Stablecoin issuers froze practically $5 million held by the infamous North Korean Lazarus Group after investigators traced the funds.

Blockchain investigator ZachXBT revealed this growth in an X submit on September 14.

Lazarus Group Hit by $5 Million in Stablecoin Freeze

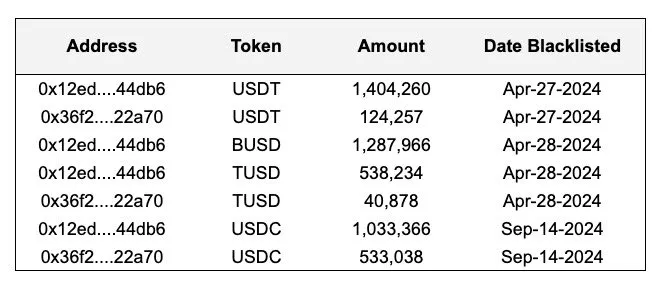

ZachXBT reported that stablecoin issuers Tether, Circle, Paxos, and Techteryx blacklisted two addresses containing $4.96 million in property. Nevertheless, these wallets nonetheless maintain $720,000 in DAI and $313,000 in Ethereum, which stay unfrozen.

These funds are linked to a broader investigation ZachXBT carried out in April. His findings counsel that the Lazarus Group laundered over $200 million from 25 crypto-related hacks between 2020 and 2023.

ZachXBT famous that $6.98 million had been frozen from these investigations, together with $1.65 million held throughout a number of exchanges. He didn’t disclose which exchanges are concerned.

Learn extra: A Information to the Finest Stablecoins in 2024

In the meantime, ZachXBT criticized Circle, the issuer of USDC, for its delayed motion in blocking the funds. He argued that Circle and its CEO Jeremy Allaire have proven little concern for the crypto ecosystem, focusing as a substitute on benefiting from it.

The blockchain investigator claimed Circle took greater than 4 months longer than different main stablecoin issuers to blacklist the Lazarus Group’s funds. He expressed frustration with the corporate’s inaction, noting that Circle did little to stop cash laundering via its platform.

“In public they pretend to be the compliant stablecoin helping protect the ecosystem when in reality it is not exactly true,” ZachXBT acknowledged.

Learn extra: Crypto Rip-off Initiatives: How To Spot Pretend Tokens

He additionally accused the corporate of “virtue signaling,” stating that regardless of having over 1,000 staff, Circle lacks an incident response workforce to dam funds after DeFi hacks or exploits.

Investigators have linked the Lazarus Group to a number of main crypto hacks, together with the latest $20 million exploit of the Indodax alternate. Stories counsel the group has siphoned round $3 billion from the cryptocurrency trade over time. Authorities suspect North Korea makes use of these stolen funds to finance its weapons program.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.