Ethereum (ETH) value may very well be getting ready to one other surge regardless of the current pump to $2,800, in line with a number of indicators analyzed on-chain.

At the moment, ETH trades at $2,771. If the indicators lately noticed are legitimate, the cryptocurrency’s worth may hit ranges not seen for the reason that succesful spot ETF launch on July 23.

Ethereum Presents a Uncommon Likelihood as Accumulation Picks Up

Yesterday, through the early Asian hours, ETH traded at $2,624. Following remarks from Fed Chair Jerome Powell signaling a strengthened dedication to inflation discount and potential rate of interest cuts, the altcoin’s worth surged. The ETH value improve brings the entire features over the past seven days to six.93%.

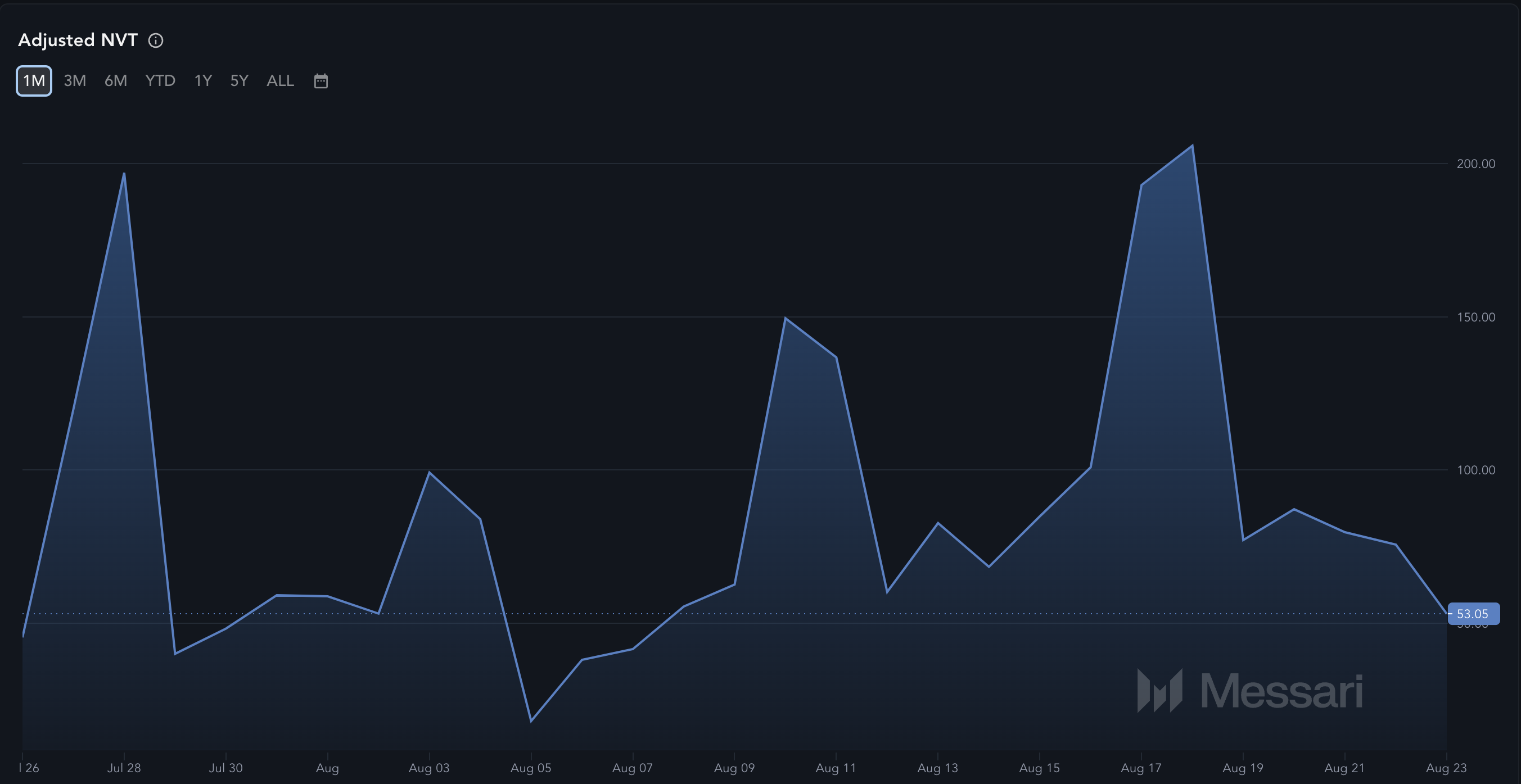

Messari knowledge reveals that Ethereum’s adjusted Community Worth to Transactions (NVT) ratio has dropped to -53.05. The NVT ratio displays whether or not a community’s market cap is rising sooner than its transaction quantity. Excessive NVT readings usually recommend that an asset is overpriced, usually indicating market tops and overvaluation durations that will result in a value decline.

Learn extra: Ethereum ETF Defined: What It Is and How It Works

Nonetheless, in Ethereum’s scenario, the huge drop within the ratio signifies that the community is undervalued, and ETH itself is at a reduction. Due to this fact, it’s not misplaced to say that the cryptocurrency is close to its backside, and the percentages of a notable value improve within the coming weeks may be excessive.

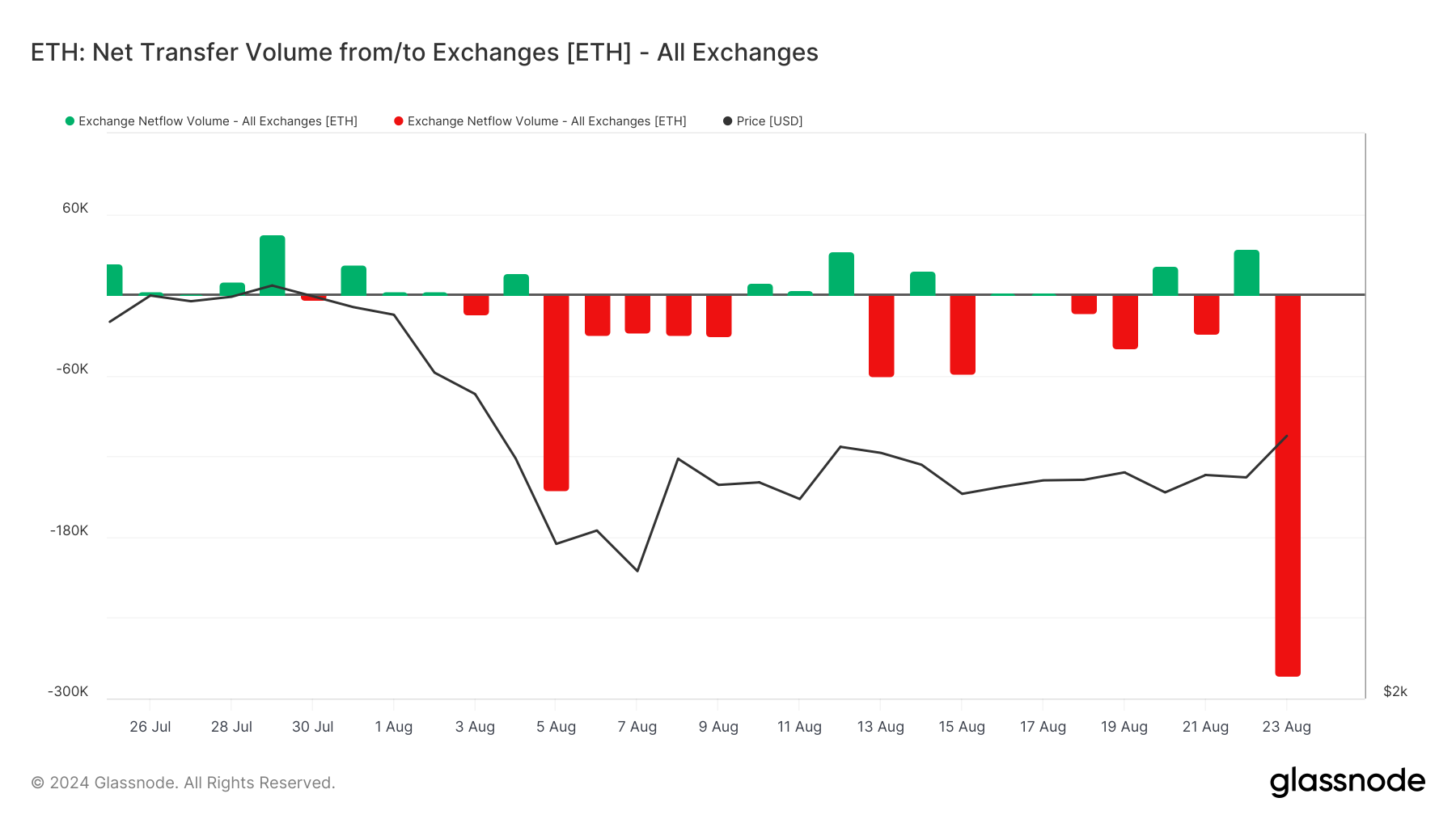

Moreover this, Ethereum is experiencing a excessive degree of alternate withdrawals. Primarily based on Glassnode’s knowledge, the alternate web switch quantity noticed a notable decline of over 280,000 ETH on August 23.

This quantity measures the distinction between cash flowing into an alternate and people taken out. A constructive worth signifies that extra cash are being despatched into exchanges — an indication of promoting stress.

Due to this fact, the current withdrawals, valued at nearly $800 million, verify a surge in shopping for stress. If sustained, this might validate the bias of shopping for ETH on the present market worth.

ETH Worth Prediction: Able to Rally

In keeping with the every day ETH/USD chart, Ethereum’s failure to interrupt under the $2,536 assist degree performed a key position in its current bounce. Had it slipped under this degree, ETH may have dropped to $2,345, doubtlessly making a bearish outlook.

The current shopping for momentum, highlighted by the Shifting Common Convergence Divergence (MACD) indicator, suggests ETH’s value may attain $2,829.50 within the quick time period. The MACD measures momentum, with constructive readings indicating bullish sentiment and damaging readings signaling bearish developments.

Moreover, the Fibonacci retracement indicator, which identifies key assist and resistance ranges primarily based on historic value actions, offers additional insights. If ETH surpasses $2,829, the subsequent potential goal may very well be round $3,265.60.

Learn extra: How To Purchase Ethereum (ETH) With a Credit score Card: A Step-by-Step Information

Within the meantime, macro market analyst Matthew Hyland shared his ideas on ETH’s value motion. In a video posted on X, Hyland talked about that the cryptocurrency wants to shut above $2,800 to rally to the peak it reached in July.

“If Ethereum can close weekly above $2,800, then it could see a majour push toward the upper $3,500 to $3,600 area,” the analyst defined.

Nonetheless, ETH dangers invalidating this bullish outlook resulting from a current choice by the Ethereum Basis. Traditionally, it has offered massive quantities of ETH for varied causes, usually main to cost drops. Earlier right this moment, on-chain knowledge revealed that the inspiration transferred 35,000 ETH to Kraken.

Like earlier instances, the switch may finally result in a sell-off. If it sends one other spherical once more, ETH’s value may very well be affected, and a decline to $2,516.21 may very well be subsequent.

Disclaimer

Consistent with the Belief Undertaking tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.