Transaction quantity in Ethereum decentralized exchanges bounced again at the same time as cryptocurrency costs retreated.

Ethereum DEX had sturdy exercise

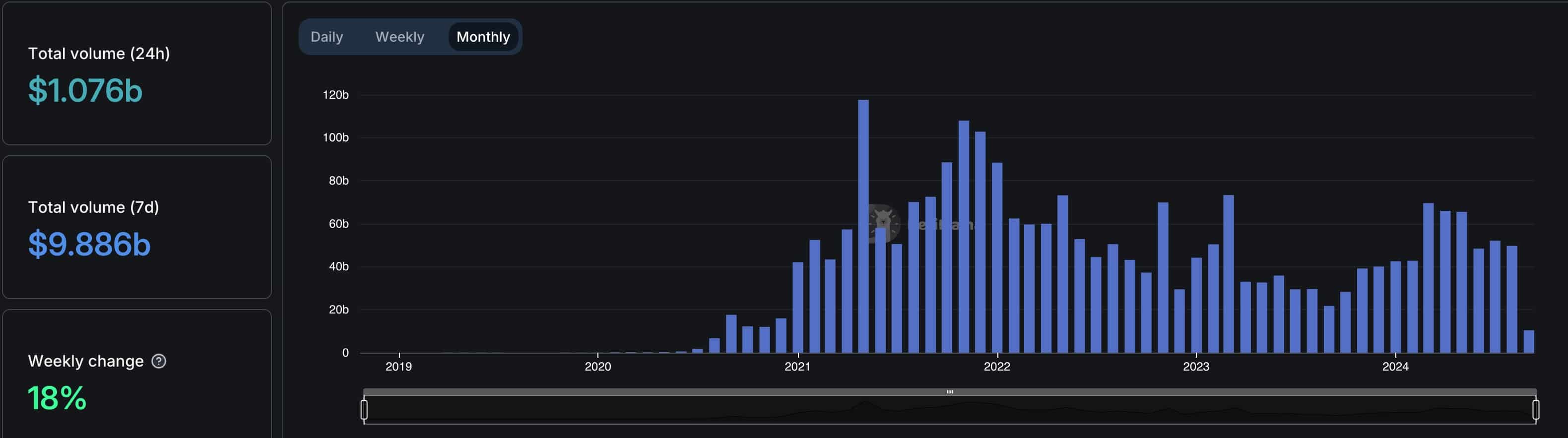

In response to DeFi Llama, the quantity in Ethereum (ETH) rose by 18% to $9.88 billion as that in different chains retreated. Solana (SOL) DEX quantity retreated by 8% whereas Base, BNB Good Chain, Arbitrum, and Polygon fell by 4%, 14%, and 10%, respectively.

The worst-performing chain was Tron (TRX) whose quantity fell by 52% to over $642 million. This decline occurred as the recognition of the lately launched SunPump meme cash eased. In response to CoinGecko, many of the SunPump tokens like Sundog, Tron Bull, and Muncat have retreated from their all-time highs.

Most DEX networks in Ethereum’s community had a giant enhance in quantity. Uniswap’s quantity rose by 14.2% to $5.7 billion after the corporate settled with the Commodity Futures Buying and selling Fee over its margin merchandise. It agreed to pay a $175,000 effective and cease providing these options within the US.

Curve Finance’s quantity jumped by 68% to over $1.48 billion whereas Balancer’s, Hashflow, and Pendle rose by 68%, 196%, and 85%, respectively.

Bitcoin and most altcoins tumbled

This quantity occurred in a troublesome week for the crypto trade as most property dived. Bitcoin dropped to $52,550, its lowest level since Aug. 5 and 26% beneath its all-time excessive. Ethereum additionally dropped beneath $2,200, down by over 44% from its highest level this yr. The full market cap of all cash dropped beneath $2 trillion for the primary time in months.

There’s a threat that the sell-off will proceed as a way of concern has unfold out there because the crypto concern and greed index has dropped to the concern zone of 34. Cryptocurrencies are likely to see extra weak spot when buyers are fearful.

DEX and CEX exchanges additionally expertise weak quantity in durations when cryptocurrencies are falling. In response to DeFi Llama, the quantity in Ethereum DEX platforms dropped to $49.5 billion in August from a excessive of $69 billion in March as most cash jumped.

The identical occurred throughout different DEX platforms as quantity fell from over $257 billion in March to $240 billion in August.

Wanting forward, cryptocurrencies could profit from the upcoming begin of rate of interest cuts by the Federal Reserve. Information launched on Friday confirmed that the unemployment price fell barely in August to 4.2% whereas the financial system created 142k jobs. Dangerous property are likely to bounce again when the Fed is chopping charges.