Ethereum’s (ETH) value continues to grapple with vital pressure, having fallen under $2,400 for the second time in three days.

Whereas the broader market would possibly hope that this newest decline marks the underside, on-chain evaluation begs to vary.

Buyers Transfer Away from ETH

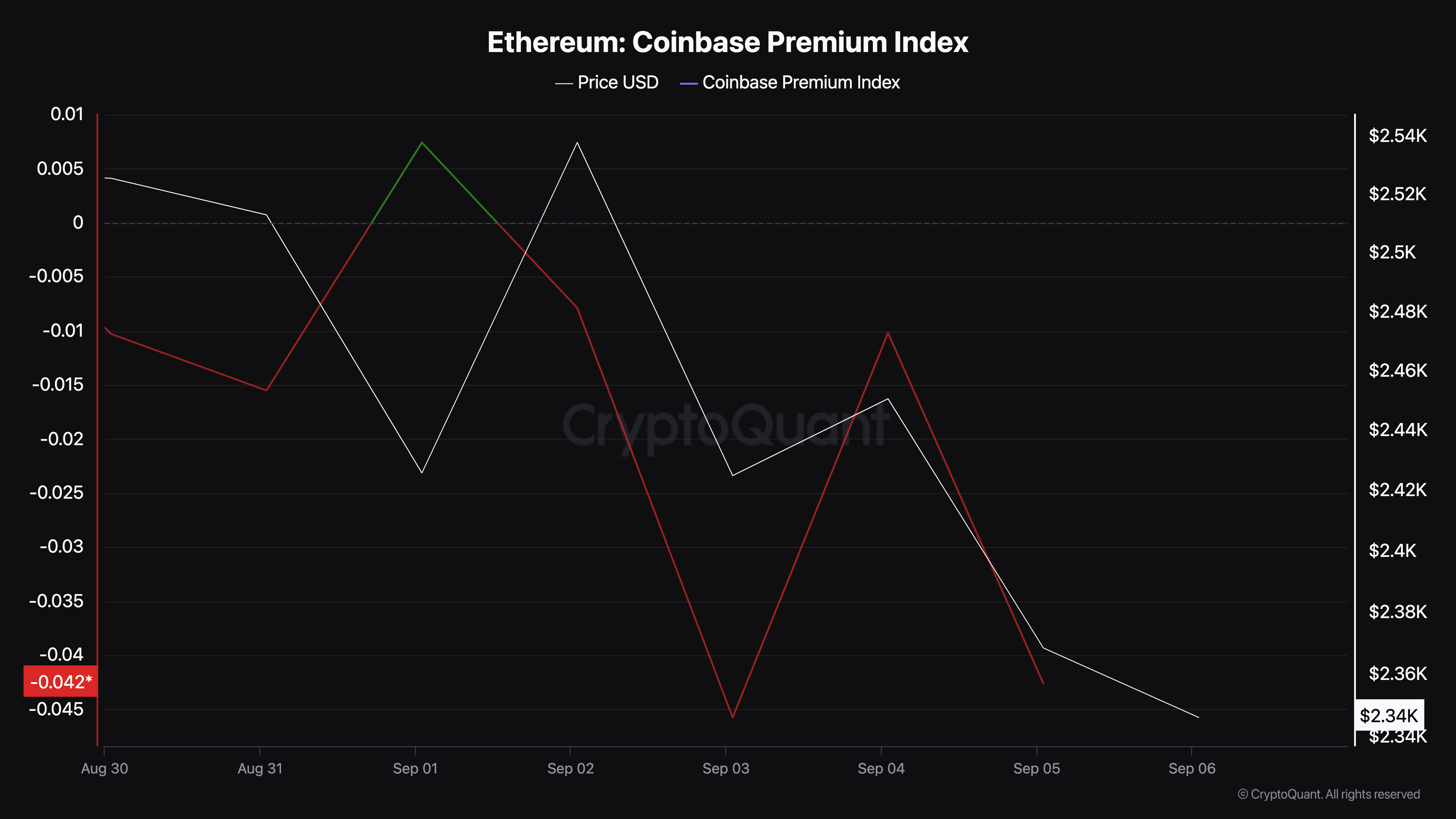

On August 24, Ethereum’s value climbed to $2,800, sparking hypothesis that the cryptocurrency would possibly retest $3,000. However that didn’t occur, as ETH continues to commerce decrease. At press time, Ethereum’s Coinbase Premium Index has plummeted, suggesting that the worth would possibly succumb to a different notable decline.

The Coinbase Premium Index gauges the distinction between the Ethereum spot value on Binance and that of Coinbase. Excessive values of this indicator counsel substantial shopping for strain within the US. Low values, nevertheless, signify that US traders are refraining from shopping for however promoting.

Primarily based on CryptoQuant’s knowledge, the index has dropped to -0.042, suggesting a notable decline in shopping for strain from American traders.

Learn extra: 9 Finest Locations To Stake Ethereum in 2024

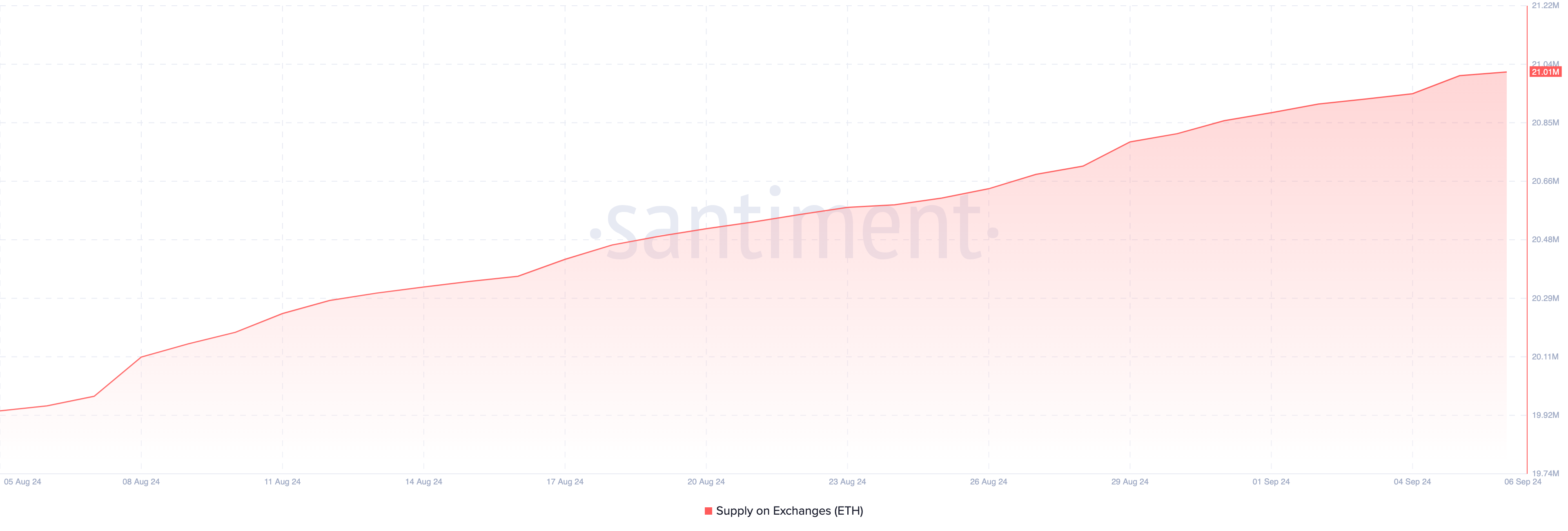

Likewise, the spot Ethereum ETFs have additionally confronted a scarcity of demand. On-chain knowledge from Santiment reveals that the ETH provide obtainable on exchanges has been climbing.

One month in the past, the quantity of ETH in exchanges was 19.94 million. At present, the identical metric is over 21 million, indicating that extra cash have flowed into these centralized platforms.

A low trade provide sometimes indicators bullish situations, because it signifies that almost all traders usually are not planning to promote quickly. Nonetheless, given Ethereum’s present scenario, it’d encounter vital promoting strain, which might drive the worth decrease.

Ethereum Worth Prediction: Freefall

On the weekly chart, ETH’s value had shaped a collection of upper lows since December 2022. Nonetheless, the worth correction seen in early August utterly invalidated the bias that the cryptocurrency would possibly leap to a better worth.

As of this writing, Ethereum’s value is $2,345, which is between the demand zone of $2,200 and $2,350. Ought to the altcoin fall under the decrease boundary of this zone, its value would possibly drop to $2,048.

As well as, the Relative Energy Index (RSI), which measures momentum by analyzing the pace and dimension of value modifications, is under the impartial stage. This RSI place means that the momentum round Ethereum is bearish, and if sustained, it might speed up the decline towards $2,200.

Breaking under this stage creates a extremely bearish state of affairs, as Ethereum’s value might drop to $1,577.

Learn extra: Methods to Purchase Ethereum (ETH) and Every little thing You Must Know

Regardless of the pessimistic state of affairs, there may be nonetheless hope. If shopping for strain from US traders and the broader market will increase, Ethereum might rebound. Ought to this occur, ETH’s value would possibly leap towards $2,800 once more.

Disclaimer

In keeping with the Belief Challenge tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.