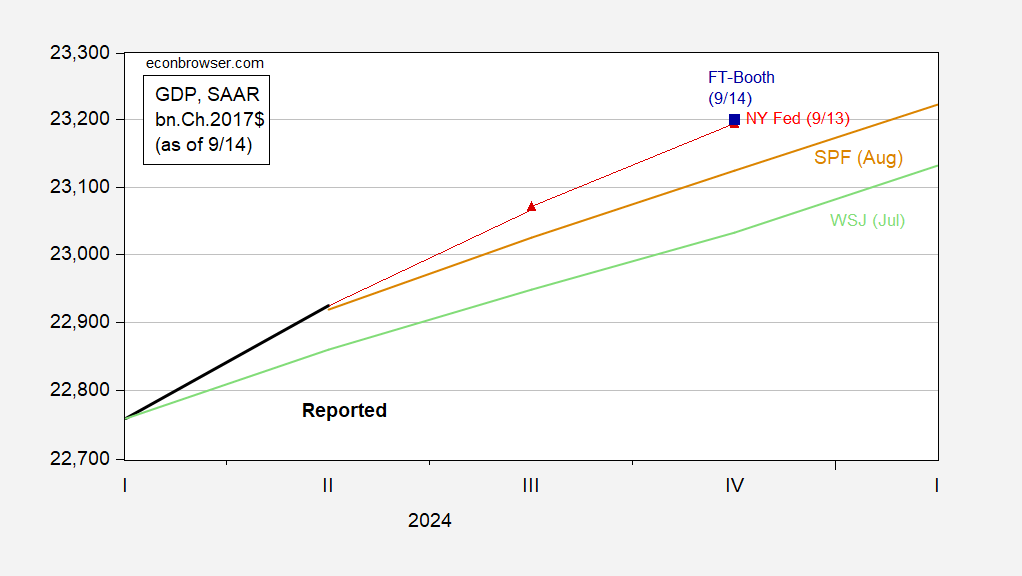

For GDP, no recession on the quick horizon:

Determine 1: GDP (daring black), FT-Sales space September median forecast (blue field), NY Fed nowcast (purple triangles), SPF August (tan line), WSJ July (gentle inexperienced), in bn.Ch.2017$ SAAR. Supply: BEA 2024Q2 advance, FT-Sales space September survey, NY Fed, Philadelphia Fed, WSJ, and writer’s calculations.

There’s been a shift upward within the FT-Sales space survey GDP degree (implied this autumn/this autumn 2024 development has risen from 2.0% in June survey to 2.3% in September). Given Q2 advance development, this means 2.4% in 2024H2 (SAAR).

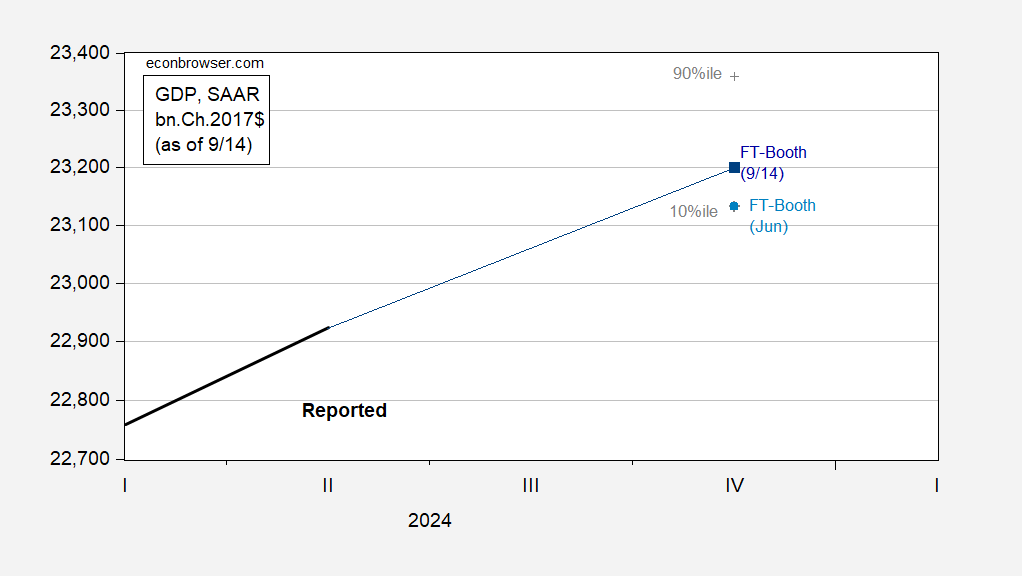

Determine 2: GDP (daring black), FT-Sales space September median forecast (blue field), 10percentile/90percentile (grey +), FT-Sales space June median forecast (gentle blue field), in bn.Ch.2017$ SAAR. Supply: BEA 2024Q2 advance, FT-Sales space September survey, and writer’s calculations.

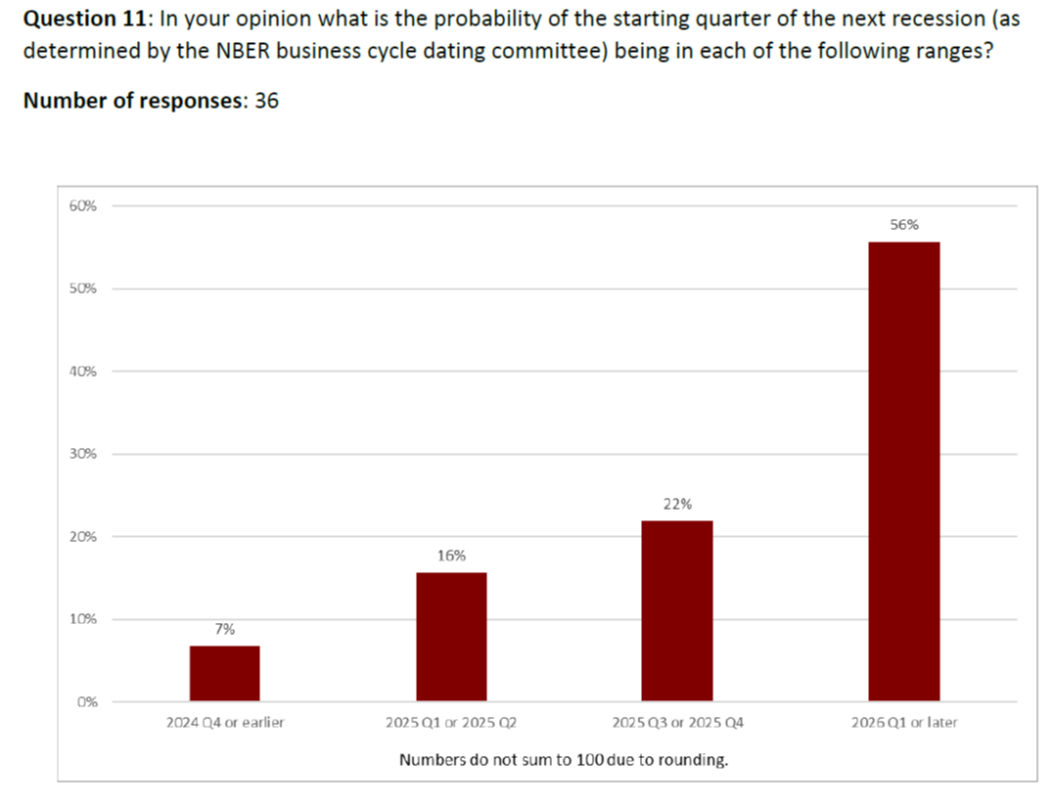

Neither the median nor 10percentile paths are suggestive of recession. The modal response is for a recession in 2026Q1 onward, as in June’s survey.

Supply: FT-Sales space.

The proportion of respondents that thought the recession would begin in 2024 has dropped from 12% to 7%, whereas the proportion that thinks the recession will begin in 2026Q1 or later has risen from 52% to 56%.