Ethereum co-founder Vitalik Buterin has firmly denied allegations that the community’s Layer-2 options can unilaterally seize customers’ funds.

This assertion comes after a number of crypto stakeholders reignited the talk over fund safety on Ethereum Layer-2 networks on the social media platform X (previously Twitter).

Buterin Addresses Skepticism Over Ethereum Layer-2 Fund Safety

On August 31, Justin Bons, founder and CIO of Cyber Capital, argued that Layer-2 networks are inherently dangerous as a result of their centralized construction, claiming they may simply steal customers’ funds.

“L2s are dangerous, as they can steal user funds and can even go down at any time! A clear consequence of their centralized design. [This] betrays the cypherpunk principles they pretended to hold dear,” Bons claimed.

Mert Mumtaz, co-founder and CEO at Helius, corroborated this view in a separate put up. In line with Mumtaz, it’s “insane” that main Layer-2 options on the mainnet have the technical functionality to take action.

Nevertheless, Buterin rapidly responded by dismissing these fears. He defined that Ethereum Layer-2 options can’t unilaterally take customers’ funds, as they require a excessive degree of consensus to perform. Buterin famous {that a} safety council, with a voting threshold of at the least 75%, oversees governance points.

Learn extra: A Newbie’s Information to Layer-2 Scaling Options

Buterin additionally added that at the least 26% of council members have to be impartial of the corporate behind the Layer-2 resolution. He highlighted that each Arbitrum and Optimism meet these standards, making the concept of L2s stealing funds extremely unlikely.

“A major nuance: the rules for stage 1 require that only a security council with >= 75% vote threshold can overrule the code, and a quorum blocking (ie. >= 26%) subset needs to be outside the company. OP and Arb both comply with this. So the orgs cannot unilaterally steal funds,” Buterin said.

Regardless of Buterin’s assertion, some group members nonetheless expressed skepticism over the scenario, with Mumtaz stating that he shouldn’t “assume intent on behalf of the organization.”

Buterin Clarifies ETH Gross sales

In a parallel improvement, Buterin additionally addressed issues about his latest Ethereum gross sales. In an August 31 put up, he defined that his gross sales usually are not profit-driven however meant to assist significant initiatives inside and out of doors the Ethereum ecosystem. He talked about that some proceeds go to charitable causes, together with biomedical analysis and improvement.

“I haven’t sold and kept the proceeds since 2018. All sales have been to support various projects that I think are valuable, either within the ethereum ecosystem or broader charity (eg. biomedical R&D),” Buterin said.

Learn extra: Who Is Vitalik Buterin? An In-Depth Have a look at Ethereum’s Co-Founder

This clarification comes at a time when the crypto group has been more and more involved in regards to the frequency of Buterin’s ETH transfers. Final month, he moved 800 ETH, value about $2.01 million, to a multisig pockets, with 190 ETH subsequently swapped for 477,000 USDC.

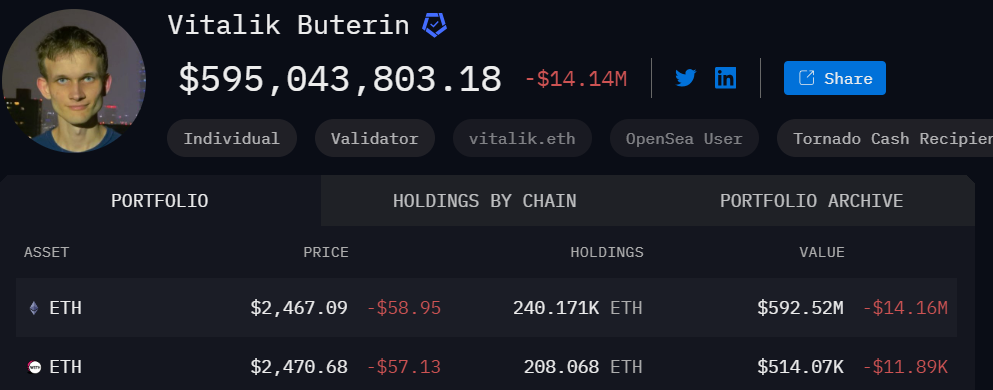

Regardless of these transactions, Buterin nonetheless holds a big quantity of Ethereum. In line with the Arkham Intelligence dashboard, he presently owns roughly $592 million value of ETH.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.