With the continuing droop in Bitcoin (BTC) and the broader crypto market, merchants ought to put together for potential value swings this week, pushed by key US financial updates.

Bitcoin is hovering round $54,000, with consultants predicting extra downward motion. Traditionally, September is the worst-performing month for BTC, however there’s hope for a rebound in October.

Key US Financial Occasions to Watch This Week

Threat-on belongings like Bitcoin have began the week quietly. The most important cryptocurrency is at the moment buying and selling at $54,800, reflecting a modest 0.7% rise within the final 24 hours.

Nonetheless, upcoming US macroeconomic occasions and the anticipated debate between Donald Trump and Kamala Harris may affect merchants’ sentiment and drive shifts in portfolios. Let’s take a more in-depth take a look at how these occasions would possibly form the markets.

Donald Trump Debate In opposition to Kamala Harris

As BeInCrypto beforehand famous, the upcoming presidential debate between Donald Trump and Kamala Harris has put crypto within the highlight. Each candidates have made the subject central to their campaigns. Harris seems to be warming as much as pro-crypto insurance policies, in keeping with current experiences.

Trump, in the meantime, has made bullish feedback about Bitcoin and the broader crypto market, successful favor amongst trade insiders. Pennsylvania Senator John Fetterman predicts a “close” debate, recognizing that each Trump and Harris are able to holding their floor.

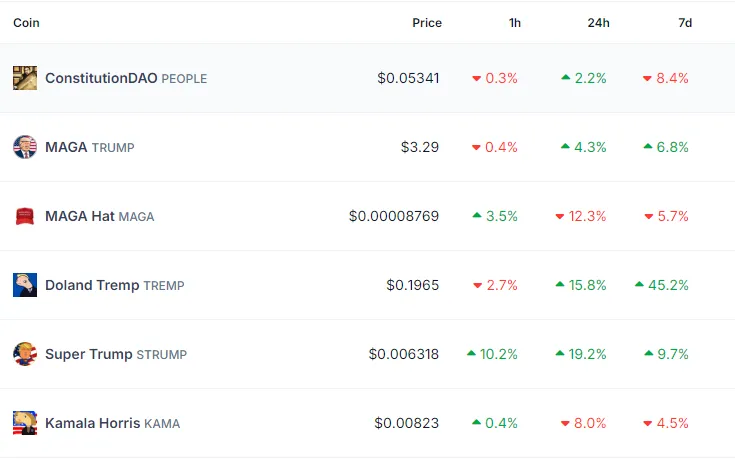

Based on CoinGecko information, PolitiFi meme cash are already seeing volatility in anticipation of the controversy, with some Trump-inspired cash posting double-digit beneficial properties.

Learn extra: How Can Blockchain Be Used for Voting in 2024?

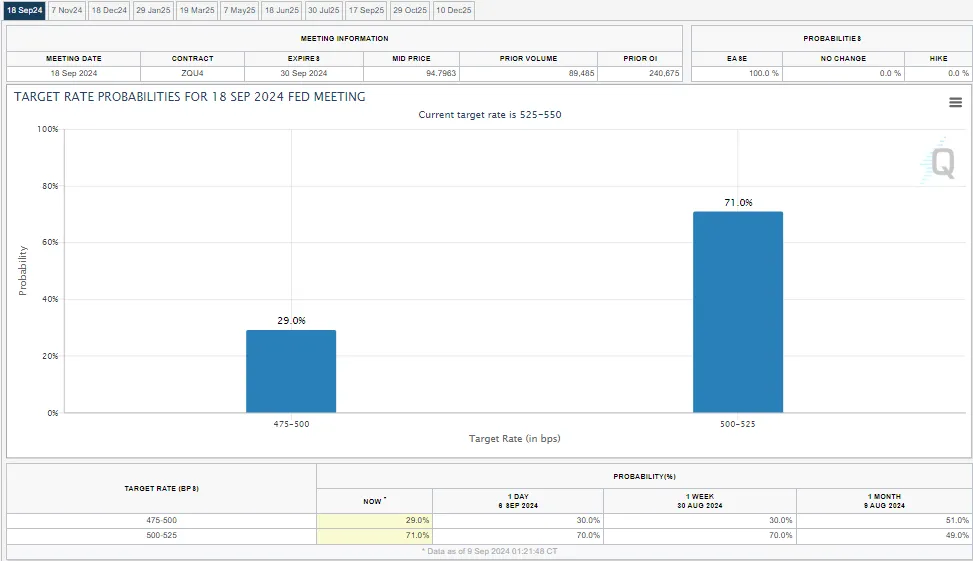

US CPI

Inflation is the point of interest this week with the discharge of the August Shopper Worth Index (CPI) and the much less important Producer Worth Index (PPI), each arriving earlier than the Federal Reserve’s subsequent assembly. These figures may play an important function in figuring out the Fed’s rate of interest choice.

The Bureau of Labor Statistics (BLS) is about to launch the August CPI on Wednesday, September 11. In July, inflation eased to 2.9% from June’s 3%, a shift that boosted Bitcoin’s efficiency.

Economists now anticipate inflation to drop additional to 2.7%, which may bolster Bitcoin’s energy if realized. Core CPI, excluding unstable objects like meals and power, is projected to chill to three.1% in August, down from 3.2% in July. Each headline and core CPI are anticipated to indicate month-to-month progress of 0.2% for August.

“Amid anticipation for the CPI data and Trump-Harris debate, traders claim Bitcoin’s current value is markedly low. Crypto markets await US economic and political news impacts,” one consumer famous.

Shopper Sentiment

Markets will even deal with the preliminary client sentiment report, set for launch on September 13. The College of Michigan’s Shopper Confidence information will spotlight the hole between the US economic system’s total energy and the way households understand their monetary well-being.

Shopper sentiment tends to be extra delicate to inflation, whereas client confidence is intently tied to the labor market. Sturdy client confidence may enhance spending and drive funding in belongings like Bitcoin if buyers stay optimistic in regards to the economic system. Nonetheless, if Friday’s information reveals that buyers are nonetheless combating inflation, excessive rates of interest, and job insecurity, crypto markets might react unpredictably.

Learn extra: Methods to Defend Your self From Inflation Utilizing Cryptocurrency

Moreover, Thursday’s preliminary jobless claims report may affect crypto volatility. This employment information would possibly affect market sentiment by shaping perceptions of financial well being and expectations for financial coverage, each of which may not directly have an effect on Bitcoin.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.