Many large-cap cryptocurrencies are up immediately, with Chainlink (LINK) seeing one of many largest good points. Trailing solely behind Polygon (MATIC), LINK’s value elevated by 10% within the final 24 hours.

Regardless of the rise, the altcoin might be getting ready to retracement, and right here is why.

Indicators Trace at Potential Chainlink Decline

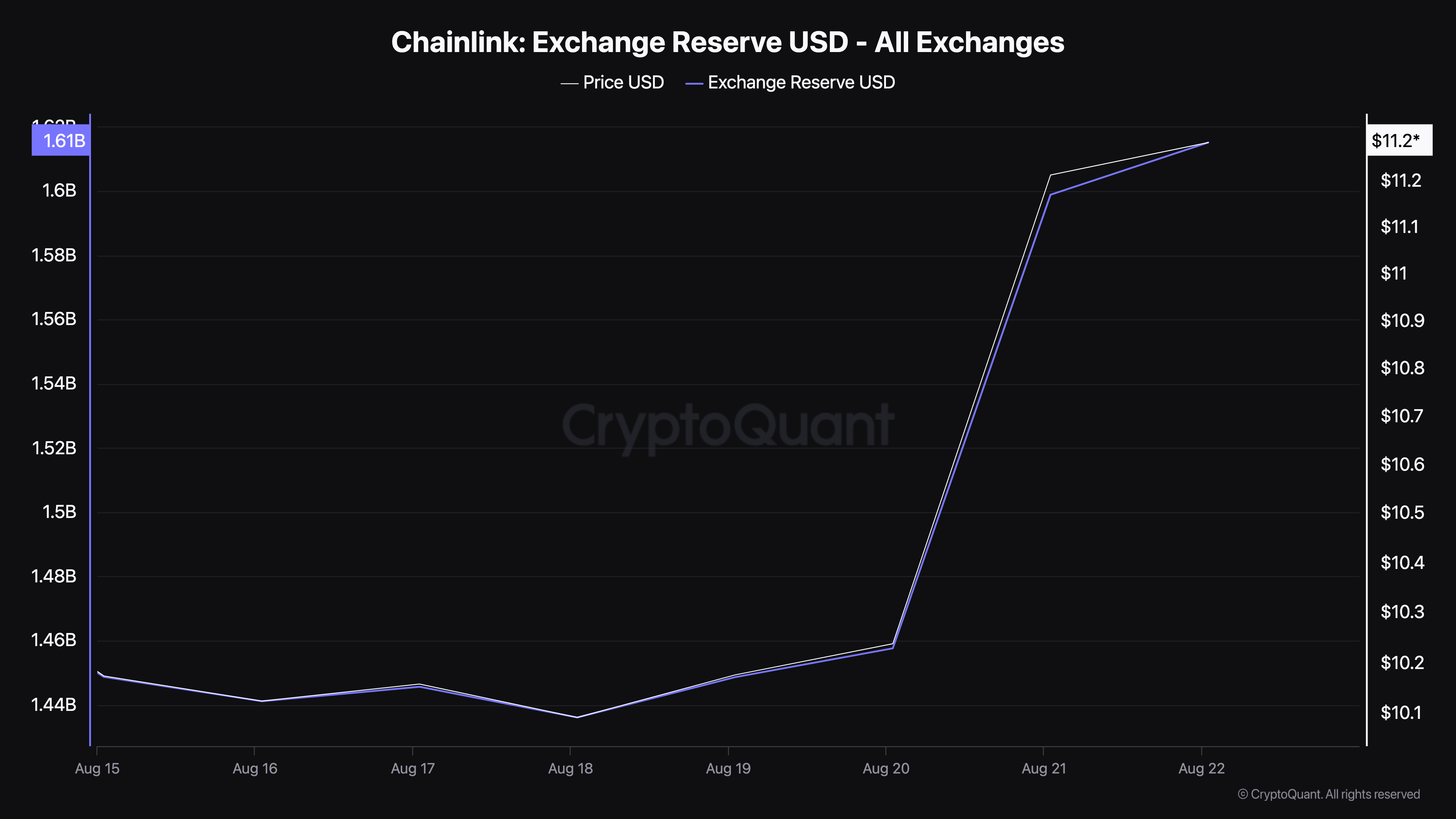

LINK value aligns with BeInCrypto’s current prediction of a rise past $11. Nonetheless, information obtained from CryptoQuant counsel that the upswing might be short-lived.

The altcoin’s reserve on exchanges has reached its highest stage since August 4. This metric tracks the whole worth of cryptocurrencies held throughout all exchanges. Usually, a rise indicators potential promoting stress.

When long-term holders plan to maintain a token, they normally transfer it off exchanges. However, when reserves decline, it suggests holders are eradicating tokens, which might cut back promote stress and assist value progress. In Chainlink’s case, the rise in reserves suggests extra tokens are returning to exchanges, reinforcing the concept that sustaining the present uptrend might be tough.

Learn extra: What Is Chainlink (LINK)?

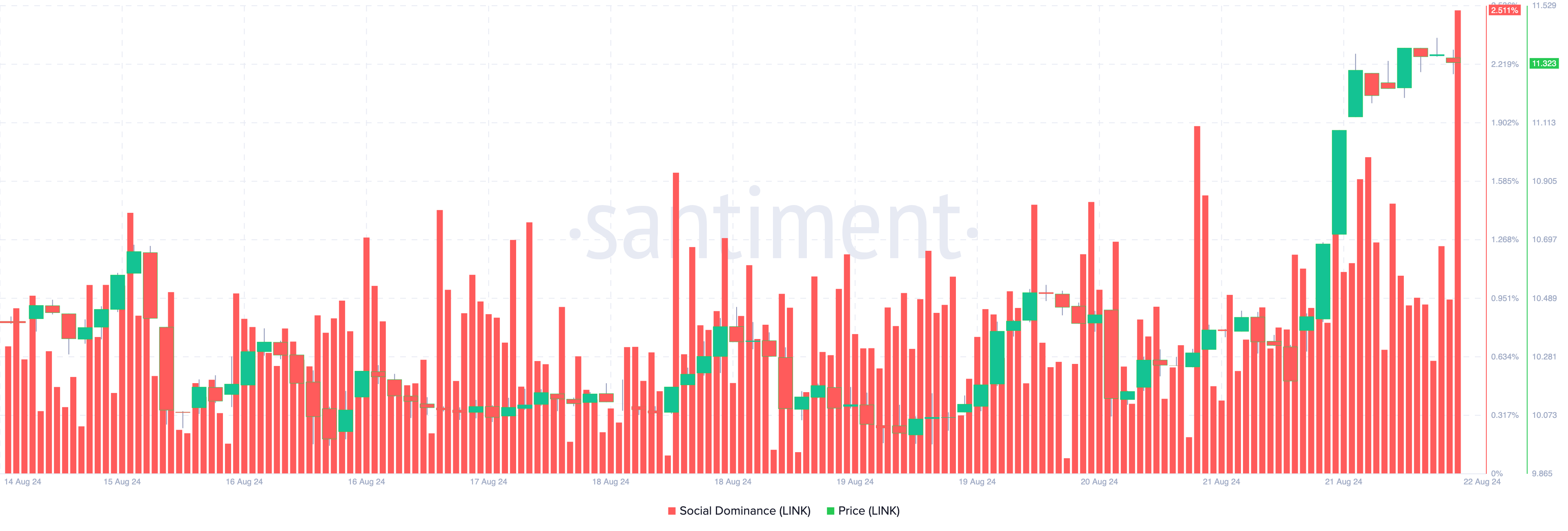

In line with Santiment’s social dominance information, the current efficiency of the cryptocurrency has captured broader market consideration, diverting focus from different belongings. Social dominance measures how continuously a undertaking is mentioned relative to others within the prime 100. Traditionally, when mentions improve, there’s usually a correlation with value actions.

Usually, an increase in social dominance results in larger costs. Nonetheless, if the metric turns into excessively excessive, it may sign a possible value peak. This normally signifies a surge in Worry of Lacking Out (FOMO), the place merchants rush in to purchase after notable good points, even because the asset may be nearing an area prime.

As such, if the sample repeats itself, LINK value might erase a few of its recently-made good points.

LINK Worth Prediction: Reversal on the Horizon

On the each day chart, LINK has fashioned a bearish pennant, which might sign a pause within the present uptrend. A bearish pennant sometimes seems when three trendlines converge: the flagpole (ensuing from an preliminary downtrend) and two strains representing resistance throughout consolidation and assist at decrease values.

Given the present market FOMO, a bearish pennant would possibly result in a breakdown beneath this sample. If confirmed, LINK’s value might fall beneath $10, doubtlessly sliding to $9.95. Nonetheless, this state of affairs could also be prevented if shopping for stress intensifies, invalidating the bearish outlook and conserving the uptrend intact.

Learn extra: How To Purchase Chainlink (LINK) and All the things You Want To Know

If LINK’s value breaks out of the bearish pennant as a substitute of breaking down, it might goal the following resistance stage round $13.10. A profitable transfer would shift the market sentiment, doubtlessly driving additional shopping for exercise and invalidating the bearish sample.

Disclaimer

Consistent with the Belief Undertaking pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.