Chainlink (LINK) has been consolidating inside a horizontal channel over the previous few weeks, with resistance at $10.78 and help at $10.06.

At the moment, the altcoin is buying and selling near its help degree, hovering round $10.14.

Chainlink Traits Sideways, however Alternative Lies Inside

LINK has traded inside a horizontal channel since August 6. This channel is shaped when an asset’s worth strikes inside a variety for a while. The higher line of this channel kinds resistance, whereas the decrease line kinds help.

This sideways motion occurs when there’s a relative stability between shopping for and promoting pressures, stopping its worth from trending strongly in both course.

This may be gleaned from LINK’s flat Relative Energy Index (RSI). As of this writing, LINK’s RSI is 40.83 and has remained flat since August 6.

When an asset’s RSI is flat, it signifies market indecision or consolidation, with neither robust shopping for nor promoting momentum. In LINK’s case, sellers are hesitant to dump as a consequence of most transactions ending in losses moderately than income.

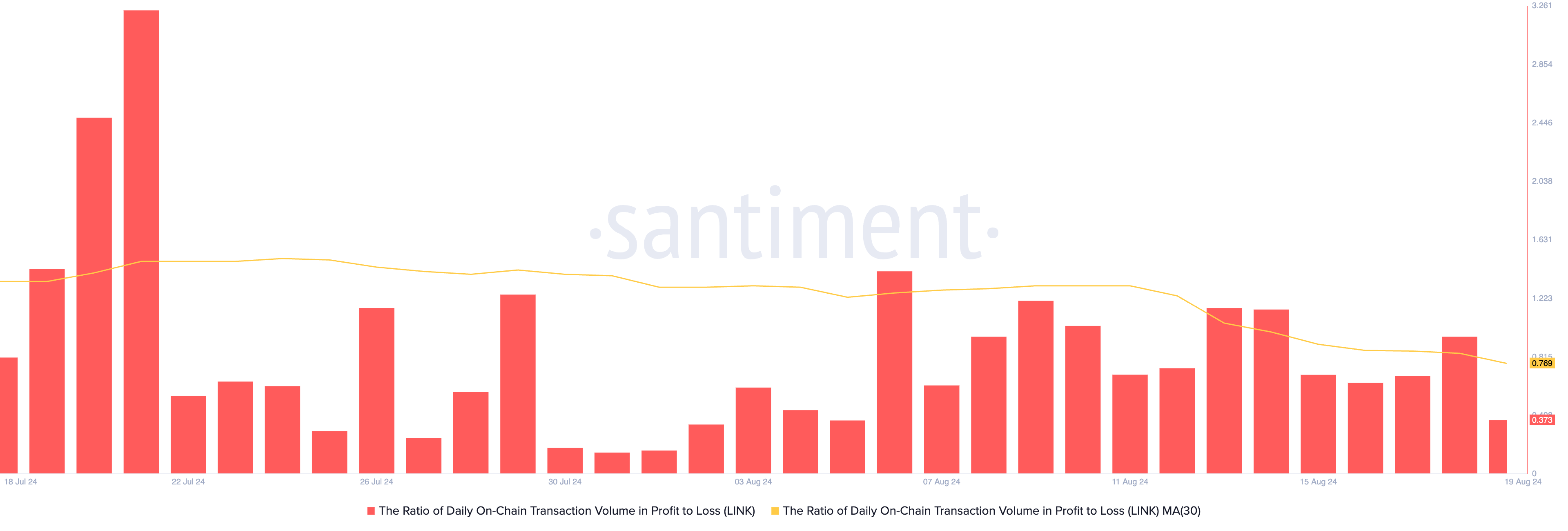

On-chain knowledge from Santiment reveals the every day transaction quantity in revenue is decrease than in loss, with a ratio of 0.76 based mostly on a 30-day transferring common. Which means that for each transaction leading to a loss, solely 0.76 transactions yield a revenue.

Nevertheless, for LINK patrons trying to commerce in opposition to the market, the continued worth consolidation has offered a shopping for alternative.

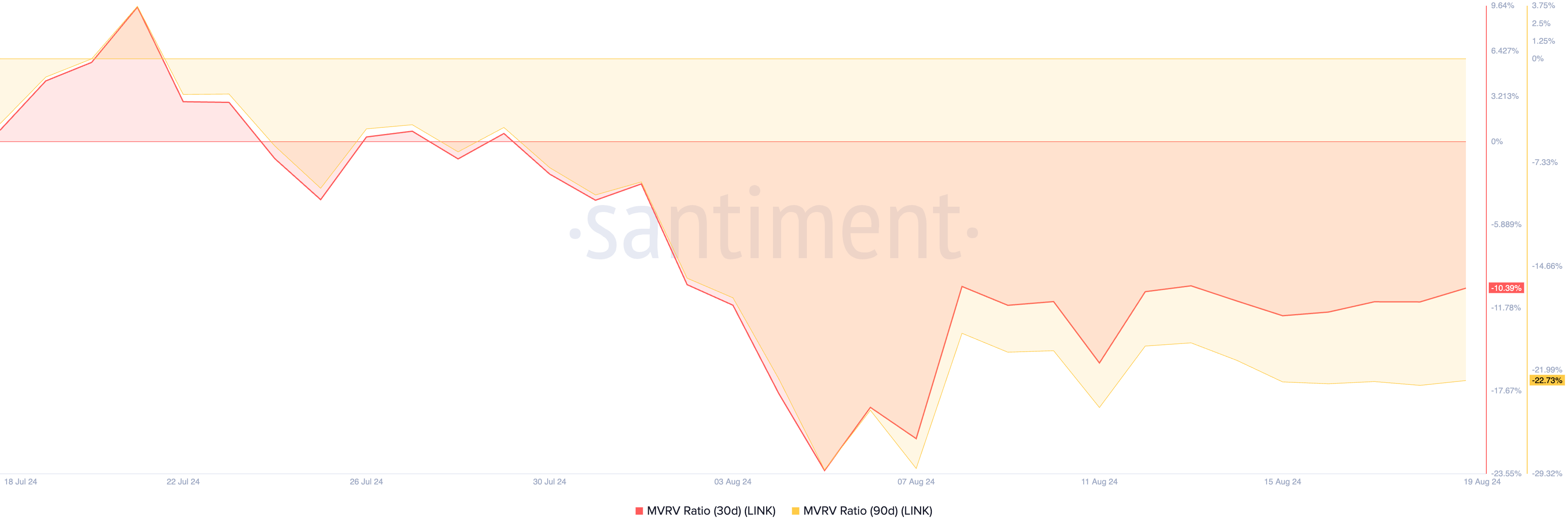

LINK’s market worth to realized worth (MVRV) ratios assessed over totally different transferring averages have flashed purchase indicators. At press time, the token’s 30-day and 90-day MVRV ratios are -10.39 and -22.73, respectively.

This metric measures the ratio between an asset’s present market worth and the typical worth of its cash or tokens in circulation.

Learn extra: Chainlink (LINK) Worth Prediction 2024/2025/2030

When an asset’s MVRV ratio is beneath zero, it’s undervalued. Its present worth is decrease than the typical worth of all its tokens in circulation, presenting a chance for these trying to “buy the dip.”

LINK Worth Prediction: This Assist Degree Is Vital

As talked about, LINK is buying and selling close to the decrease line of its horizontal channel, which kinds key help. If bulls fail to carry this degree, it could recommend that promoting stress is surpassing shopping for exercise, indicating a possible additional decline.

On this state of affairs, LINK’s worth may drop beneath $10 and head towards $8.17.

Learn extra: Chainlink ETF Defined: What It Is and How It Works

Nevertheless, if the demand for LINK surges and it breaks above resistance, the bearish projection is invalidated, and the token’s worth will climb to $11.64.

Disclaimer

In step with the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.