Bitcoin’s (BTC) value might have formally hit “reset” following an unbelievable rise within the coin’s long-term holder internet place change. Traditionally, an increase on this metric helps the value get better.

However will or not it’s the identical this time? This on-chain evaluation examines the probabilities.

$20 Billion within the Bag for Bitcoin HODLers

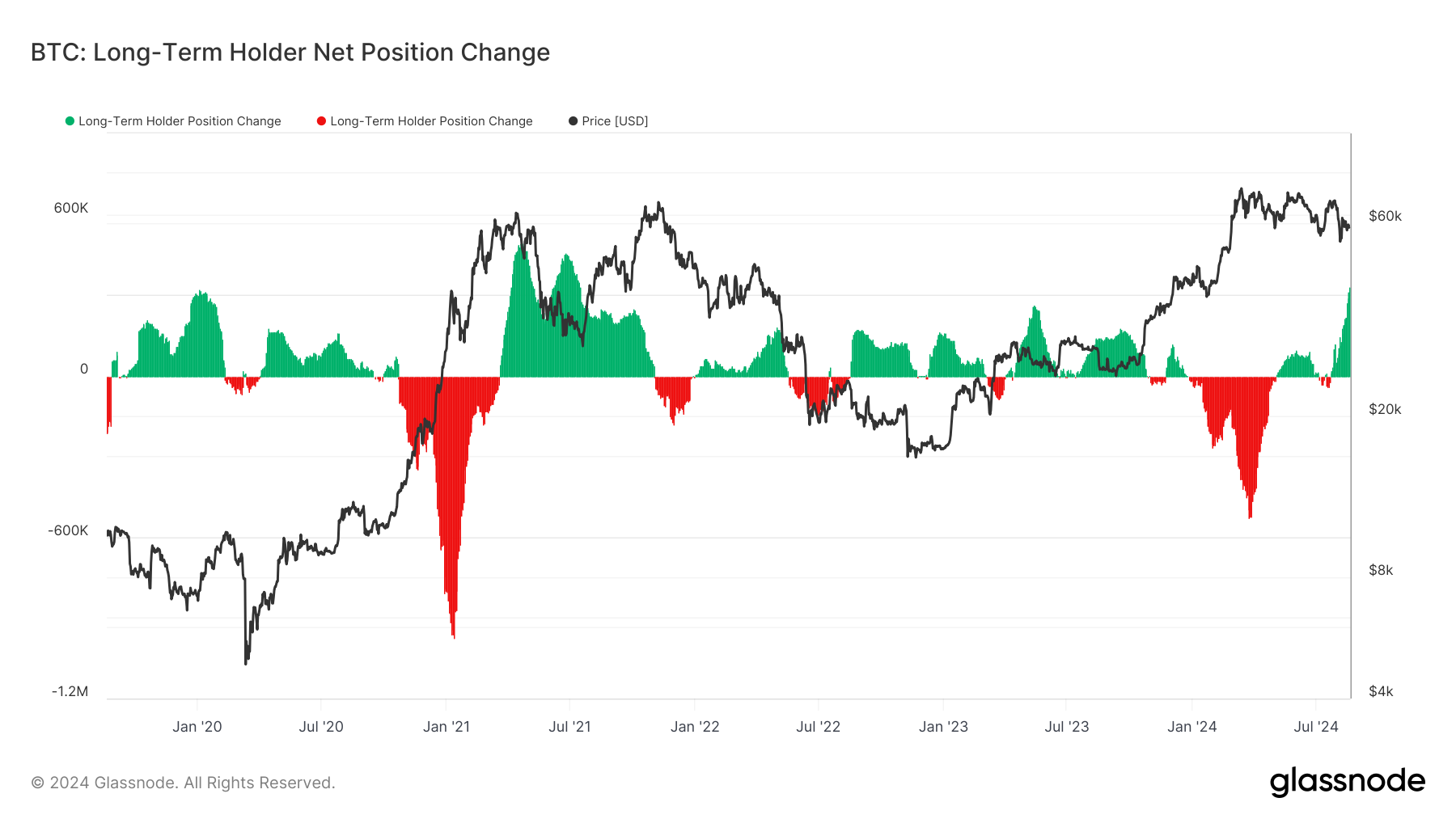

Based on Glassnode, Bitcoin’s long-term holder internet place change has been rising since July 22. Nevertheless, at this time, the metric, which tracks the 30-day change in provide held by long-term holders, hit its highest level since January 2020.

As seen within the picture under, long-term holders bought 334,358 BTC at this time. On the coin’s present value, this worth is price practically $20 billion. Buying such a lot of Bitcoin means that holders are assured within the coin’s long-term potential.

As an illustration, the final time holders accrued such a quantity, Bitcoin’s value was $10,300 (in 2020). By the top of the identical yr, the worth had elevated to $28,988, representing roughly a 300% value improve.

Whereas historical past doesn’t precisely repeat, patterns usually rhyme. If long-term holder provide impacts Bitcoin equally, a breakout might happen mid to long run. Nevertheless, this surge won’t result in the large 200%-300% good points seen beforehand. At present, Bitcoin is priced at $58,579, marking an 11.95% drop within the final 30 days.

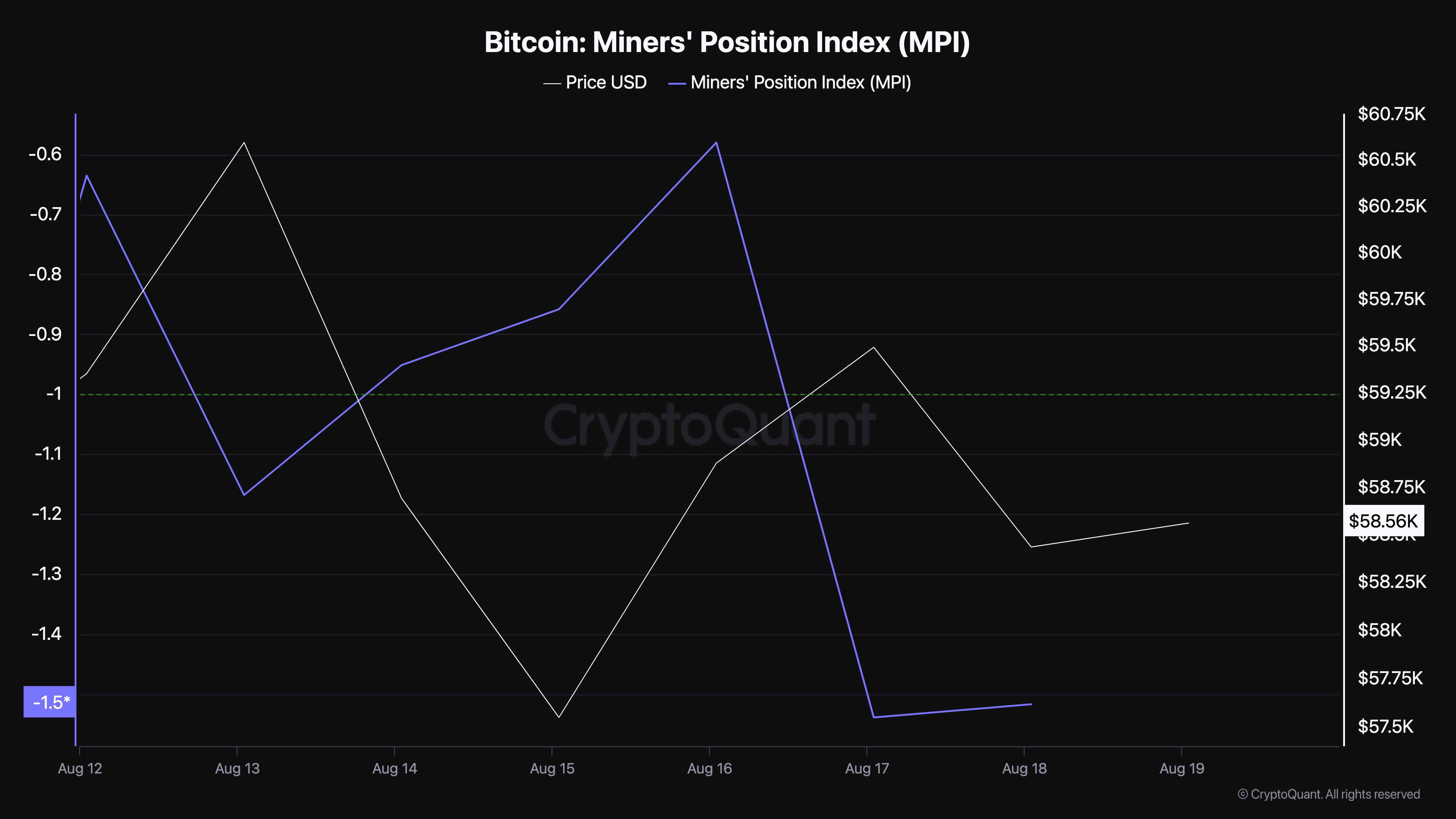

Within the quick time period, Bitcoin might discover reduction because of the Miner’s Place Index (MPI). The MPI is the ratio of the entire miner outflow, measured in {dollars}, to the 365-day transferring common of the identical ratio. Increased values recommend that miners are taking cash out of their reserves and promoting them.

Normally, this results in a value drop. Nevertheless, in accordance with CryptoQuant, the MPI is right down to its lowest stage for the reason that earlier week.

Learn extra: Who Owns the Most Bitcoin in 2024?

The current drawdown signifies that miners have shunned promoting. If this stays the case, BTC may keep away from one other drop. As a substitute, the cryptocurrency’s value may try and revisit $60,000.

Bulls Able to Pull the Purchase Set off

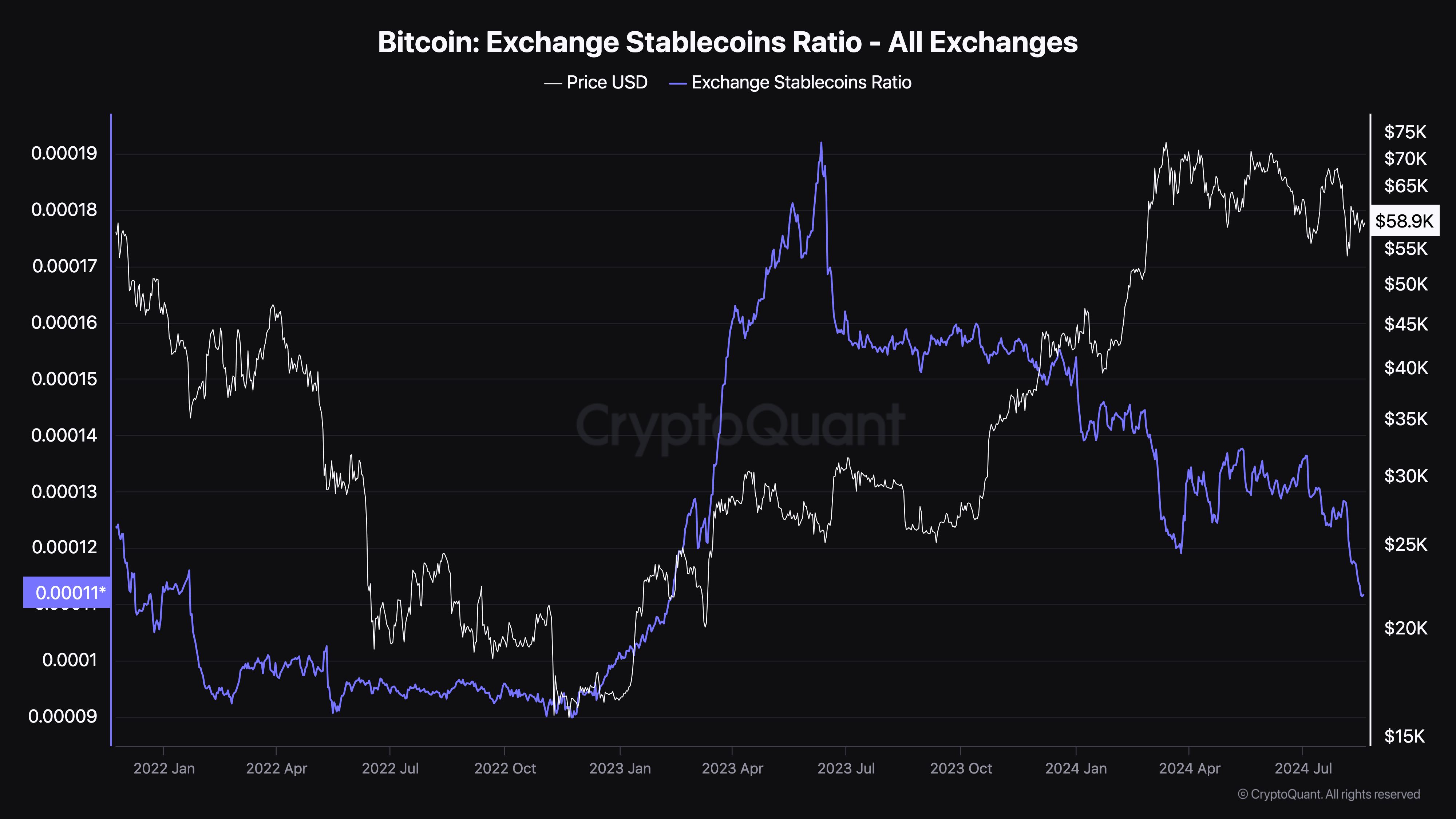

One other metric that helps that is the Alternate Stablecoin Ratio, which measures the shopping for energy out there. When the stablecoin ratio is excessive, shopping for energy is low, indicating a better probability of a value drop.

Nevertheless, at press time, Bitcoin’s Alternate Stablecoin Ratio is at its lowest since February 2023. This decline means that market contributors have vital shopping for energy to drive a value improve.

Relating to this, CryptoQuant analyst Axel Adler opined that Bitcoin is nearing the top of its consolidation interval.

“The current 5-month consolidation looks healthy, with most investors having sold their coins to others at a profit, and there have been no massive stress-induced panic sales. Now, realized losses have exceeded profits, which often occurs at the end of a consolidation period,” Adler wrote.

BTC Worth Prediction: $63,000 May Be Subsequent

From a technical standpoint, Bitcoin is at present buying and selling under the 200-day Exponential Shifting Common (EMA). This indicator usually indicators pattern path, and with BTC under it, the outlook suggests a possible bearish pattern within the quick time period.

Nevertheless, it is usually price noting that a short value improve might ship Bitcoin’s value above the 200 EMA (purple). If this occurs, bulls might push the value greater. Ought to this be the case, the worth of BTC may attain $60,536.

Moreover, the value might commerce greater if MACD turns optimistic and the 12 EMA (blue) crosses the 26 EMA (orange). As seen under, a crossover of the shorter EMA over the longer one led to a considerable value improve for BTC.

Learn extra: Bitcoin (BTC) Worth Prediction 2024/2025/2030

As an illustration, the Could crossover propelled BTC to $72,045, and in July, it reached $68,308 after one other bullish crossover. At present, the EMAs are aligned equally. If the 12 EMA crosses above the 26 EMA, it could affirm a bullish pattern, doubtlessly pushing Bitcoin to $63,237.

Nevertheless, if a bearish crossover happens, the outlook might reverse, main BTC to a decline towards $54,491.

Disclaimer

According to the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.