Popcat skilled a considerable bullish development final week, coinciding with an total uplift within the cryptocurrency market.

Over the previous seven days, Popcat’s (POPCAT) value has soared 95.7%, climbing from $0.393 on Aug. 19 to a peak not noticed since July 30. Within the final 24 hours alone, the asset has elevated by 2.2%, presently buying and selling at $0.75.

This latest surge has elevated Popcat’s market capitalization past $735 million, rating it because the 102nd-largest cryptocurrency by market cap. Its day by day buying and selling quantity has reached roughly $76.4 million.

A big driver behind this value escalation was the itemizing of Popcat perpetual contracts on Binance Futures, which provide merchants as much as 75x leverage, as per the latest announcement from the change.

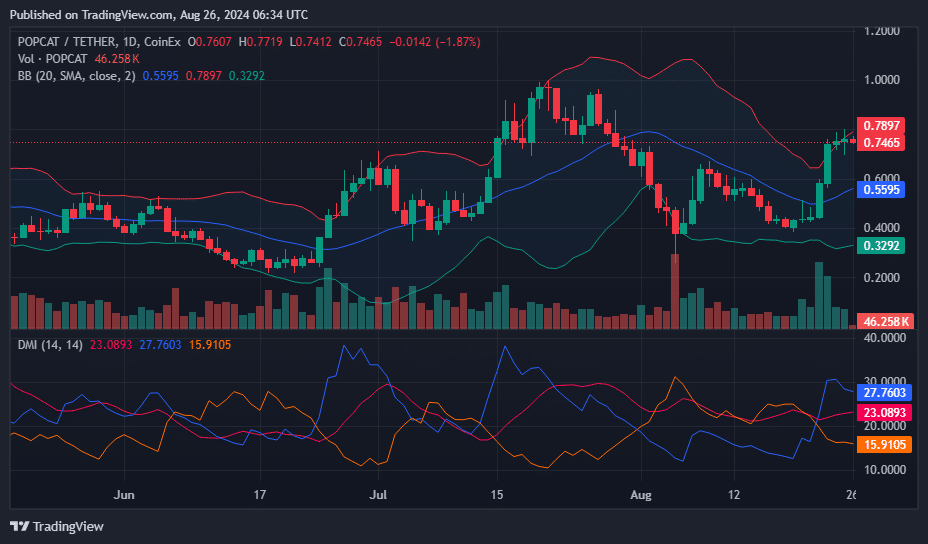

As of now, Popcat’s value positions it above the center Bollinger Band at $0.5595, indicating a bullish motion from decrease ranges. Nonetheless, it stays beneath the higher Bollinger Band set at $0.7897, suggesting that there’s potential room for upward motion earlier than encountering vital resistance.

The width between the decrease Bollinger Band at $0.3292 and the higher band at $0.7897 signifies reasonable market volatility. The present value nearing the higher band however not touching it might suggest that whereas the worth has recovered from decrease ranges, it hasn’t reached a state of overbought situation but, permitting scope for additional upward motion.

The +DI line is at 27.7603, which is increased than the -DI line at 15.9105. This exhibits that the shopping for strain is presently stronger than the promoting strain.

The DMI setup underscores the continued constructive sentiment because the +DI stays dominant over the -DI, aligning with the bullish sign from the Bollinger Bands. Given these indicators, merchants may search for potential purchase alternatives, anticipating a take a look at of the higher Bollinger Band at $0.7897 within the close to future except new market dynamics emerge to shift the present development.

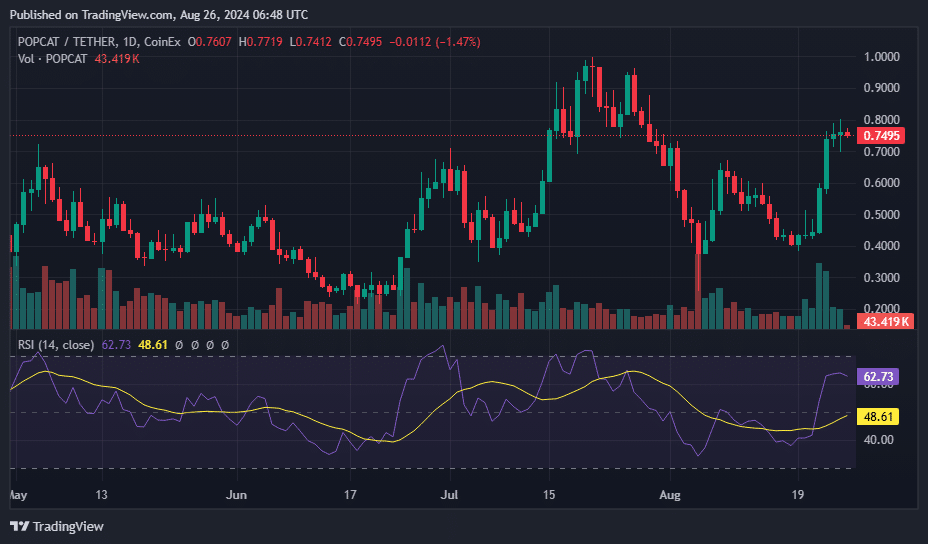

The RSI worth stands at 62.73, which is considerably above the impartial threshold of fifty however nonetheless beneath the everyday overbought marker of 70. This means sturdy upward momentum with out veering into overbought territory, suggesting that whereas the market is powerful, there may be probably extra room for the worth to rise earlier than turning into overextended.