Chainlink (LINK) value shortly returned to $10 on September 4 after the token had initially slipped beneath the determine a day earlier. This resurgence comes after the decentralized blockchain community confirmed that Sonic Labs had turn into the newest challenge to combine its Cross-Chain Interoperability Protocol (CCIP).

Whereas this could possibly be a optimistic improvement, its native token could battle to rise considerably above its present worth. The explanations for this are detailed beneath.

Chainlink Adoption Continues, However It’s Additionally a Stalemate

The CCIP integration with Sonic Labs, previously often known as the Fantom Basis, occurred on September 3. Sonic Labs introduced that the initiative would allow seamless interplay between Chainlink and its blockchain.

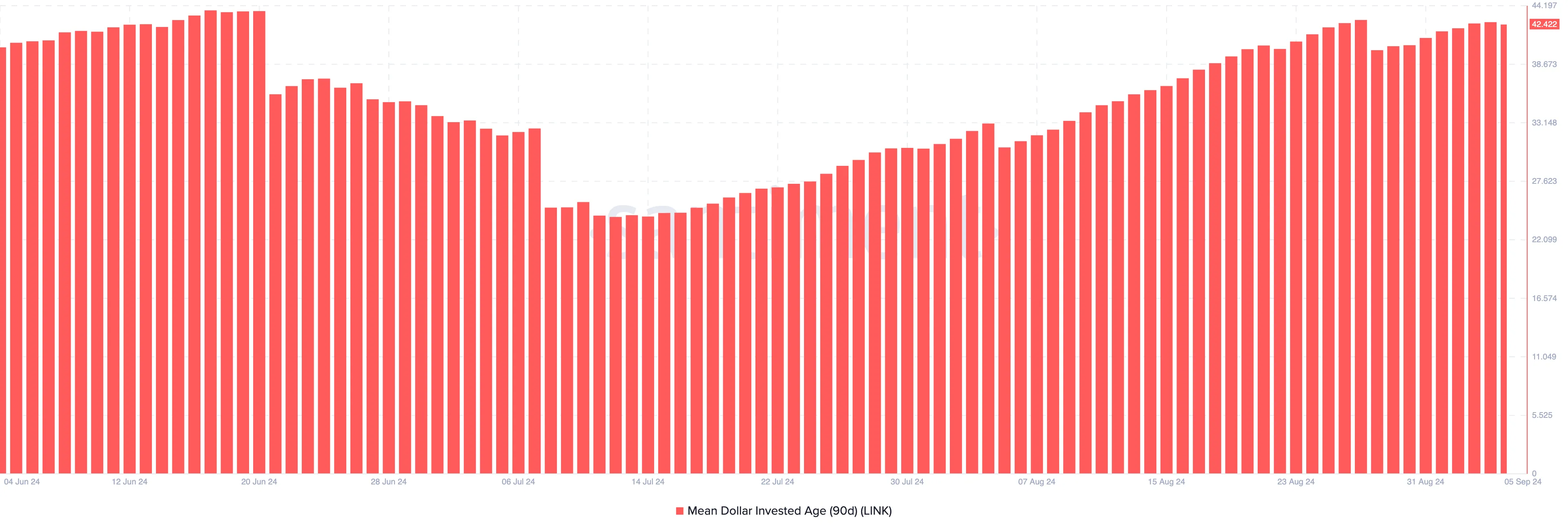

Usually, such developments may have led to a big surge in LINK’s worth. Nonetheless, Santiment knowledge reveals that the 90-day Imply Greenback Funding Age (MDIA) has been rising since August 28.

MDIA measures the typical age of tokens on a blockchain, weighted by their buy value. When this metric will increase, it alerts that tokens have gotten extra dormant, making value progress more durable to realize.

Conversely, a decline in MDIA means that dormant tokens are re-entering circulation, doubtlessly driving up costs. With MDIA on the rise, LINK could face value stagnation within the quick time period.

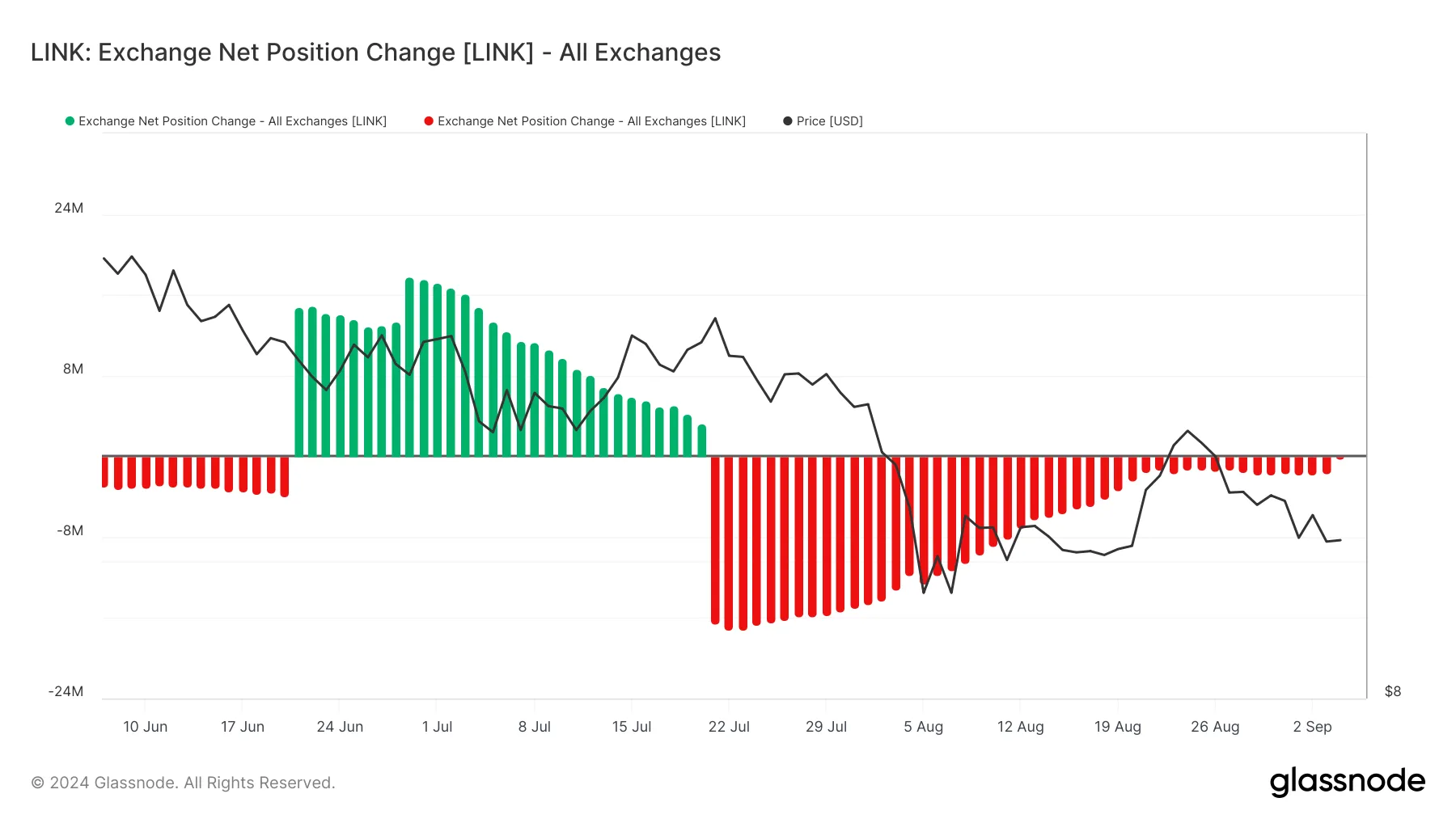

One other metric supporting this view is Chainlink’s Trade Web Place Change. This metric screens whether or not the market is inclined to promote extra tokens or maintain onto them on a 30-day horizon.

In response to Glassnode, the metric has been declining since late July, suggesting that market individuals want to carry LINK fairly than promote. Nonetheless, the speed at which tokens are being faraway from exchanges has slowed in comparison with earlier weeks.

This means uncertainty in regards to the cryptocurrency’s short-term potential. If this pattern continues, LINK’s value could expertise consolidation fairly than a big breakout or breakdown.

Learn extra: How you can Purchase Chainlink (LINK) With a Credit score Card: A Step-By-Step Information

LINK Value Prediction: No Main Transfer But

In response to the day by day chart, LINK’s value continues to converge with the Relative Power Index (RSI). At press time, the RSI, which measures momentum, is right down to 40.22, suggesting that the typical acquire for the cryptocurrency is smaller than the typical loss.

The final time the token skilled an identical motion, the value fell to $9.44. At the moment, Chainlink is buying and selling at $10.22. Though the cryptocurrency could not drop beneath $9 this time, it may proceed to maneuver sideways.

As proven within the chart beneath, LINK may fall to $9.94 if bulls lose their maintain on the $10 stage. On the upside, the token would possibly rise to the overhead resistance at $10.86. Nonetheless, within the quick time period, Chainlink could face issue breaking out of this range-bound motion.

Learn extra: 13 Greatest Penny Cryptocurrencies To Make investments In September 2024

Nonetheless, if the token surpasses the $10.86 stage, this forecast may shift, resulting in a breakout that pushes the value to $12.65. Conversely, if it drops beneath $9.44, the value would possibly fall as little as $8.05.

Disclaimer

In step with the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.