From EJ Antoni (Heritage), article entitled “Coming recession may already have arrived” within the Boston Herald (8/21):

“…an increasing number of indicators say the recession has arrived in the broader economy.”

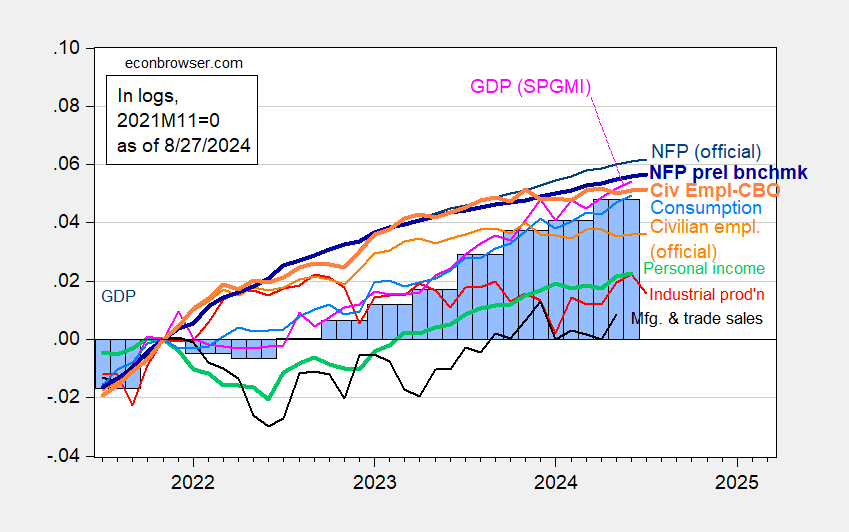

Listed below are key indicators adopted by the NBER Enterprise Cycle Courting Committee:

Determine 1: Nonfarm Payroll (NFP) employment from CES (blue), NFP implied preliminary benchmark revision (daring blue), civilian employment (orange), implied civilian employment utilizing CBO estimates of immigration (daring orange), industrial manufacturing (pink), private earnings excluding present transfers in Ch.2017$ (daring inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (mild blue), and month-to-month GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Supply: BLS through FRED, Federal Reserve, BEA 2024Q2 advance launch, S&P International Market Insights (nee Macroeconomic Advisers, IHS Markit) (8/1/2024 launch), and writer’s calculations.

For preliminary benchmark revision, see right here; for different civilian employment utilizing CBO estimates of immigration, see right here. Notice I used 2024 CBO estimates in these estimates as properly; within the earlier iteration, I used CBO estimates solely up by way of 2023M06.

Of those indicators, I’d solely depend civilian employment from the family survey and maybe industrial manufacturing as signaling a potential recession.

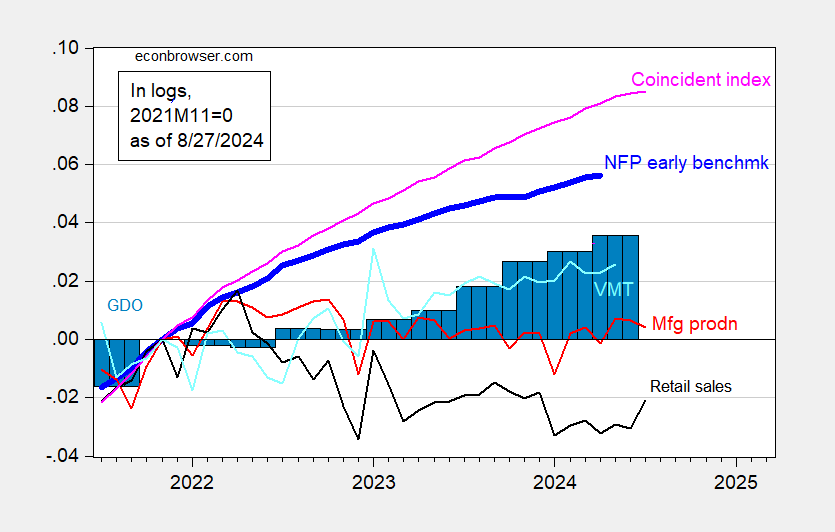

Listed below are some different indicators. Notice that the vertical scale is similar for Determine 2 as for Determine 1, for the sake of comparability.

Determine 2: Nonfarm Payroll early benchmark (NFP) (daring blue), manufacturing manufacturing (pink), retail ales in 2019M12$ (black), car miles traveled (mild blue), and coincident index (pink), GDO (blue bars), all log normalized to 2021M11=0. Supply: Philadelphia Fed, Federal Reserve, Census, through FRED, BEA 2024Q2 advance launch and estimated (by writer) enterprise surplus, and writer’s calculations.

Amongst these indicators, retail gross sales and manufacturing manufacturing is perhaps signaling a recession, though the previous has picked up on the newest out there month. The coincident index rose at an annualized 1.8% during the last three months reported.

The same old caveat applies — all these sequence will probably be revised, significantly the GDP sequence, which is why the NBER BCDC doesn’t place major reliance upon this sequence (see how the 2001 recession solely briefly match the 2 consecutive quarter rule-of-thumb, right here).

The one indicator in favor of the recession name is the Sahm rule. The caveat right here is that the indicator is pulled up due to a serious labor power enhance, somewhat than employment lower, as proven on this publish. A 12 months in the past, I famous that the usual time period unfold fashions indicated a excessive chance of recession by mid-year 2024, so I’m loath to declare the outlook secure now, although weekly indicators (e.g., WEI, for information via 8/17) nonetheless point out development at 2.32%. Nonetheless, not fairly able to be put within the recession camp, but.