Gert van Lagen, a outstanding technical analyst, means that Bitcoin’s (BTC) value might attain unprecedented heights this cycle. In a current publish on X, van Lagen referred to Bitcoin’s weekly chart to again up his evaluation.

Presently, Bitcoin is buying and selling at $62,290. If van Lagen’s forecast holds true, BTC might get away and surge towards $200,000.

Bitcoin May Be on the Brink of a Breakout

The analyst shared a step-like parabolic curve on the chart from the publish. Given the illustration, it seems that BTC has been forming the sample since 2021. The chart, as seen beneath, additionally reveals a Cup and Deal with sample, which reveals a bullish continuation.

The Cup and Deal with sample consists of a cup formation, which reveals how a cryptocurrency strikes from a downtrend to an uptrend. That is adopted by a consolidation interval (deal with) earlier than one other breakout.

Per van Lagen, Bitcoin is at present shifting across the deal with, suggesting that the parabolic transfer to the “banana zone” is shut. The banana zone, a time period that Raoul Pal usually makes use of, describes a interval the place BTC, alongside different cryptocurrencies, skilled explosive upward progress.

Learn extra: Bitcoin Dominance Chart: What Is It and Why Is It Necessary?

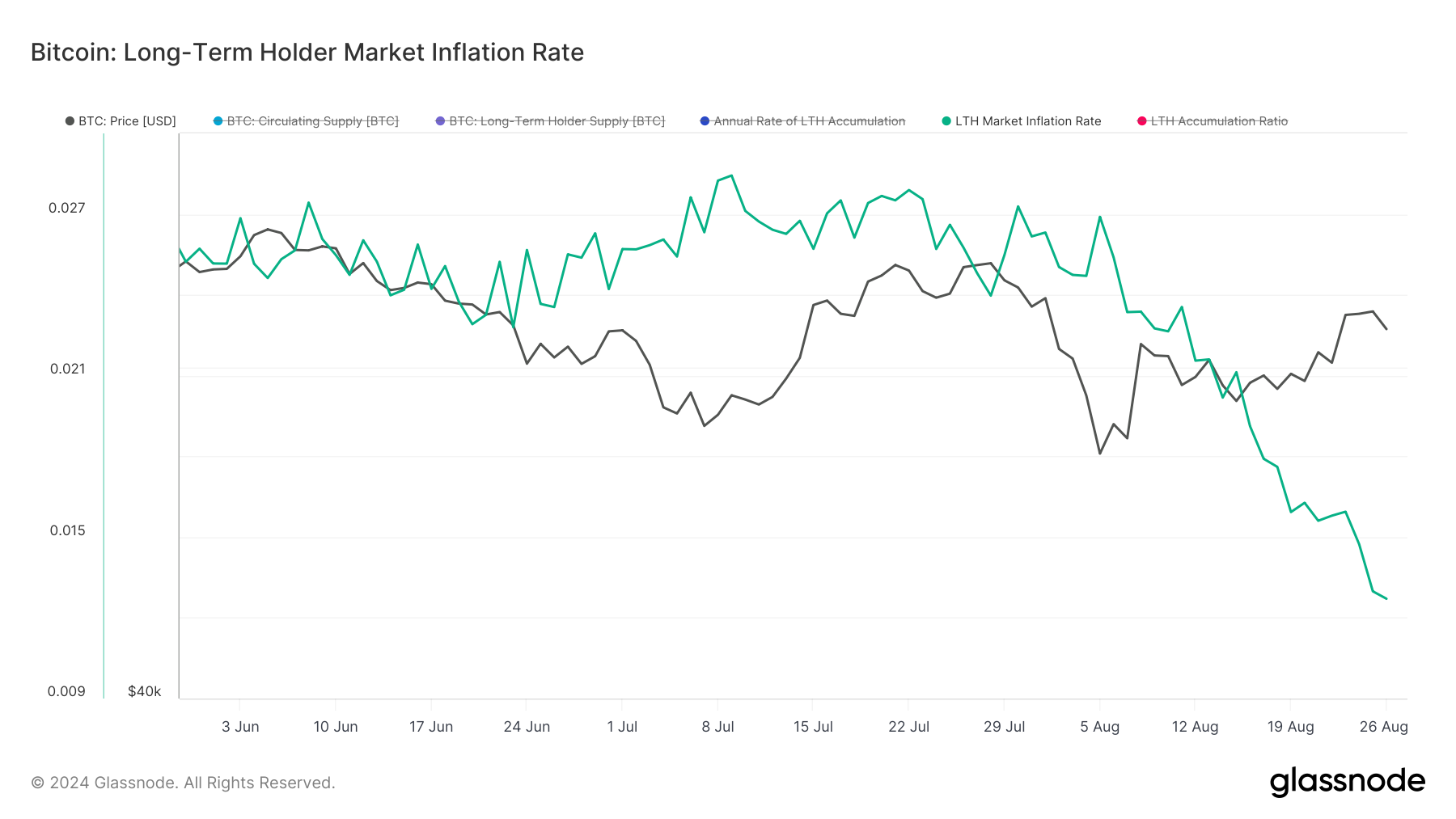

Moreover, the Lengthy-Time period Holder Market Inflation, which measures the annual price of accumulation or distribution, appears to align with the bias.

Increased market inflation values counsel that holders are shrinking their steadiness and including stress to the promote aspect. Decrease values, however, point out that long-term holders are accumulating at a sooner price.

Traditionally, Bitcoin value hits the cycle high at an especially excessive studying. Nonetheless, as proven beneath, the Lengthy-Time period Holder market inflation has been lowering for the reason that first week of August. If this decline continues, BTC might expertise a notable rebound.

BTC Value Prediction: Quick-Time period Evaluation Factors to $64,000

On the 4-hour chart, Bitcoin reveals its readiness to exit the present drawdown. If validated, this purchase sign might ship the cryptocurrency’s value towards $64,240.

Nonetheless, it’s necessary to notice that the $61,839 and $60,680 ranges are important for BTC. If Bitcoin falls beneath $61,839, its worth might decline additional to $60,680. Conversely, if bulls defend this zone, the value is prone to rise above $64,000.

Past the technical evaluation, Bitcoin ETFs have skilled vital inflows for practically ten consecutive days. This development mirrors the circumstances that led to Bitcoin’s all-time excessive in March. If these inflows proceed into the following month, Bitcoin’s value might rally towards $70,000.

Learn extra: What Is a Bitcoin ETF?

Equally, analyst Michaël van de Poppe means that BTC might attain a brand new all-time excessive if it holds above $62,000.

“Bitcoin broke through $61.5-62K as the crucial resistance zone. I’d prefer to see that level as a retest and hold as support. Then, we’ll see a new run towards the all-time high,” van de Poppe defined.

Nonetheless, if BTC fails to take care of its momentum above $61,839, this bullish outlook is likely to be invalidated. In that state of affairs, the cryptocurrency might face a deeper correction, doubtlessly dropping beneath $60,000.

Disclaimer

Consistent with the Belief Undertaking tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.