying and selling above the $60,000 stage. Nevertheless, this proved to be short-lived, as the value rapidly reversed, dropping beneath $60,000 — a transfer identified in buying and selling circles as a “fakeout.” On the time of writing, Bitcoin stands at $58,345, reflecting a 1.95% lower up to now 24 hours.

Learn extra: Bitcoin (BTC) Value Prediction 2024/2025/2030

Regardless of this volatility, analysts keep a constructive long-term outlook for Bitcoin. Potential catalysts for a bullish development embody anticipated price cuts, elevated inflows into Bitcoin exchange-traded merchandise (ETPs), and favorable regulatory developments.

Institutional Buyers and Wall Road Giants Reveal Spot Crypto ETF Holdings

This week, institutional traders disclosed their positions in Bitcoin and Ethereum ETFs by means of their 13-F filings with the US Securities and Alternate Fee (SEC). Goldman Sachs, for instance, holds positions in seven of the 11 accessible spot Bitcoin ETFs within the US. Its largest stake is within the iShares Bitcoin Belief (IBIT), with an funding valued at roughly $238.6 million.

Along with IBIT, Goldman Sachs has invested closely in different Bitcoin ETFs. Notably, the financial institution holds $79.5 million in Constancy’s Bitcoin ETF (FBTC) and $56.1 million within the Invesco Galaxy Bitcoin ETF (BTCO), amongst others.

Equally, Morgan Stanley, one other Wall Road big, additionally demonstrated a choice for BlackRock’s IBIT, with positions valued at $188 million. Moreover, Morgan Stanley has smaller holdings within the Ark 21Shares Bitcoin ETF (ARKB) and the Grayscale Bitcoin Belief (GBTC).

The buying and selling agency DRW Capital additionally offered its important stake in crypto ETFs, significantly specializing in Ethereum. The corporate’s filings point out an allocation of over $150 million to the Grayscale Ethereum Belief.

Moreover, the State of Wisconsin Funding Board (SWIB) reported proudly owning almost 2.9 million shares of BlackRock’s spot Bitcoin ETF (IBIT) as of June 30. This place, valued at almost $99 million, marks a big improve from the earlier quarter, the place SWIB held round 2.5 million shares. Apparently, SWIB additionally decreased its publicity to the Grayscale Bitcoin Belief by offloading 1 million shares throughout the first quarter.

Vetle Lunde, a senior analyst at K33 Analysis, just lately famous that the second quarter of 2024 noticed a notable improve in institutional possession of Bitcoin ETFs. The 13-F filings revealed that 1,199 skilled corporations held investments in US spot ETFs as of June 30. This quantity marks a rise of 262 corporations from the earlier quarter.

“While retail investors still hold the majority of the float, institutional investors increased their share of total AUM by 2.41 percentage points, now accounting for 21.15% in Q2,” Lunde remarked.

This development in institutional participation is critical. It signifies that enormous monetary entities have gotten extra comfy with the risk-reward profile of crypto investments.

Hydra Replace Prepares Cardano for Chang Arduous Fork

On August 9, Cardano launched model 0.18.0 of its Hydra Head scaling answer. This improve is especially essential as Cardano prepares for its upcoming Chang arduous fork, which goals to totally decentralize the blockchain.

Sebastian Nagel, a Cardano developer, emphasised that one of many key options of this replace is the power to withdraw funds from an open head with out closing it. This enchancment aligns with Cardano’s broader purpose of transitioning right into a decentralized community. Charles Hoskinson, Cardano’s founder, envisions it as a world system that includes superior governance and community-driven initiatives.

Hypothesis Surrounding BlackRock’s Blockchain Initiative

In accordance with a report by Token Terminal, BlackRock might be exploring the launch of a proprietary blockchain just like Coinbase’s Layer-2 community, Base. The report means that such a blockchain may centralize the record-keeping of BlackRock’s huge holdings, enhancing transparency, effectivity, and safety. If this plan materializes, it can align with BlackRock’s broader technique of leveraging know-how to streamline its operations and supply novel options to its shoppers.

Nevertheless, such a venture would have challenges, together with managing the complicated regulatory setting and making certain the blockchain’s safety and scalability. Regardless of BlackRock not confirming these plans and potential challenges, the asset administration agency probably launching a blockchain may signify a significant shift within the conventional finance sector.

Six Altcoins Take a Hit After Binance Delisting Announcement

On August 12, Binance, the world’s largest crypto alternate by buying and selling quantity, introduced the delisting of six altcoins. Efficient August 26, 2024, at 03:00 UTC, Binance will take away all spot buying and selling pairs for these tokens.

Traditionally, when Binance proclaims the itemizing or delisting of altcoins, it considerably impacts their costs. The latest delisting resolution instantly triggered the costs of the affected tokens to drop.

Learn extra: Which Are the Finest Altcoins To Spend money on August 2024?

The tokens impacted have been PowerPool (CVP), Ellipsis (EPX), ForTube (FOR), Loom Community (LOOM), Reef (REEF), and VGX Token (VGX). A few of these even skilled worth declines exceeding 20%.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.