All eyes are on Bitcoin (BTC) after it reclaimed the $61,000 mark, following the discharge of the Federal Open Market Committee (FOMC) minutes. The latest value motion has reignited curiosity within the cryptocurrency, particularly given Bitcoin’s correlation with international liquidity.

This correlation additionally attracts consideration to the US greenback index (DXY), as adjustments within the DXY can influence BTC. Sometimes, when the greenback weakens, Bitcoin strengthens because of traders looking for various belongings.

DXY Information New 2024 Lows: a Have a look at Macro Drivers

The U.S. Greenback Index (DXY) has fashioned decrease highs since June, hitting recent lows in 2024. After breaking under the January 1 low of $101.340, the DXY dropped additional, bottoming at $100.923 on Wednesday.

On the time of writing, it’s buying and selling at $101.311. A falling DXY is bullish for danger belongings like Bitcoin and different cryptocurrencies.

Alternatively, international liquidity (M2) is trending upward. M2 measures the overall sum of money circulating within the international economic system, together with checking accounts, financial savings accounts, and different liquid belongings that may be shortly transformed into money.

Danger belongings, together with Bitcoin, usually correlate with rising liquidity. The connection between Bitcoin’s value and M2 growth displays broader market sentiment and financial circumstances. The next M2 growth signifies a free financial coverage and an elevated cash provide, which regularly boosts danger belongings like cryptocurrencies.

“BTC is the most sensitive asset to liquidity. Historically, a 10% increase in global liquidity has corresponded in a 40% increase in Bitcoin’s price,” wrote Cryptonary.

Learn extra: The way to Defend Your self From Inflation Utilizing Cryptocurrency

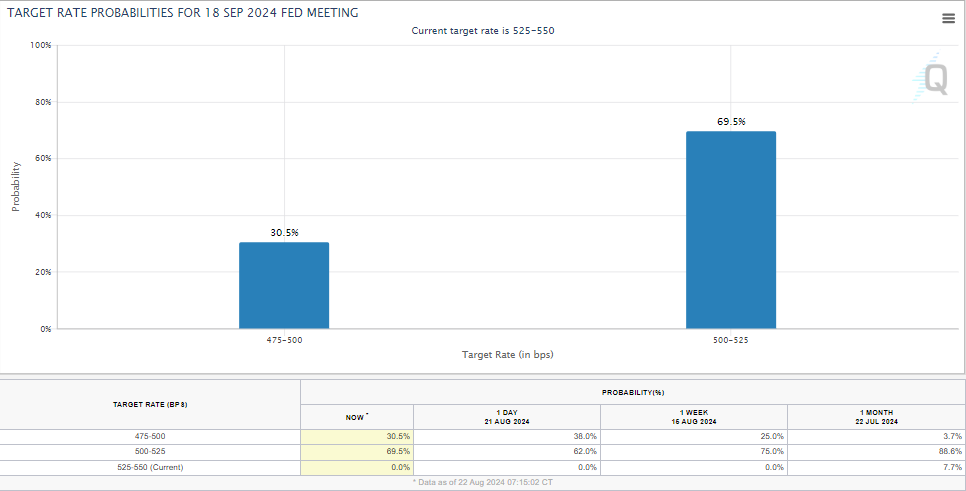

The Federal Reserve is more likely to ease financial coverage at its subsequent assembly, based on the FOMC minutes launched on Wednesday. Nevertheless, this is determined by information persevering with to align with expectations. The minutes additionally indicated that some policymakers supported a 25-basis-point (bps) price minimize through the July assembly. Regardless of this, the Fed selected to maintain charges unchanged, as BeInCrypto reported.

Based mostly on the CME FedWatch Device, the chance of a 50 bps price minimize in September has elevated to 30.5%, reflecting rising market sentiment towards a possible easing of coverage.

Nevertheless, it’s vital to notice that Fed Chair Jerome Powell has constantly urged warning, highlighting that slicing charges too quickly stays a serious concern. Even so, the FOMC minutes usually present essential insights into policymakers’ evolving views on rates of interest. That is notably related if there’s a shift of their stance.

All eyes shall be on Powell’s upcoming speech on Friday on the Jackson Gap symposium, as markets search for extra clues concerning the Fed’s subsequent steps. As BeInCrypto reported, Powell’s remarks may set off market volatility, particularly in risk-on belongings like Bitcoin.

The prospect of decrease rates of interest typically advantages danger belongings, which aligns with Bitcoin’s latest transfer above $61,000. The worth has damaged above the symmetrical triangle, however affirmation of this breakout remains to be pending. Markets will carefully monitor Powell’s feedback for additional route.

Learn extra: Bitcoin (BTC) Value Prediction 2024/2025/2030

A secure candlestick shut above $60,000, supported by the Relative Energy Index (RSI) holding above 50, would verify the continuation of Bitcoin’s uptrend. For additional upside, Bitcoin should break by the provision zone between $65,777 and $68,424. If this resistance is flipped into assist, generally known as a bullish breaker, it may pave the way in which for a push towards a brand new all-time excessive.

On the flip aspect, Bitcoin may fall again under $60,000, breaching the higher trendline of the symmetrical triangle. In a worst-case situation, additional promoting strain may drive BTC under the triangle’s decrease trendline and into the demand zone.

If shopping for strain inside the assist zone between $53,485 and $57,050 fails to counteract the sellers, Bitcoin’s value may drop even additional, probably focusing on the liquidity residing under $52,398. This could mark a draw back transfer, indicating a attainable reversal in development.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.