Spot Ethereum exchange-traded funds, or ETFs, had seven consecutive days of outflows shedding over $5.7 million in property on Friday, Aug. 23, bringing the cumulative determine to $464 million, knowledge by SoSoValue exhibits.

Cumulative web property locked in these Ethereum (ETH) ETFs stand at about $7.65 billion.

The Grayscale Ethereum Belief has $5 billion adopted by the Grayscale Mini Ethereum Belief with $1.01 billion. It’s adopted by ETFs from Blackrock, Constancy, Bitwise, and VanEck.

Institutional buyers reluctance

In a be aware to Bloomberg, crypto analyst Noelle Acheson famous that many institutional buyers are a bit reluctant to put money into Ethereum ETFs and like to deal with Bitcoin (BTC) for his or her diversification efforts.

Nevertheless, she expects that Ether ETFs will doubtless see extra inflows sooner or later, akin to the steel trade, the place gold ETFs maintain over $100 billion in property whereas these monitoring silver have lower than $20 billion.

The chance value

The opposite purpose why Ethereum ETFs are struggling is the chance of holding them vis-a-vis shopping for Ether.

Consumers of the most cost effective Ether ETF — Grayscale Mini Ethereum — pays a small expense ratio of 0.15%. Nevertheless, they may also keep away from earning profits by means of staking.

Information by StakingRewards exhibits that Ethereum yields about 3% or $300 in the event you make investments $10,000 in it.

The information exhibits that Ethereum’s web staking influx has risen in 20 of the final 30 days, reaching over $93.7 billion. Due to this fact, since Ether ETFs monitor Ethereum costs, many buyers are choosing Ether.

Ethereum is underperforming Bitcoin

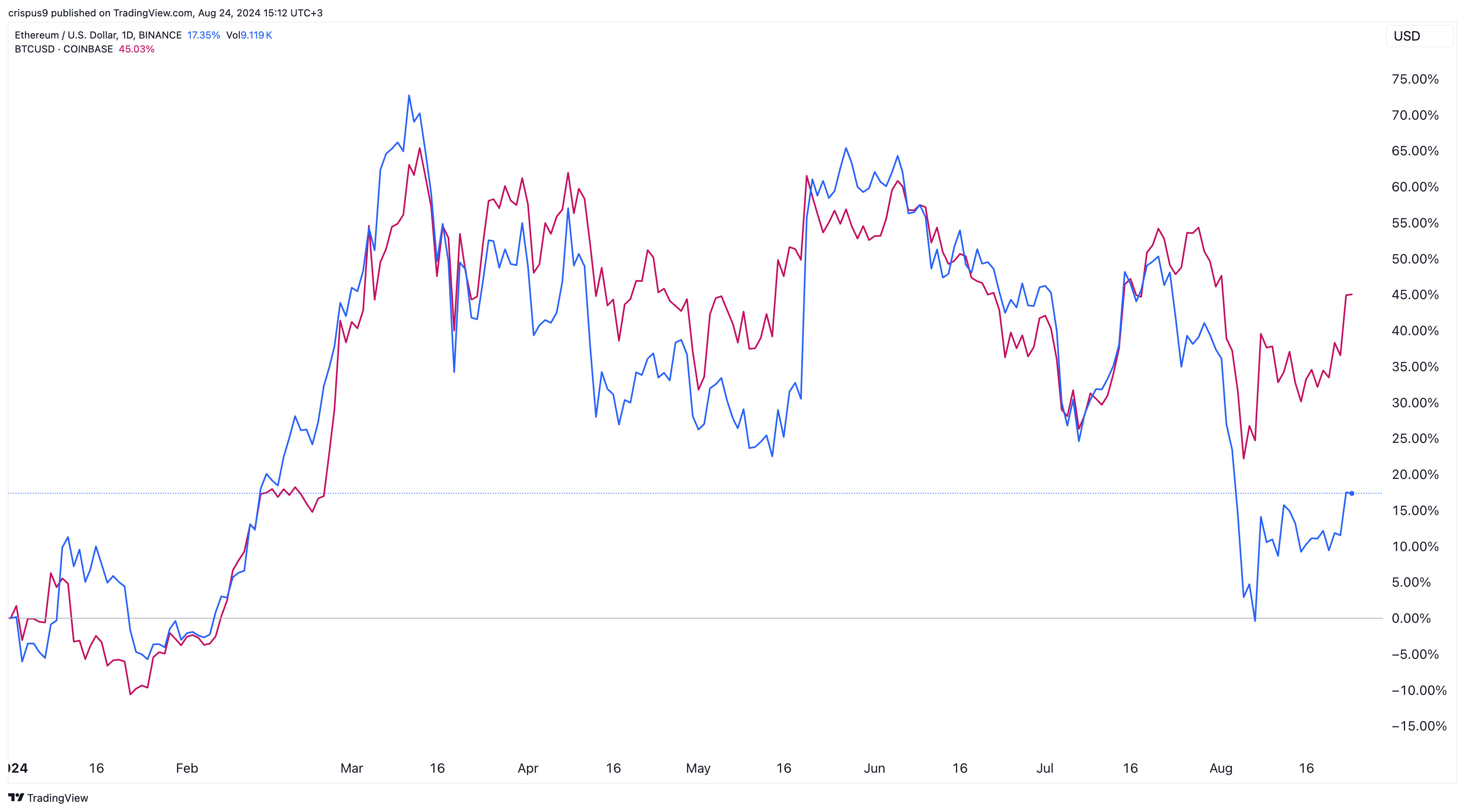

One other doubtless purpose is that Bitcoin is doing higher than Ether this 12 months. It has risen by over 45% whereas ETH is up by lower than 20%.

This efficiency is probably going as a result of Ethereum is going through substantial competitors from Solana (SOL) and Tron (TRX).

Tron has grow to be a serious participant in stablecoin transactions, dealing with day by day volumes of over $40 billion. Equally, Solana has seen substantial traction due to its meme cash. In consequence, in July, Solana was the most important chain in DEX volumes, dealing with over $58 billion.

Ethereum’s ETF efficiency will doubtless be a crimson flag for monetary companies corporations contemplating launching different altcoin ETFs like Solana and Avalanche.