Bitcoin and altcoins staged a powerful comeback after Jerome Powell, the Federal Reserve chairman, hinted that rates of interest would begin falling in September.

Bitcoin (BTC) jumped to $64,000 on Aug. 24 whereas Ethereum (ETH) pushed to $2,765. The whole market cap of all cash rose by nearly 5% to over $2.26.

The identical development occurred within the inventory market, the place key indices just like the Dow Jones, S&P 500, and the Nasdaq 100 approached their all-time highs. Nonetheless, there’s a danger that good points within the inventory and crypto market will likely be short-lived.

Purchase the rumor, promote the information

The market was already factoring in fee cuts for September after the current weaker-than-expected U.S. jobs numbers. The chance within the Fed Price Monitor device has been above 80% previously three weeks.

Due to this fact, Powell’s assertion was only a clue as to what to anticipate on the subsequent assembly, scheduled for Sept. 18. As such, with a fee reduce absolutely priced in, there’s a danger that shares and crypto will retreat as traders promote the information.

This development has occurred a number of occasions. For instance, Bitcoin dropped by nearly 10% after halving, whereas Ether has fallen by double digits because the Securities and Trade Fee accepted ETFs.

Shares usually drop sharply after the Fed begins chopping charges. Geiger Capital, a conservative-leaning commentator on X.com, recalled 2001 and 2002 as examples.

On the optimistic aspect, shares have executed effectively when the Fed begins cuts, as we noticed in 2020 throughout the early phases of the Covid-19 pandemic.

One other optimistic is that these cuts are coming at a time when American corporations are reporting robust earnings progress.

Cash markets are seeing inflows

Another excuse why cryptocurrencies could retreat after the Fed begins chopping is that low-risk cash market funds are nonetheless seeing inflows.

Knowledge exhibits that these funds had over $90 billion in internet inflows within the first half of August whilst expectations of fee cuts rose. These funds now maintain over $6.2 trillion in property.

The idea has been that dangerous property like crypto and shares will see extra inflows as cash market traders capitulate.

This rotation will possible occur, however it’s going to take time since rate of interest cuts will possible be gradual.

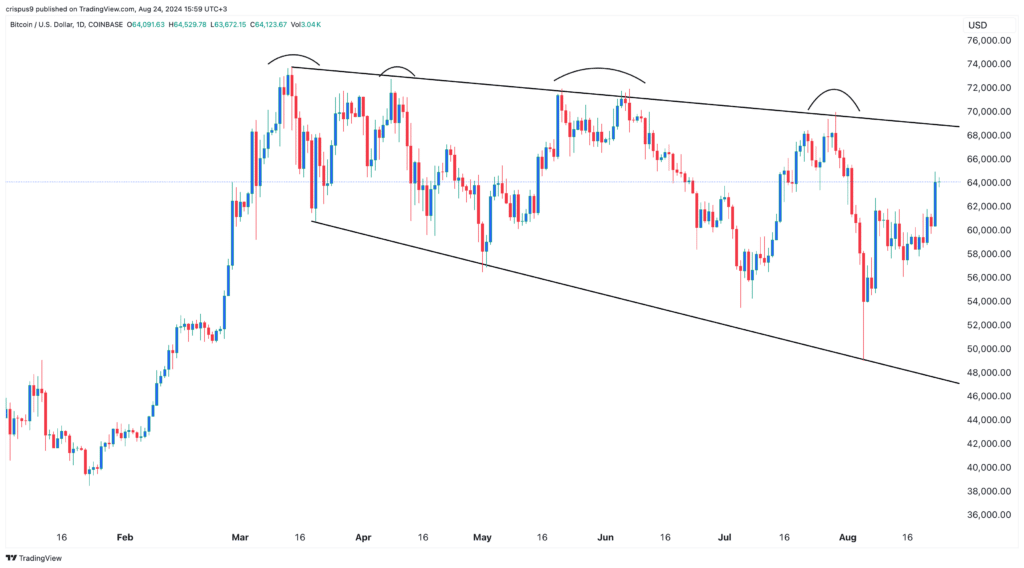

Bitcoin remains to be forming decrease highs

Bitcoin rebounded to $64,000 after falling to $49,000 earlier this month. Nonetheless, this value motion remains to be not but an entire breakout as a result of it has remained on this vary previously few months.

Notably, Bitcoin has been forming a collection of decrease highs since March. The primary excessive was at $73,800 adopted by $72,000 and $70,000. As such, an entire bullish breakout will likely be confirmed if the coin clears the primary excessive at $73,800. Earlier than that occurs, there’s a danger that Bitcoin will resume the bearish development.

On the optimistic aspect, the collection of decrease highs and decrease lows has resulted in a falling broadening wedge sample, a preferred bullish signal.