Two weeks later, Solana’s (SOL) worth moved north, reaching a peak of $163.60. The worth enhance hinted at a return to $200.

Nevertheless, as of this writing, the worth of cryptocurrency has dropped by 15%. Buying and selling at $140.39, SOL’s worth might threat one other decline resulting from causes highlighted on this evaluation.

Solana Bullish Momentum Fades

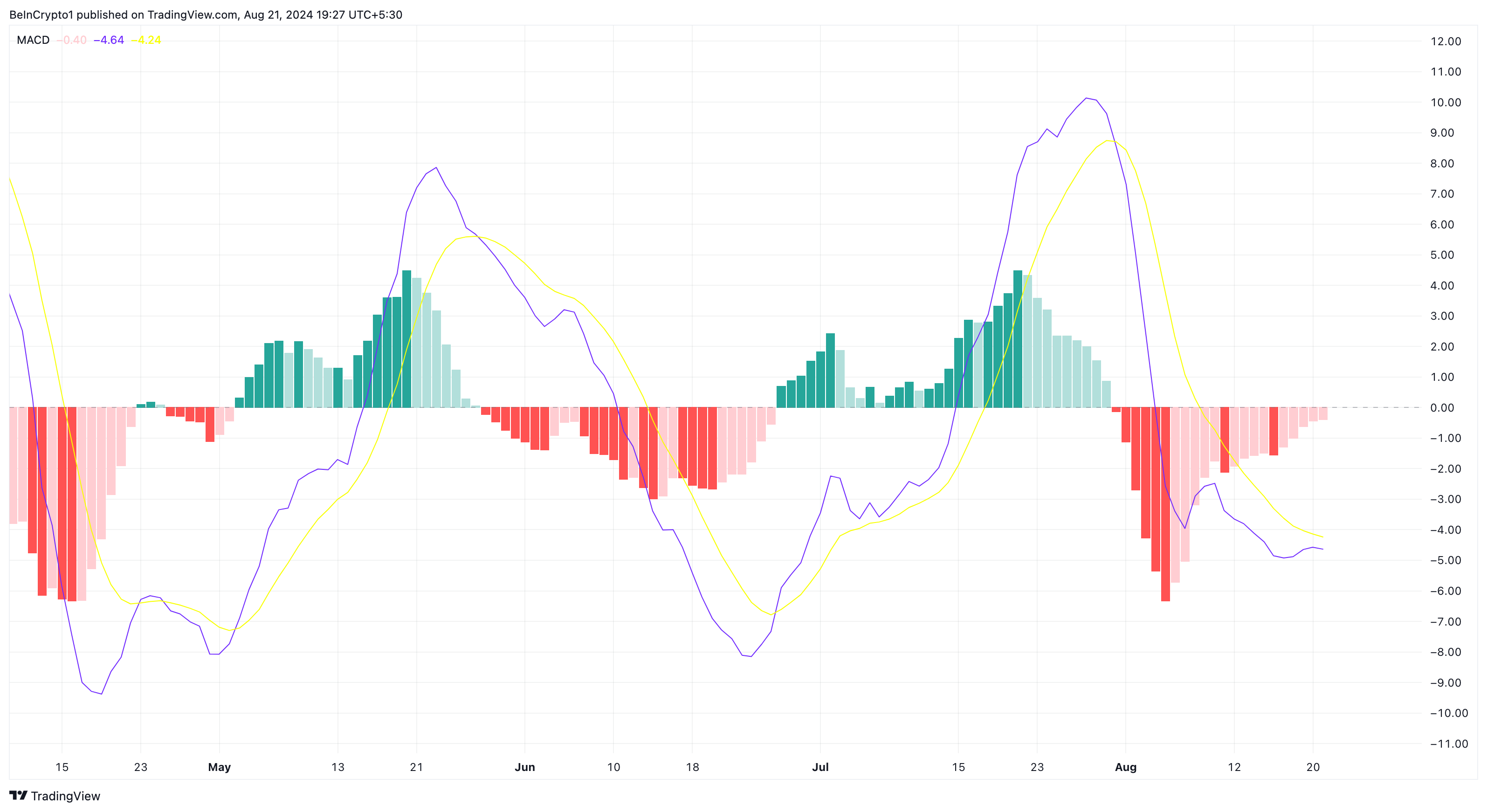

As of this writing, the Transferring common convergence divergence (MACD) is destructive on the SOL/USD every day chart. The MACD supplies robust indications of development reversals and measures the momentum of a cryptocurrency’s worth.

This indicator additionally makes use of the Exponential Transferring Common (EMA) in detecting the development. Particularly, a constructive studying of the MACD signifies bullish momentum, rising the probabilities of a worth rise

Since it’s destructive for Solana’s worth, it signifies that momentum is bearish, and the latest decline might proceed. Additionally, if the 12 EMA (blue) crosses over the 26 EMA (yellow), the development is bullish. In SOL’s case, the longer EMA has crossed above the shorter one, suggesting that the development across the token is bearish

Learn extra: What Is Solana (SOL)?

From the chart under, SOL’s worth tried a V-shaped restoration between July 31 and August 10. This technical sample seems when the value of an asset falls from a peak and reverses towards the identical area.

Usually, elevated shopping for stress backed by the sample sends the value larger. Nevertheless, Solana’s worth was rejected as quickly because it hit $163.60.

Since then, the cryptocurrency has struggled to rebound. Based on the chart, the SOL worth dangers dropping essential assist at $131.06. If bulls defend this stage, the value can rebound. Nevertheless, if promoting stress will increase, the SOL worth might collapse to $121.09.

SOL Value Prediction: Can the Token Slip Beneath $130?

An in-depth evaluation of the every day chart exhibits the Superior Oscillator (AO) place in destructive territory. The AO compares historic worth actions to latest ones and makes use of it to measure market momentum.

Much like the MACD, a constructive studying of the indicator displays rising upward momentum. A destructive ranking, then again, signifies in any other case. At press time, the AO is destructive, indicating that SOL’s earlier upward momentum has been challenged.

If this stays the identical, the token’s worth may slide additional down. Trying on the Fibonacci retracement indicator, SOL’s worth dangers pulling again to $129.85 if bulls fail to defend the assist at $131.06.

Learn extra: 13 Finest Solana (SOL) Wallets To Think about in August 2024

Nevertheless, a rebound to $142.09 or $151.98 may change into a actuality if the cryptocurrency bounces off the assist or resists dropping that low.

Disclaimer

In keeping with the Belief Venture pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.