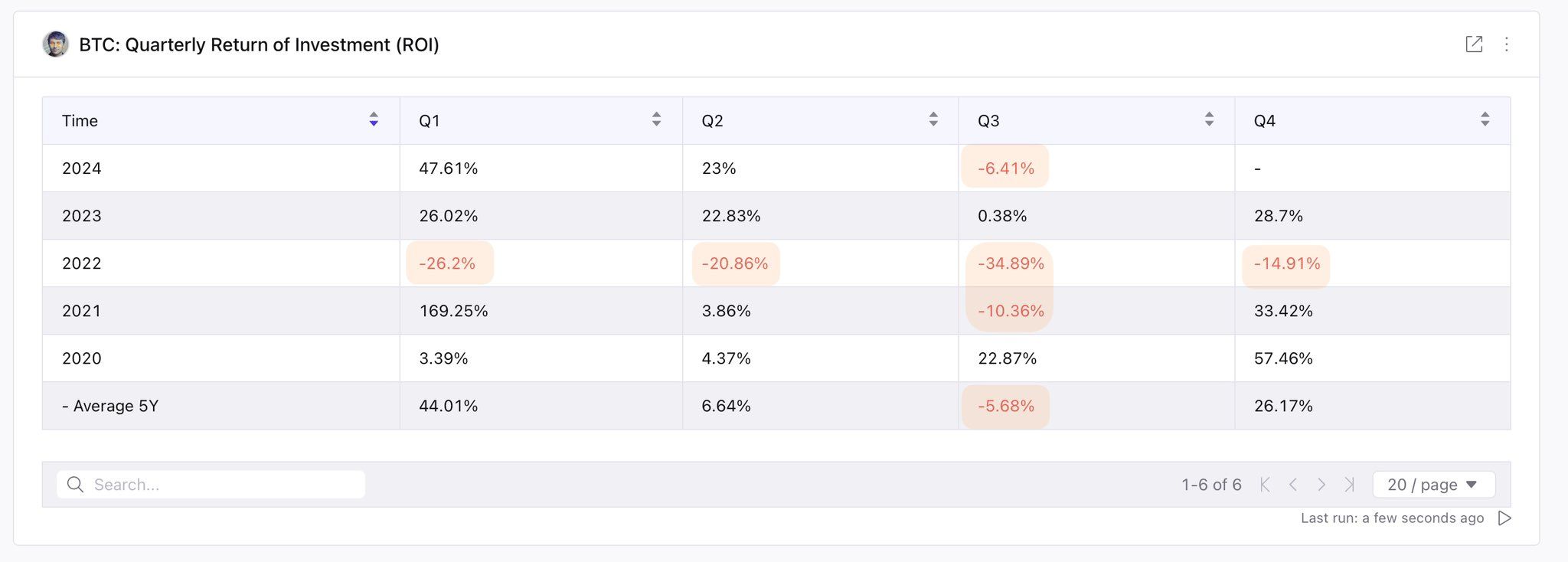

Bitcoin’s (BTC) worth has skilled various ranges of return for every quarter of the final 5 years. Nonetheless, one factor synonymous with these durations is how the coin produces a constructive return between October and December.

With September approaching, BTC might be shut to a different season the place the worth would possibly go on a parabolic rally. Will it’s the identical this time?

What Historical past Says About Bitcoin Efficiency in This fall

Traditionally, Bitcoin’s worth tends to underperform within the third quarter (Q3). Nonetheless, in response to a chart shared by analyst Axel Adler, Bitcoin has seen a mean improve of 26% each fourth quarter (This fall) since 2019.

For instance, in October 2023, BTC traded round $26,000. By December, it had surged to $44,000. In distinction, Bitcoin didn’t obtain such positive factors in 2022 because of the FTX contagion, which pushed the market right into a bear section.

In 2021, Bitcoin rose from $40,000 to $69,000 between September and November, earlier than experiencing a slight decline in December. The same sample occurred in 2020 when BTC’s worth doubled throughout This fall.

Learn extra: What Is Bitcoin? A Information to the Authentic Cryptocurrency

If this sample holds true, Bitcoin’s worth might be poised for a major improve as soon as September ends. To gauge this potential, it’s essential to guage the present market situations surrounding the coin.

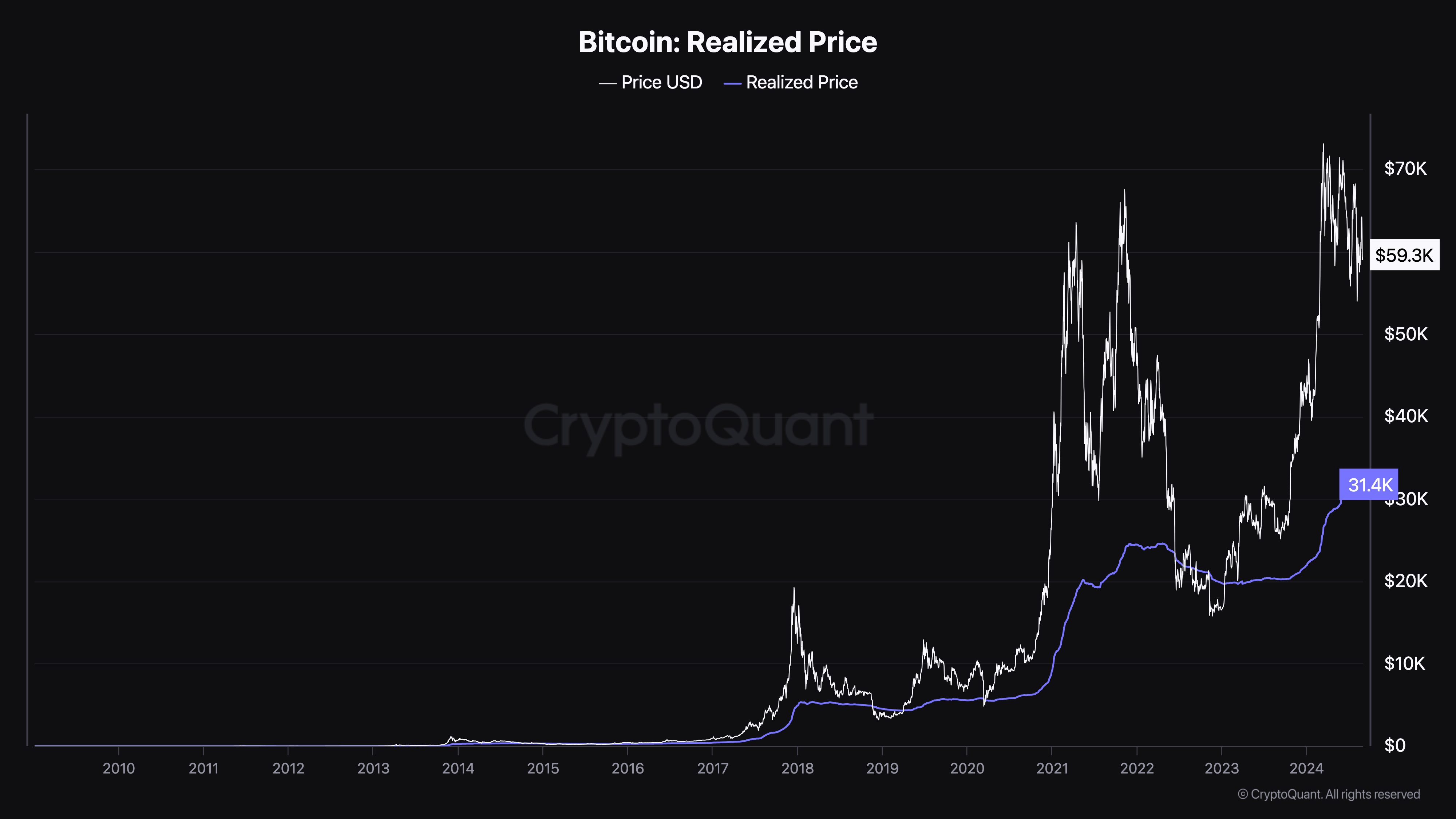

BeInCrypto particularly examines the Realized Value, which represents the common worth the whole market paid for Bitcoin. Traditionally, this metric has served as an on-chain assist or resistance degree for BTC.

At press time, Bitcoin’s Realized Value is $31,400. This worth seems to be offering assist for the cryptocurrency, as indicated by the CryptoQuant chart under. For the Realized Value to behave as resistance, it could have to align with or exceed Bitcoin’s present market worth.

When this occurs, the worth tends to lower afterward. Due to this fact, the present worth of the metric means that Bitcoin nonetheless has an excellent upside potential. Therefore, a major worth improve might be possible by This fall and earlier than the top of this 12 months.

BTC Value Prediction: The Coin Hints at a 24% Achieve, However First…

As of this writing, Bitcoin is buying and selling at $59,551, down from $64,452. Notably, this worth is hovering across the 200-day Exponential Transferring Common (EMA), a key technical indicator that measures development path. The 200 EMA (blue) provides insights into the long-term development.

When the 200 EMA rises above Bitcoin’s worth, it typically stalls the uptrend or pulls it down. Conversely, when the 200 EMA is under the worth, it creates room for Bitcoin to develop. At the moment, if BTC fails to climb above this indicator, its worth might drop to $57,818 or probably as little as $54,474.

The Chaikin Cash Stream (CMF), which tracks the movement of liquidity right into a cryptocurrency, additionally helps the potential for a decline. The CMF studying has dropped, signaling a lower in shopping for strain.

Learn extra: Bitcoin (BTC) Value Prediction 2024/2025/2030

Nonetheless, if previous efficiency is any indication, BTC might rise by 24% within the early months of This fall, pushing the coin’s worth to $71,974. Alternatively, if the broader market experiences a major decline in capital influx, this prediction might be invalidated, probably inflicting Bitcoin’s worth to fall to $49,068.

Disclaimer

Consistent with the Belief Undertaking tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.