of 2022H1, in mild of his declaration of recession now. From August 1, 2022, from Heritage Explains episode “Biden’s Recession”:

By way of how we outline it or what marks a recession, the essential understanding is that when the financial system shrinks for 2 consecutive quarters, so three months, after which one other three months, that’s a recession. The explanation that the White Home has been making a variety of hay of, oh, that’s not official definition, blah, blah, blah. Okay. I suppose there is no such thing as a technical official definition, however I’ve taught loads of economics programs. That was what we utilized in each single class. That’s what you’ll see in most, if not all economics textbooks. That’s been the understanding for the final 100 years. So the concept that is someway new or not true, I dismiss that out of hand.

Because it occurs, that is what I wrote on that very same day:

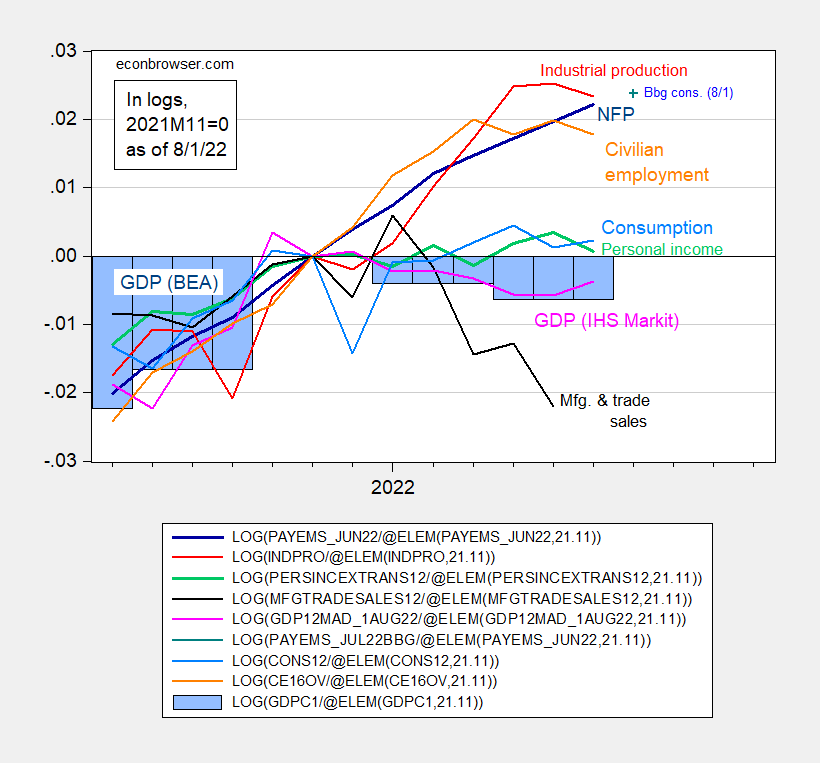

If one took GDP because the determinant of NBER decided enterprise cycles, that is what the image would appear to be (normalizing on mid-This fall):

Determine 1: Nonfarm payroll employment (daring darkish blue), Bloomberg consensus as of 8/1 (blue +), civilian employment (orange), industrial manufacturing (crimson), private revenue excluding transfers in Ch.2012$ (daring inexperienced), manufacturing and commerce gross sales in Ch.2012$ (black), consumption in Ch.2012$ (mild blue), and month-to-month GDP in Ch.2012$ (pink), official GDP, 2022Q2 advance (blue bars), all log normalized to 2021M11=0. Supply: BLS, Federal Reserve, BEA through FRED, IHS Markit (nee Macroeconomic Advisers) (8/1/2022 launch), NBER, and creator’s calculations.

The six plotted collection are these targeted on by the NBER Enterprise Cycle Courting Committee, along with official BEA GDP, and IHS Markit’s month-to-month GDP (not at the moment on the record). Of the important thing six, nonfarm payroll employment (black) and private revenue ex-transfers are given extra weight.

Observe that these are “real time” information (i.e., what we truly knew at the moment). Whereas private revenue was trending sideways, nonfarm payroll employment was rising strongly. Arguments that employment was truly falling appear on reflection doubtful (and even on the time).

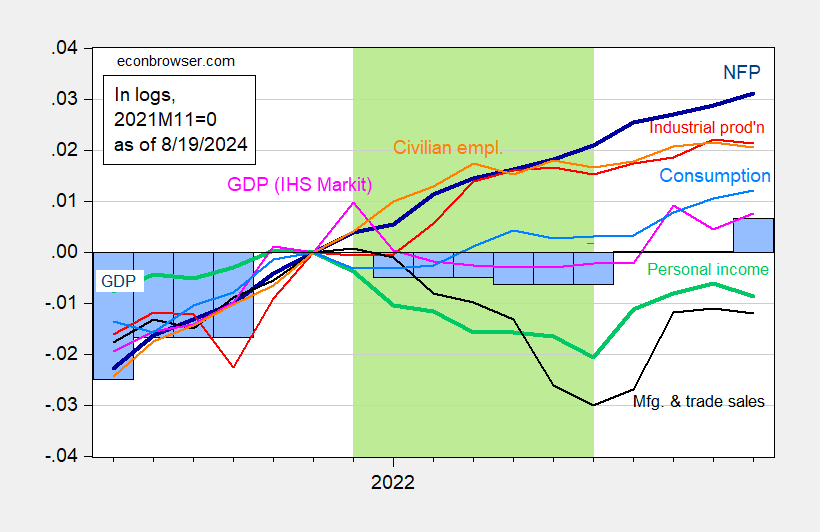

Right here’s the present vintages image of financial exercise throughout this era.

Determine 2: Nonfarm payroll employment (daring darkish blue), civilian employment (orange), industrial manufacturing (crimson), private revenue excluding transfers in Ch.2017$ (daring inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (mild blue), and month-to-month GDP in Ch.2017$ (pink), official GDP, 2024Q2 advance (blue bars), all log normalized to 2021M11=0. Hypothesized 2022H1 recession shaded mild inexperienced. Supply: BLS, Federal Reserve, BEA through FRED, IHS Markit (nee Macroeconomic Advisers) (8/1/2022 launch), NBER, and creator’s calculations.

Discover the contours look totally different for a number of collection. It is a reminder that the info get revised.

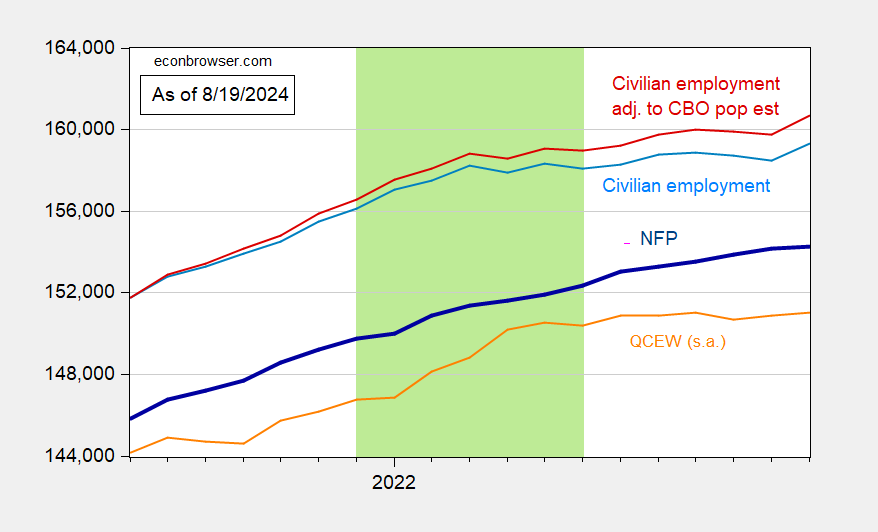

For those who’re nonetheless worrying about NFP (birth-death mannequin and all that stuff), keep in mind there’s been a benchmark revision for the reason that 2022 information. Right here’s what the info appear to be now, for NFP, QCEW and inhabitants from the family survey.

Determine 3: Nonfarm payroll employment (daring blue), QCEW complete coated employment (orange), civilian employment as reported (mild blue), adjusted so as to add in further 3.8 mn immigrants (crimson) (see textual content), all in 000’s, seasonally adjusted. QCEW seasonally adjusted by creator utilizing X-13 in logs. Hypothesized 2022H1 recession shaded mild inexperienced. Supply: BLS, Dallas Fed, and creator’s calculations.

The calculation of the adjusted civilian employment collection is reported on this put up.

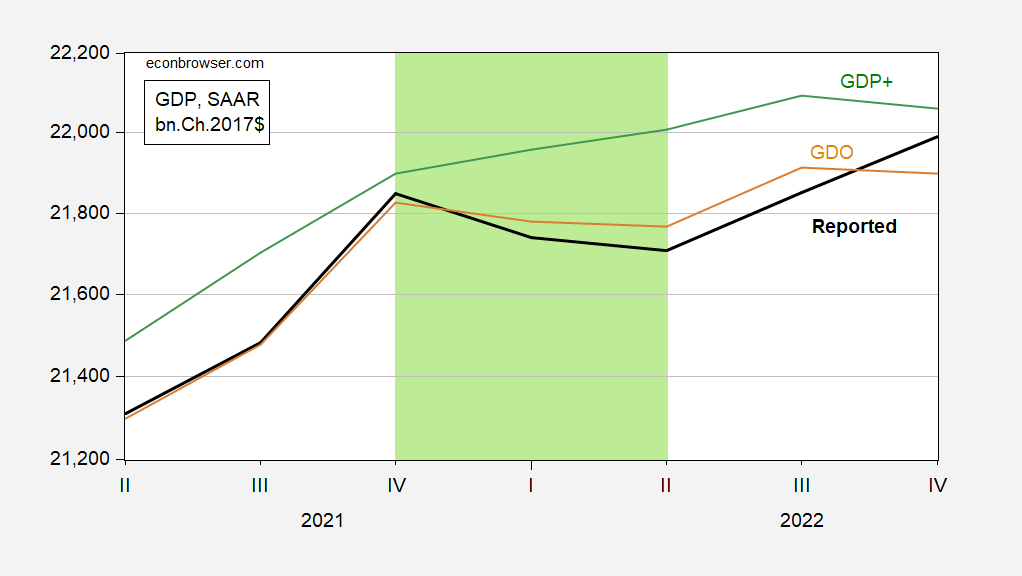

Dr. Antoni’s argument is targeted on the two-quarter GDP rule-of-thumb. We all know that GDP is topic to massive revisions over time, so even when one hewed to the two-quarter rule-of-thumb, one might get totally different solutions over time. GDO and GDP+ are various measures.

Determine 4: GDP (daring black), GDO (tan), and GDP+ (sky blue), all in bn.Ch.2017$ SAAR. GDP+ scaled to 2019Q4 GDP. Hypothesized 2022H1 recession shaded mild inexperienced. Supply: BEA, Philadelphia Fed, creator’s calculations.

So, recession in 2022? I don’t assume so. Lastly, keep in mind this assertion:

[The 2 consecutive quarter rule] was what we utilized in each single class. That’s what you’ll see in most, if not all economics textbooks. That’s been the understanding for the final 100 years.

Not true within the textbooks I used. I don’t know what textbooks Dr. Antoni used. My suggestion. Take a look at the info, particularly, GDP progress over an extended span.

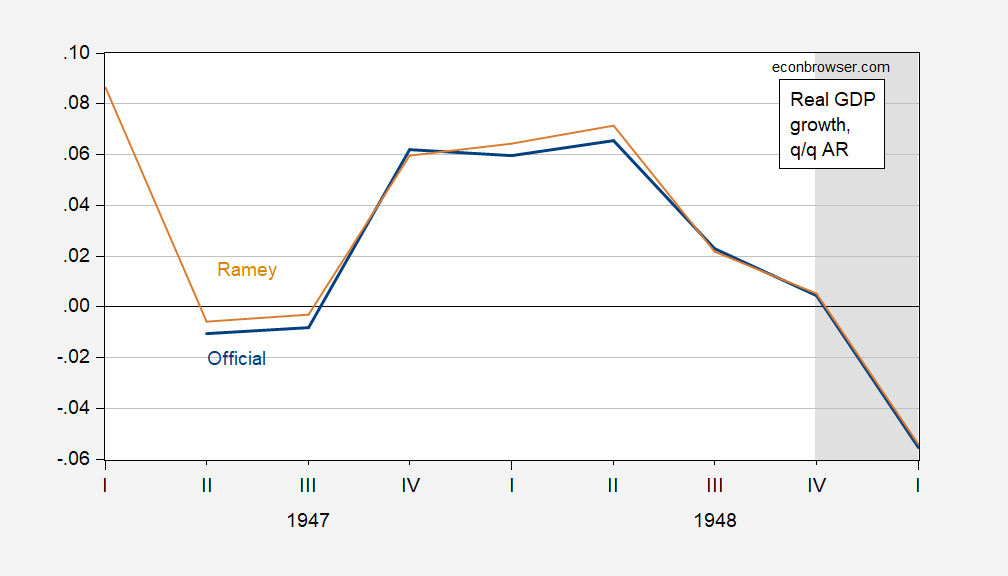

Determine 5: Quarter-on-Quarter actual GDP progress annualized for official collection (blue), and for Ramey collection (tan). NBER outlined peak-to-trough recession dates shaded grey. Supply: BEA, Valerie Ramey, NBER, and creator’s calculations.

Observe NBER doesn’t date a recession to 1947, when there have been two consecutive quarters of adverse progress.