Bitcoin (BTC) and the broader crypto markets are navigating difficult situations, traditionally worsened by September’s seasonality struggles.

In a latest report, Kaiko researchers lately explored how a possible US fee reduce and different key financial occasions may have an effect on Bitcoin. These 4 charts offered by the analysts clarify what to anticipate from BTC within the coming weeks.

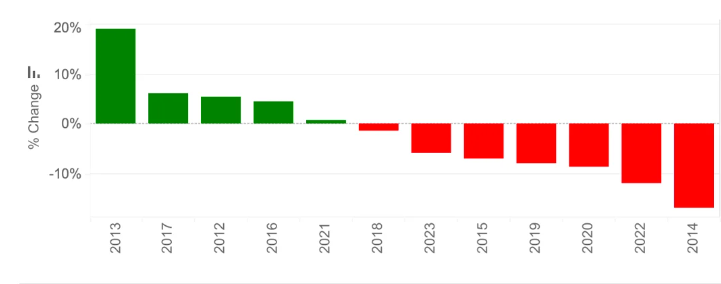

Month-to-month Change in Bitcoin Worth in September

As BeInCrypto reported, the third quarter has traditionally been difficult for Bitcoin and the broader crypto market, with September typically delivering the worst returns. Kaiko highlights that Bitcoin has declined in seven of the final twelve Septembers.

In 2024, this sample continues, with Bitcoin down 7.5% in August and 6.3% to this point in September. As of this writing, Bitcoin is buying and selling over 20% under its latest all-time excessive of almost $73,500, recorded greater than 5 months in the past.

Learn Extra: How To Purchase Bitcoin (BTC) and Every little thing You Want To Know

Nonetheless, in line with Kaiko Analysis, upcoming US fee cuts may present a lift to danger belongings like Bitcoin. Bitget Pockets COO Alvin Kan shares this stance.

“At the Jackson Hole meeting, Federal Reserve Chairman Jerome Powell hinted that it might be time for policy adjustments, leading to expectations of future interest rate cuts. The US Dollar Index responded by dropping sharply and is now fluctuating around 100. With a rate cut in September becoming a consensus expectation, the official start of rate cut trading could improve overall market liquidity, providing a boost to crypto assets,” Kan instructed BeInCrypto.

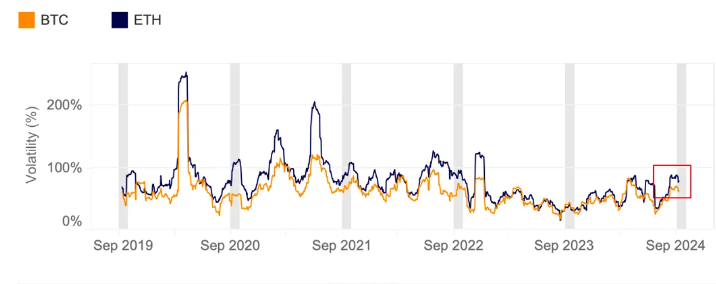

30-day Historic Volatility

In response to the report, September is shaping as much as be extremely unstable, with Bitcoin’s 30-day historic volatility surging to 70%. This metric measures the fluctuation in an asset’s worth over the previous 30 days, reflecting how dramatically its worth has moved inside that interval.

Bitcoin’s present volatility is sort of double final 12 months’s ranges and is approaching the height seen in March, when BTC hit an all-time excessive of over $73,000.

Ethereum (ETH) has additionally skilled heightened volatility, surpassing each March’s ranges and Bitcoin’s, pushed by ETH-specific occasions resembling Bounce Buying and selling’s liquidations and the launch of Ethereum ETFs.

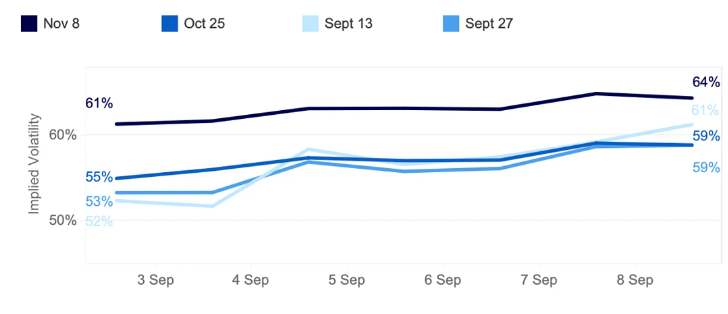

BTC Implied Volatility by Expiry

For the reason that begin of September, Bitcoin’s implied volatility (IV) has risen after dipping in late August. The IV indicator measures market expectations for future worth fluctuations primarily based on present choices buying and selling exercise. Greater IV means that merchants anticipate bigger worth swings forward, although it doesn’t specify the route of the transfer.

Notably, short-term choices expiries have seen the sharpest improve, with the September 13 expiry leaping from 52% to 61%, surpassing end-of-month contracts. For the layperson, when short-term implied volatility exceeds longer-term measures, it signifies heightened market stress, known as an “inverted structure.”

Threat managers typically see an inverted construction as a sign of heightened uncertainty or market stress. Consequently, they might interpret this as a warning to de-risk their portfolios by decreasing publicity to unstable belongings or hedging towards potential draw back.

“These market expectations align with last week’s US jobs report, which dampened hopes for a 50bps decrease. However, upcoming US CPI data could still sway the odds,” Kaiko researchers notice.

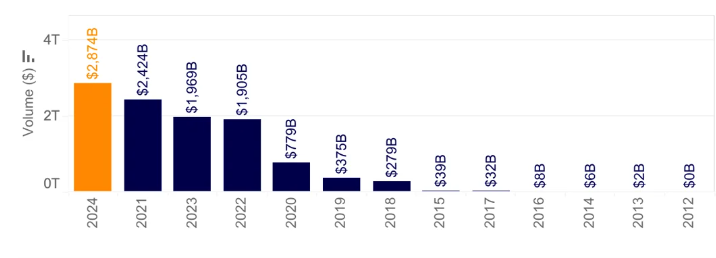

Commerce Quantity

The Bitcoin commerce volumes chart additionally highlights the present market volatility, exhibiting elevated dealer participation. Cumulative commerce quantity is nearing a file $3 trillion, up almost 20% within the first eight months of 2024 after its final peak in 2021.

Learn extra: Bitcoin (BTC) Worth Prediction 2024/2025/2030

Historically, Bitcoin traders see a fee reduce as a constructive market catalyst. Nonetheless, issues stay about how the market would possibly interpret a larger-than-expected reduce. Markus Thielen, founding father of 10X Analysis, cautions {that a} 50 foundation factors fee reduce may very well be perceived as an indication of urgency, probably triggering a retreat from danger belongings like Bitcoin.

“While a 50 basis point cut by the Fed might signal deeper concerns to the markets, the Fed’s primary focus will be mitigating economic risks rather than managing market reactions,” Thielen stated in a notice to purchasers.

Alongside fee reduce speculations, different components contributing to crypto market fluctuations embody the upcoming US elections. As BeInCrypto reported, the Donald Trump versus Kamala Harris debate is predicted to set off motion, notably in Bitcoin and Ethereum.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.