Outflows from U.S. spot Bitcoin ETFs, or exchange-traded funds, surpassed $706 million this week as bears pushed Bitcoin to $53,304 — its lowest degree since Aug. 5.

In line with knowledge from SoSoValue, the 12 spot Bitcoin ETFs logged $169.97 million in internet outflows on Sep. 6, with Grayscale and Constancy main the pack.

- Constancy’s FBTC shed $85.5 million, with the fund experiencing detrimental flows for the previous seven buying and selling days.

- Grayscale’s GBTC added to the exit liquidity, with $52.9 million leaving the fund, bringing complete losses to over $20 billion since its inception. Over the previous eight days, the fund has misplaced $279.9 million, persevering with its outflow streak since Aug. 27.

- Bitwise’s BITB noticed outflows of $14.3 million

- ARK 21Shares’ ARKB, $7.2 million

- Grayscale’s Bitcoin mini belief, $5.5 million

- Valkyrie’s BRRR, $4.6 million

BlackRock, WisdomTree keep away from outflows

BlackRock’s IBIT and WisdomTree’s BTCW had been the one Bitcoin ETFs that prevented outflows over the previous week. Nevertheless, they recorded no new inflows within the final two days.

This investor hesitancy coincides with Bitcoin’s current dip. The bellwether crypto was again as much as $54,333 on the time of writing after briefly touching $52,690—its lowest level since Aug 5. But BTC was down 3% over the previous day.

Bitcoin is down 10.4% from its weekly excessive and 17.5% from its 30-day peak of $64,648, reached on Aug. 26. The turbulence intensified over the previous 24 hours as $113.86 million in Bitcoin positions had been liquidated, in accordance to Coinglass.

Bitcoin’s worth drop got here amid rising unease within the crypto market, fueled by what’s dubbed the “Redtember” seasonal droop and uncertainty over potential U.S. rate of interest cuts. These elements dampened investor confidence and glorified market volatility.

In line with knowledge from Various, the broadly monitored Crypto Concern and Greed Index nonetheless stands at 23, its lowest degree in over a month. This means excessive investor nervousness and a risk-averse market atmosphere.

Additional draw back anticipated

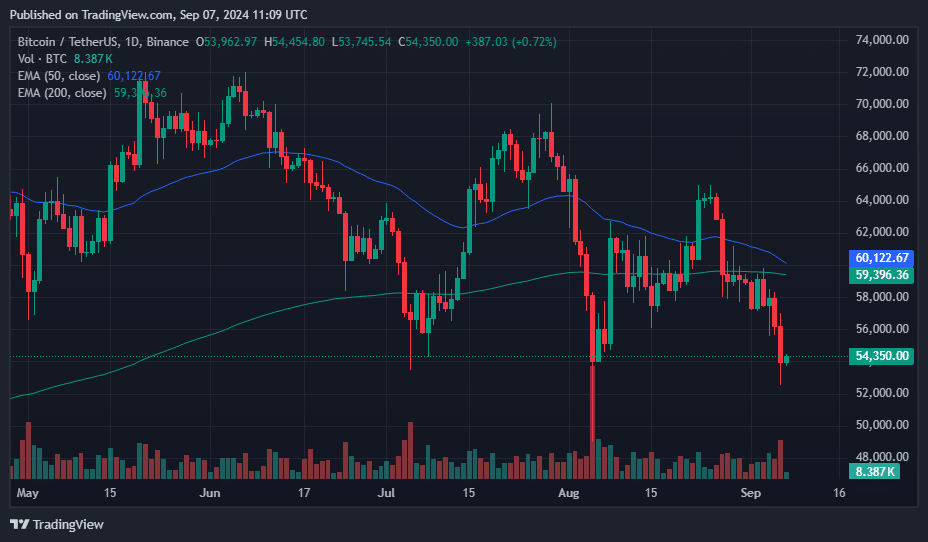

Technical indicators counsel {that a} loss of life cross may type quickly, with the 50-day and 200-day Exponential Transferring Averages nearing a crossover. Dying crosses are one of the vital feared patterns in technical evaluation. Bitcoin plummeted greater than 67% after forming a loss of life cross in January 2022.

Analysts on social media platform X additionally maintained a bearish outlook. In line with crypto analyst Pushpendra Singh Digital, BTC is caught in a falling wedge sample.

He suggests a breakout above the wedge across the $57,800 to $58,000 vary may result in a powerful upward transfer.

Nevertheless, if BTC drops under the help trendline round $54,000, it may result in additional downsides.

Echoing this cautious sentiment, a 1D BTC/USDT chart shared by Crypto analyst Nika additionally highlighted Bitcoin’s wrestle to climb above the $58,000 degree.

If the cryptocurrency fails to clear this resistance zone, it may face a extra important downward path, with potential help ranges at $45,000 and $42,000.