Uniswap Protocol CEO Hayden Adams challenged allegations that the decentralized cryptocurrency alternate takes bribes to permit deployments on its platform.

As an open-source protocol, Uniswap supplies liquidity and buying and selling for ERC20 tokens on the Ethereum blockchain.

Uniswap CEO Denies Taking Bribes

Adams dismissed the allegations, stating they have been made to bait engagement. He clarified that neither Uniswap Labs nor the Uniswap Basis fees protocols for deploying on its platform. He additional defined that governance votes decide whether or not a protocol is deployed or not.

“I rarely engage with forks trying to bait engagement, but for the record, this is completely false. Neither Uniswap Labs nor Uniswap Foundation have ever charged for a protocol deployment,” Adams defined.

Uniswap Labs is accountable for creating each the Uniswap protocol and the Uniswap interface. For the interface, the ecosystem focuses on the exercise and energy required for chain-specific deployment.

Adams’ feedback have been in response to accusations made by a person named Alexander on X (previously Twitter), who claimed that Uniswap bribed some protocols with quantities as excessive as $20 million.

“If you, or someone you love, has been asked to pony up $20 million for an ineffective Uniswap deployment just know that you are not alone and we’re here to help,” Alexandar wrote.

Learn extra: How To Purchase Uniswap (UNI) and Every thing You Want To Know

Alexander’s remarks adopted claims by Millicent Labs cofounder Kene Ezeji-Okoye, who alleged that Uniswap fees $10 million for protocol deployments and an extra $10 million for person incentives geared toward buying and selling carbon credit.

In 2022, the Celo Basis, which oversees the Celo blockchain — a carbon-negative, mobile-first platform for Web3 and environmental influence — approached Uniswap to advertise inexperienced use circumstances. As a part of this initiative, the Celo Basis sought to restructure its treasury utilizing inexperienced asset-backed tokens.

A proposal submitted to Uniswap on behalf of the Celo Basis and different events outlined that Celo would commit $10 million in CELO tokens for Uniswap-specific person incentives and grants, together with an extra $10 million in monetary incentives.

Based on a snapshot of the governance proposal vote, customers accredited it with 12 million ‘ayes’ towards solely 603 ‘nays’. BeInCrypto reached out for remark, however neither Hayden Adams nor Alexander instantly responded.

In the meantime, the decentralized alternate just lately settled its case towards the US Commodities Futures Fee (CFTC). Amid allegations of unlawful retail commodity transactions utilizing digital property, the alternate paid $175,000 in fines, a slap on the wrist following Uniswap’s cooperation with the authorities.

Learn extra: Uniswap (UNI) Worth Prediction 2023/2025/2030

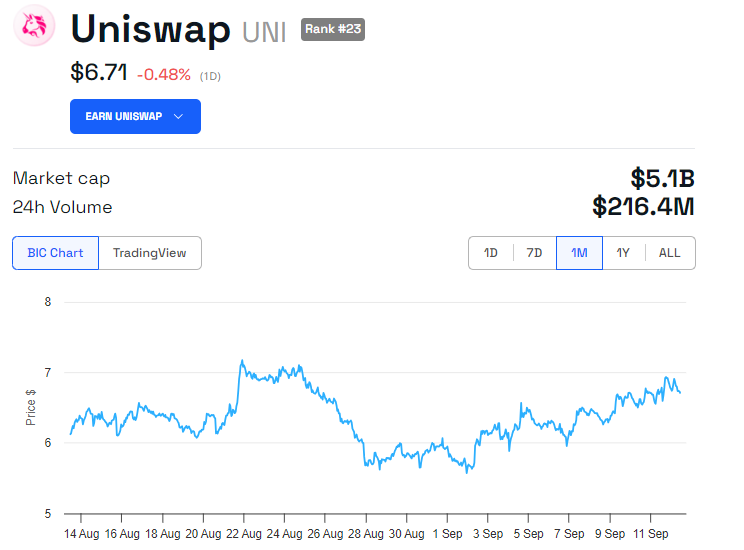

Amidst the most recent controversy, the Uniswap token (UNI) is down by 0.48% because the Thursday session opened. As of this writing, it’s buying and selling for $6.71.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.