The outlook for United States-based Solana exchange-traded funds (ETFs) in 2024 stays grim. Current regulatory actions counsel that these ETFs have a minimal probability of receiving approval underneath the present administration.

This conclusion follows the US Securities and Change Fee’s (SEC) rejection of mandatory filings.

Solana ETF Approval Stays Unsure

On Tuesday, the SEC reportedly declined the Chicago Board Choices Change’s (CBOE) 19b-4 filings for 2 potential spot Solana ETFs. Consequently, these paperwork have been faraway from the CBOE web site. This resolution got here after in depth discussions between the SEC and issuers, specializing in whether or not Solana needs to be labeled as a safety.

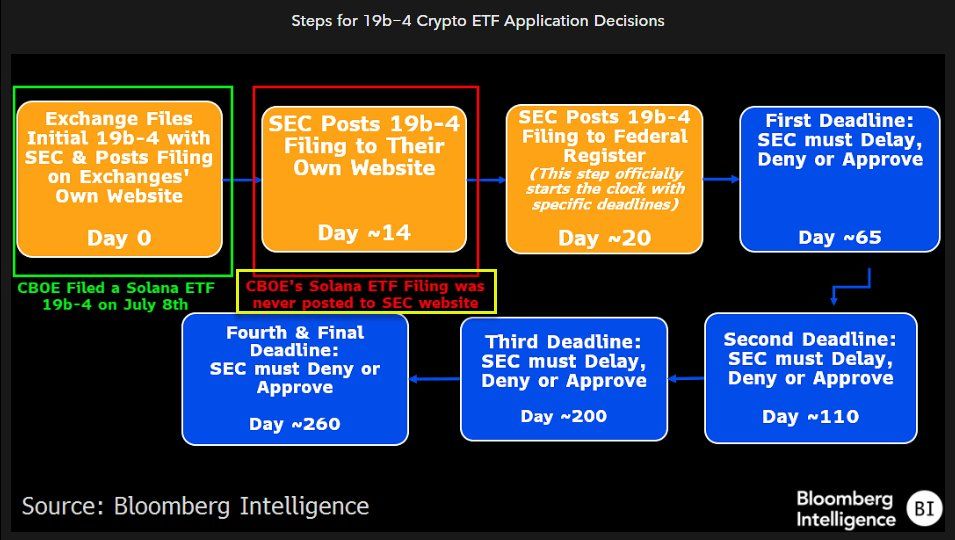

The essential 19b-4 filings essential to provoke the SEC’s evaluate course of by no means reached the Federal Register. Consequently, the SEC halted any progress towards approval or denial.

Bloomberg ETF analyst Eric Balchunas offered perception with a flowchart exhibiting that the Solana ETFs didn’t advance previous the second step of the method, which entails the SEC posting the 19b-4 submitting on their web site.

“A snowball’s chance in hell of approval unless there’s a change in leadership. Near-zero chance in 2024, and if Kamala Harris wins, there’s probably near-zero chance in 2025, too. The only hope, in my opinion, is if Donald Trump wins,” Balchunas mentioned.

Learn extra: Solana ETF Defined: What It Is and How It Works

At the moment, prediction markets like Polymarket counsel a decent race. Trump has a 52% probability of successful the 2024 election, carefully adopted by Harris at 47%. Furthermore, there are speculations that if Harris prevails, she may elevate the present SEC chief, Gary Gensler, to the US Treasury Secretary function.

Additionally weighing in on the dialogue, Nate Geraci, President of the ETF Retailer, highlighted the unlikely approval of a Solana ETF shortly underneath the present administration. He additionally identified the absence of CME-traded Solana futures, that are believed to be mandatory for the approval.

“The only viable path for spot Solana ETF approval would be the establishment of a clear regulatory framework that distinctly classifies which crypto assets are securities versus commodities,” Geraci mentioned.

Including one other layer to the dialogue, VanEck’s head of digital asset analysis, Matthew Sigel, stays decided to launch a spot Solana ETF. He referred to a 2018 case involving the Commodity Futures Buying and selling Fee (CFTC) in opposition to My Huge Coin Pay.

“Courts have drawn parallels between natural gas and digital tokens. For natural gas, it doesn’t matter if the gas is delivered to different hubs like Henry Hub in Louisiana or elsewhere: if futures contracts exist for one, all types of natural gas are treated as commodities. This same logic could apply to digital assets like Solana and could shape the future of ETF regulation,” Sigel argued.

Furthermore, in July 2024, CFTC Chairman Rostin Behnam mentioned that 70-80% of cryptocurrencies are usually not securities. He additionally advocated for the CFTC’s full oversight of the crypto market.

Certainly, if the CFTC regulates the crypto market, it might open the doorways for a spot in Solana ETF.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.