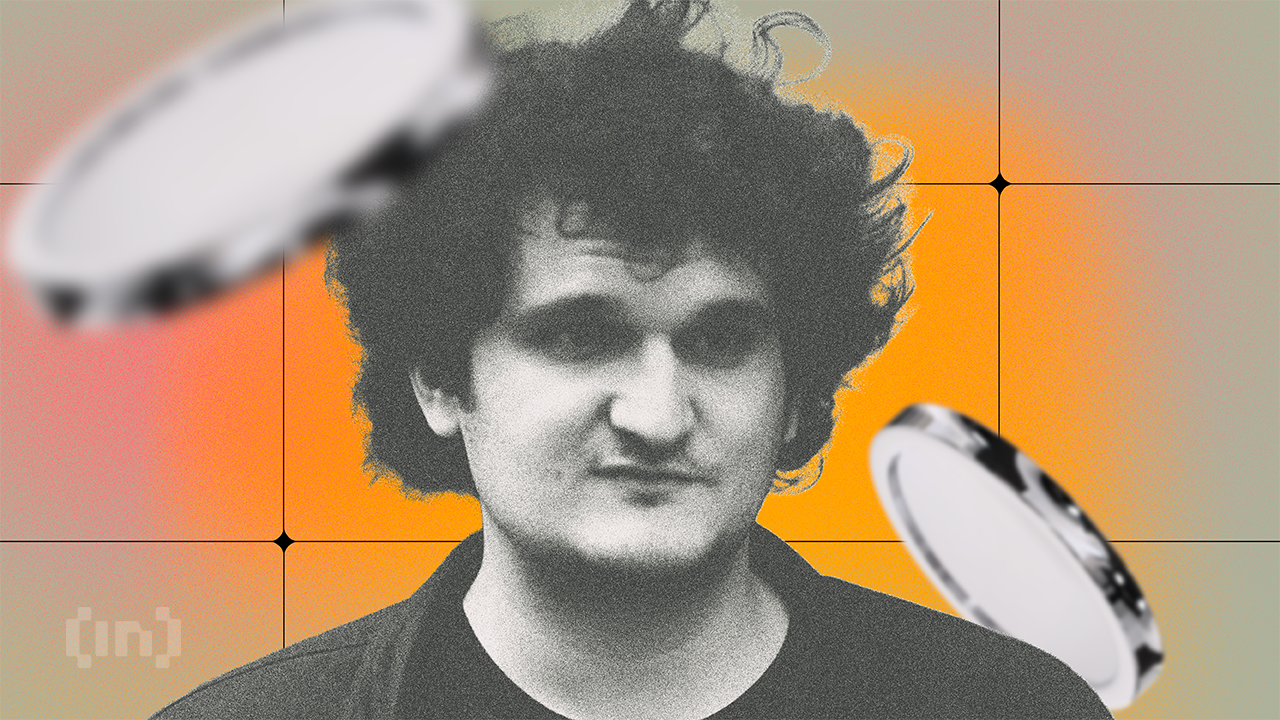

On September 13, FTX founder Sam Bankman-Fried (SBF) filed an attraction to overturn his final November conviction on fraud and conspiracy fees.

In a 102-page submitting, SBF’s authorized group argued the trial was unfair, calling it a “sentence first, verdict afterward” scenario. They claimed the judgment was rushed and biased.

SBF’s Authorized Staff Claims He Was Presumed Responsible From the Outset

Led by lawyer Alexandra Shapiro, SBF’s attorneys said that he was by no means presumed harmless. They argued that everybody concerned, together with the decide, assumed his guilt from the beginning.

“Sam Bankman-Fried was never presumed innocent. He was presumed guilty — before he was even charged. He was presumed guilty by the media. He was presumed guilty by the FTX debtor estate and its lawyers. He was presumed guilty by federal prosecutors eager for quick headlines. And he was presumed guilty by the judge who presided over his trial,” the attorneys lamented.

Learn extra: FTX Collapse Defined: How Sam Bankman-Fried’s Empire Fell

The protection accused US District Choose Lewis Kaplan of bias, alleging he influenced the trial’s consequence. Shapiro contended that Kaplan’s remarks through the trial urged guilt earlier than the case had concluded. The protection additionally criticized the decide for proscribing key arguments that might have demonstrated SBF’s makes an attempt to stabilize FTX.

“Many of the judge’s rulings were not just erroneous but unbalanced — repeatedly putting a thumb on the scale to help the government and thwart the defense. But that is not all. The judge continually ridiculed Bankman-Fried during trial, repeatedly criticized his demeanor, and signaled his disbelief of Bankman-Fried’s testimony,” the attorneys wrote.

SBF’s authorized group additional argued that the jury noticed solely “half the picture” relating to FTX person funds. They claimed the prosecution misrepresented the case by portraying the funds as completely misplaced, whereas SBF allegedly precipitated the loss deliberately.

“From day one, the prevailing narrative — initially spun by the lawyers who took over FTX, quickly adopted by their contacts at the US Attorney’s Office — was that Bankman-Fried had stolen billions of dollars of customer funds, driven FTX to insolvency, and caused billions in losses. Now, nearly two years later, a very different picture is emerging — one confirming FTX was never insolvent, and in fact had assets worth billions to repay its customers. But the jury at Bankman Fried’s trial never got to see that picture,” the attorneys said.

Bankman-Fried’s attorneys additionally raised considerations about Sullivan & Cromwell’s position within the case. In response to them, the legislation agency — which initially served as FTX’s exterior authorized counsel and later turned its lead chapter agency — wrongly pressured SBF to step down as CEO. The attorneys additionally argued that the legislation agency aimed to position full blame on Bankman-Fried to divert consideration from its personal questionable practices.

“Sullivan & Cromwell — which billed hundreds of millions of dollars in this case — performed prosecutorial tasks that had nothing to do with bankruptcy. Moreover, the Debtors and S&C were motivated to place all blame squarely on Bankman-Fried — to avoid scrutiny of their own business decisions, their own conflicts of interest, their own exorbitant billing, and their own misconduct,” SBF attorneys claimed.

Contemplating all of those causes, the protection is asking for a brand new trial with a distinct, neutral decide.

Learn extra: Who Is John J. Ray III, FTX’s New CEO?

Final 12 months, Bankman-Fried was convicted on seven counts of fraud and conspiracy. He acquired a 25-year jail sentence and was ordered to forfeit $11 billion for his position in defrauding FTX clients, traders, and Alameda Analysis lenders.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.