In simply 10 days, POPCAT has dropped over 30%, however the decline is probably not over. A deeper evaluation of a number of indicators reveals that additional declines might be on the horizon.

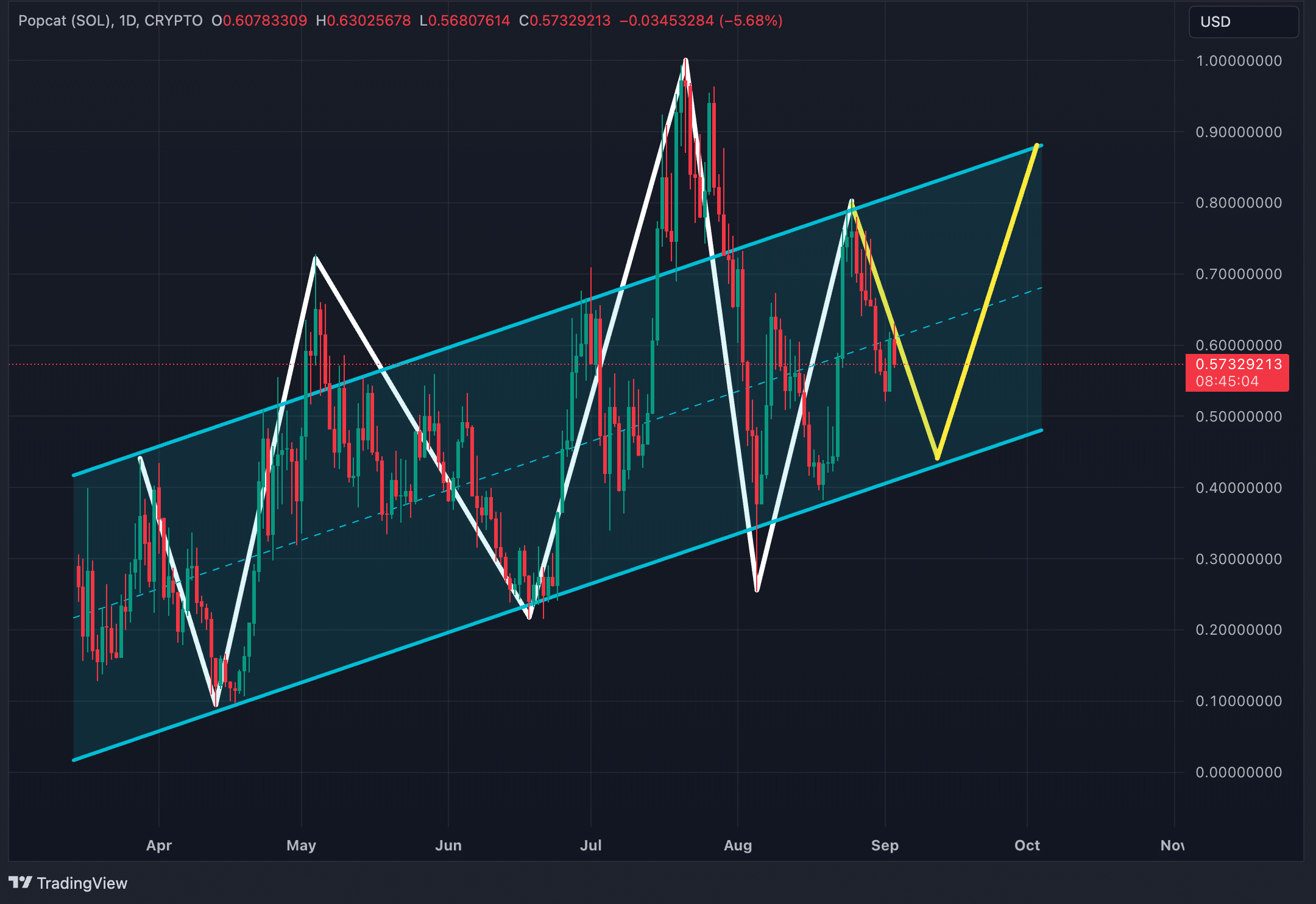

Inside POPCAT’s parallel channel

POPCAT respects a parallel channel that defines its motion. Whereas there have been moments when the worth broke above or under the channel, it continues to stick to this sample over time. The white strains on the chart provide a simplified illustration of the worth actions throughout the channel.

Trying forward, the yellow strains depict a potential future path for POPCAT. The subsequent transfer may see a drop to round $0.43 within the coming weeks, representing an additional decline of over 23% from the present stage. After this, the worth might then rally in the direction of $0.87 round October to November.

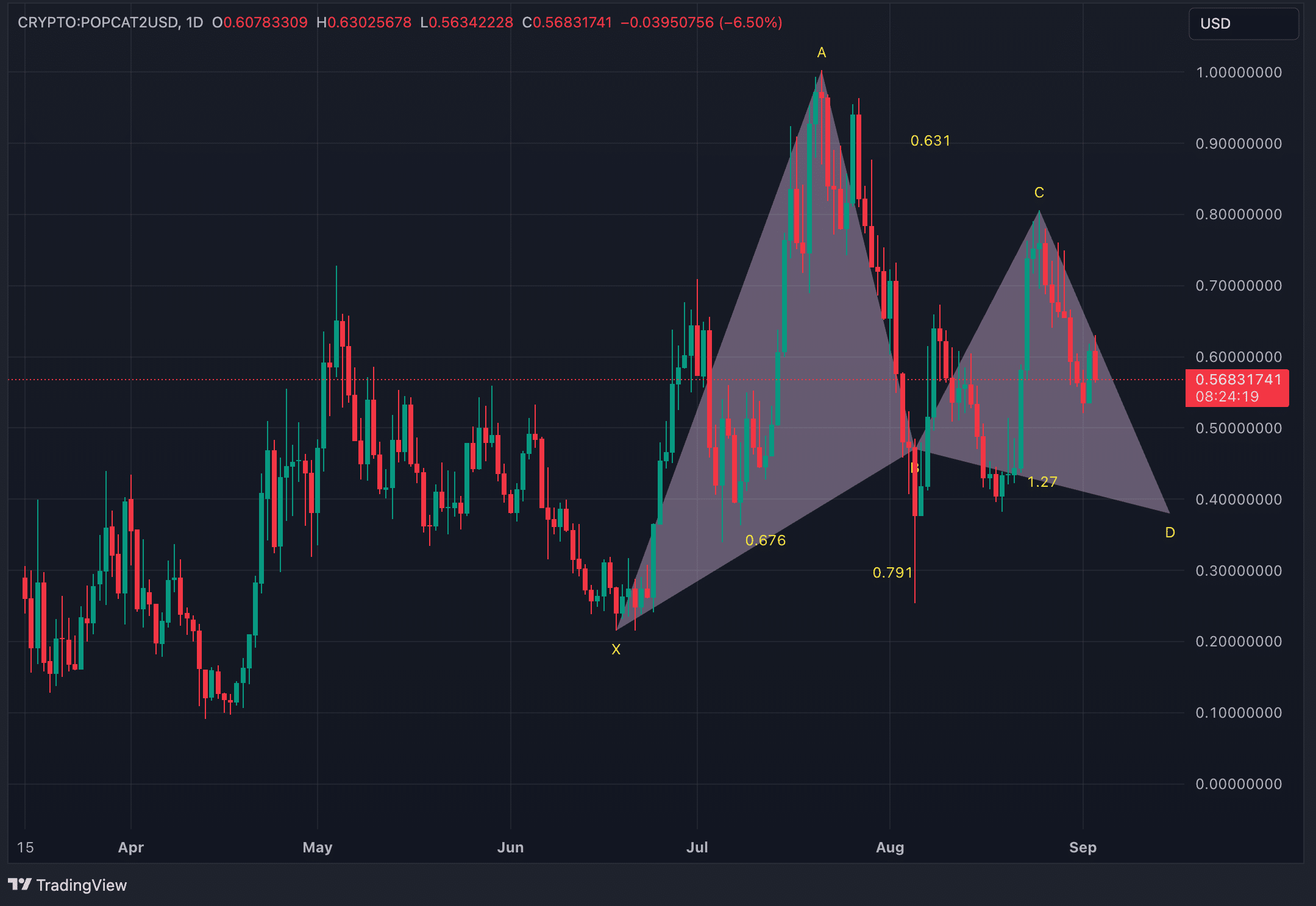

Gartley harmonic sample on the verge of completion

One robust indication that helps the probability of an additional downturn in POPCAT is the event of the Gartley harmonic sample on its each day chart. The Gartley sample is a sort of harmonic worth formation that indicators potential reversal zones based mostly on Fibonacci ratios and has an 85% success fee. It consists of 5 factors—X, A, B, C, and D—and represents a retracement adopted by a continuation of the general pattern.

Within the case of POPCAT, the sample has shaped with the ultimate level D but to be accomplished. If the Gartley sample completes as anticipated, the worth may drop to roughly $0.38. This goal lies barely under the decrease boundary of the established parallel channel.

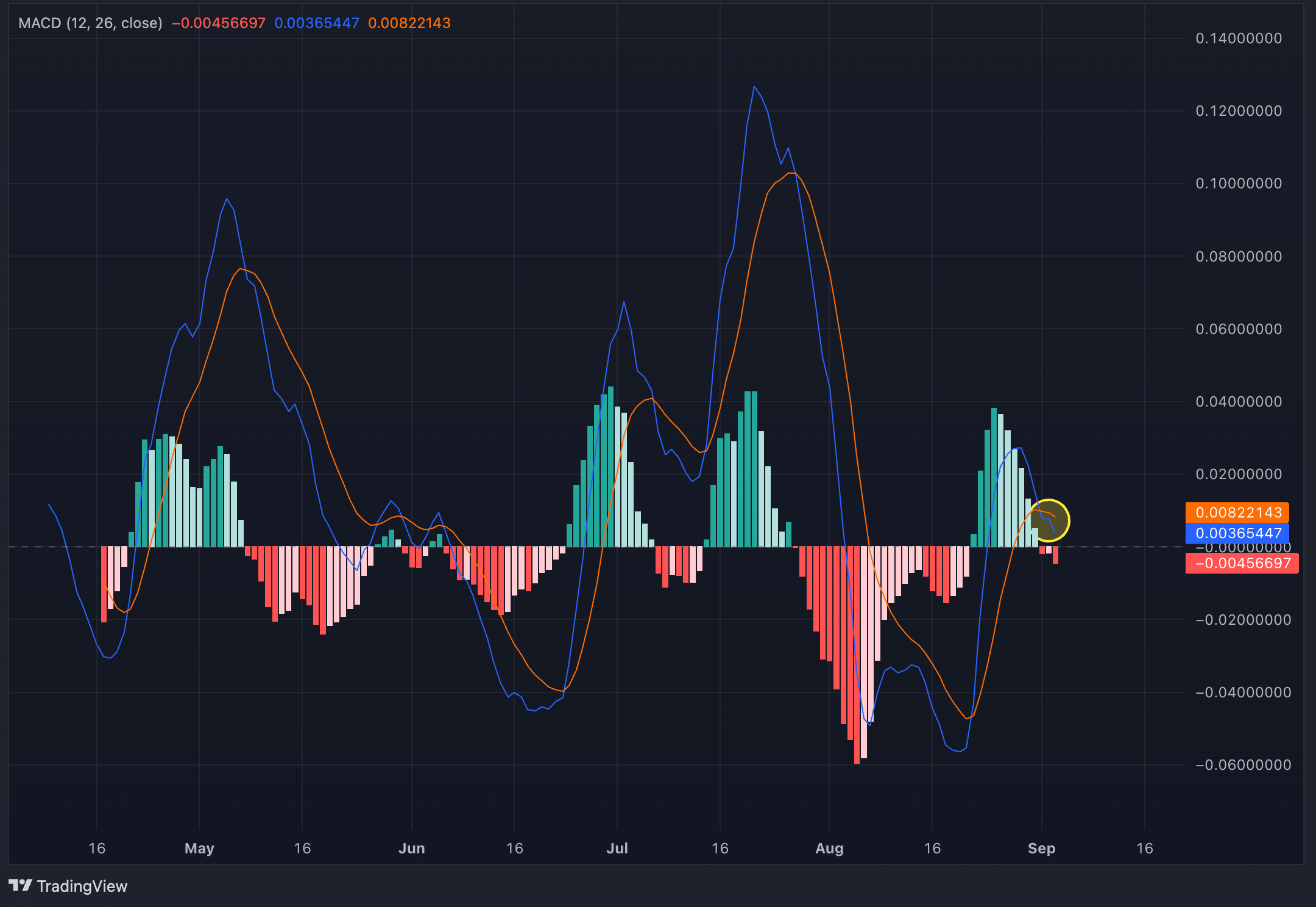

MACD Reversal

One other issue pointing towards a possible continued decline in POPCAT is the current bearish crossover within the Transferring Common Convergence Divergence (MACD) indicator. The MACD is a momentum indicator that consists of two strains: the MACD line and the sign line. It reveals the energy and path of a pattern by analyzing the connection between these two strains.

A crossover happens when the MACD line crosses under the sign line, which is seen as a bearish sign, much like a “death cross” in shifting averages. The crossover signifies that the momentum has shifted from bullish to bearish.

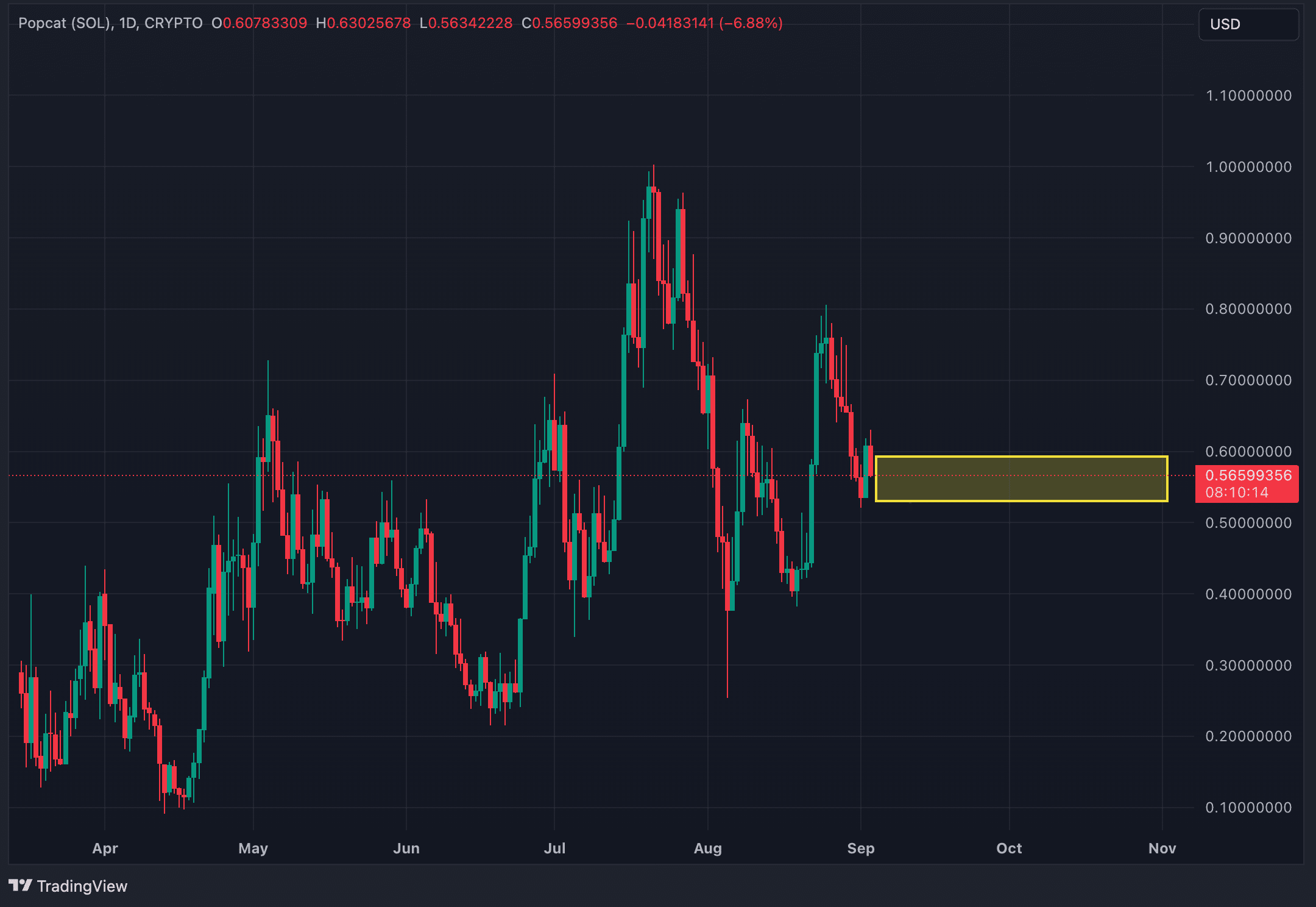

Counterpoints: Restricted downturn risk

Whereas a number of components recommend a continued downturn for POPCAT, there are additionally indicators that would restrict and even conclude the present decline.

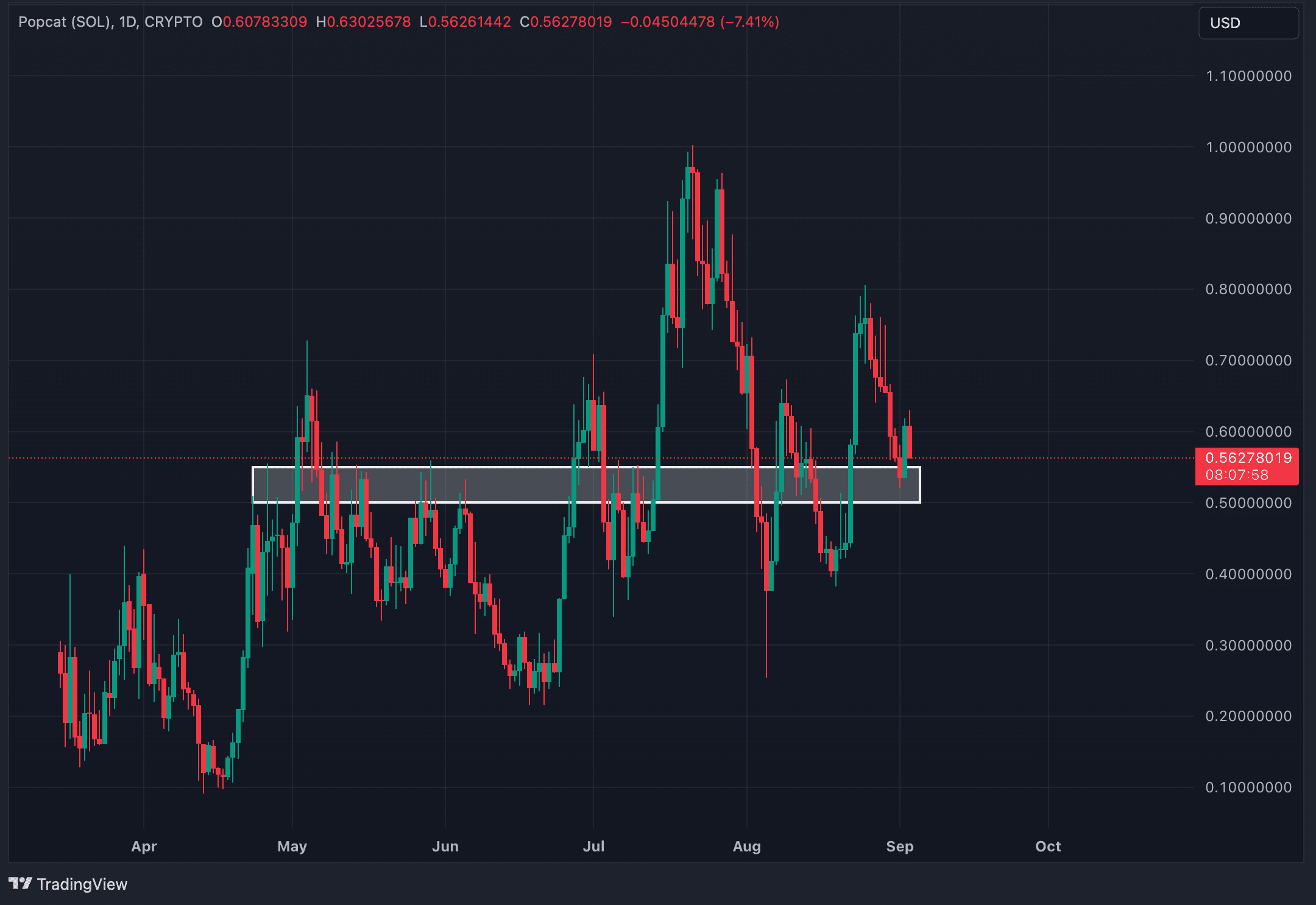

First, there’s a confluence of a number of Fibonacci golden pockets within the $0.53 to $0.593 vary. These embrace the Fibonacci retracement from the low on August 19 to the excessive on August 25, the excessive on July 1 to the low on August 5, and the low on July 5 to the excessive on July 21. Moreover, the 50% retracement ranges from different Fibonaccis additionally converge inside this worth zone, which strengthens the assist on this space. Till POPCAT drops under $0.53, the downward motion will doubtless not proceed. Then again, if it fails to interrupt above $0.593, we additionally can not affirm that the decline has ended.

Including to this, the historic volatility vary for POPCAT between $0.50 and $0.55 has been fairly an necessary zone, appearing as assist or resistance on 38 completely different events. The world intently aligns with the golden pocket confluence, which additional reinforces the importance of this zone as a possible flooring for the present downtrend.

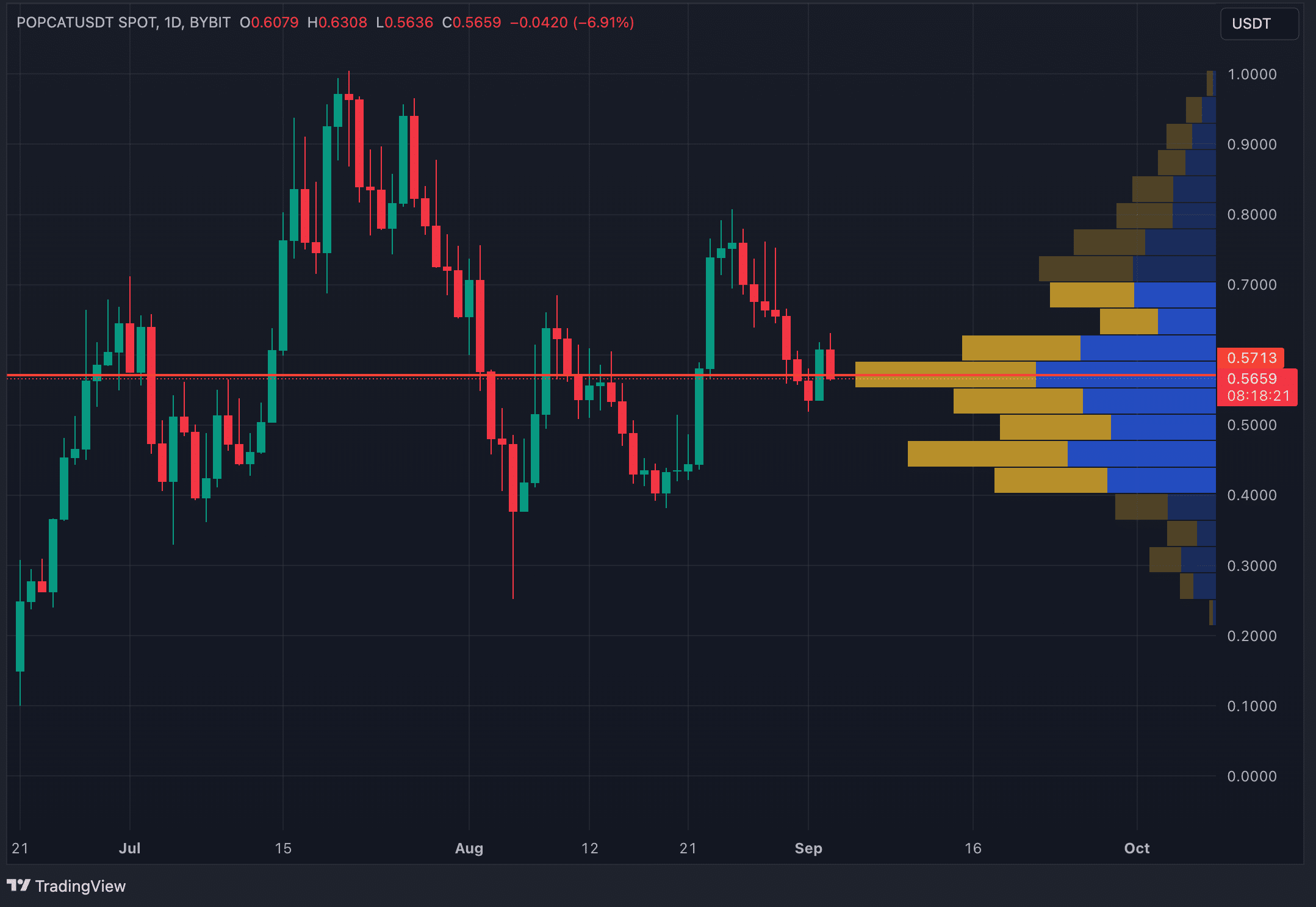

Lastly, the Seen Vary Quantity Profile (VRVP) provides one other layer of assist within the $0.55 to $0.593 space. The VRVP is a device that shows buying and selling exercise at numerous worth ranges and highlights areas with excessive buying and selling volumes as main zones of assist or resistance. On this case, the quantity bar within the $0.55 to $0.593 vary is the most important and suggests robust purchaser curiosity. Nonetheless, if POPCAT drops under $0.40, the quantity profile thins out significantly, indicating little to no assist under that stage, which may result in even steeper declines if breached.

Strategic issues

On the present worth stage, POPCAT presents a conundrum. On the one hand, a number of indicators recommend additional downturns, whereas on the opposite, key assist ranges trace that the bearish section might have already run its course, with bullish momentum doubtlessly on the horizon.

In our evaluation, which aligns with insights shared in earlier articles, the upcoming financial coverage shift—particularly the anticipated fee cuts in September—mixed with the traditionally weak efficiency of cryptocurrencies in September may render these assist zones for POPCAT out of date. Given this outlook, the strategic strategy would contain shorting POPCAT all the way down to the $0.43 stage.

Disclosure: This text doesn’t characterize funding recommendation. The content material and supplies featured on this web page are for instructional functions solely.