Bernstein analysts recommend that DeFi might carry out properly within the occasion the Federal Reserve cuts US rates of interest. Worldwide liquidity and fee differentials might show key for crypto.

These predictions contradict mounting issues that fee cuts will hurt funding in Bitcoin and Ethereum.

Charge Cuts Would possibly Spell Hassle

Because the US financial system continues its doldrums of perceived inflation and cost-of-living will increase, stress is rising to chop Fed rates of interest. Three Democratic Senators referred to as for “aggressive” measures, Bloomberg reported Monday, citing Capitol Hill rumors that impending fee cuts could also be gentle.

Of their letter, Senators Elizabeth Warren, Sheldon Whitehouse, and John Hickenlooper referred to as for a 75-point fee lower to “mitigate potential risks to the labor market.” The cuts’ actual phrases are disputed between totally different factions, however it’s extraordinarily seemingly that some type of them will go.

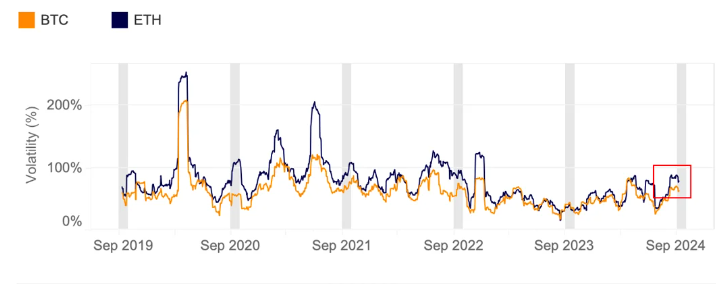

Within the eyes of the crypto group, nonetheless, these proposed cuts are extra controversial. Surveys from Bitfinex declare that Bitcoin’s value might bounce instantly upon fee cuts, however its information means that alerts in the end flip bearish within the aftermath.

Lowered rates of interest are an incentive for brand spanking new funding in US markets, however additionally they sign total weak point. Bitcoin is perceived as a danger on asset, and subsequently fee cuts might have an unintended consequence. General funding goes up, however the market shuns riskier belongings.

Moreover, September is usually a weak month for the inventory market, unbiased of those cuts. For crypto markets, these challenges might show daunting.

Bernstein’s Narrative

Nonetheless, a report from analysts at Bernstein is portray a rosier image. Analysts Gautam Chhugani, Mahika Sapra and Sanskar Chindalia claimed that DeFi as an trade is ready to reap the benefits of new alternatives.

Particularly, international merchants will in a position to present liquidity on decentralized markets for USD-backed stablecoins. On this approach, DeFi can reap the benefits of US-specific market circumstances, and earn yields from the greenback’s efficiency.

This sentiment echoes a few of Arthur Hayes’ August 2024 commentary on fee cuts. Particularly, he paid particular consideration to rate of interest differentials between the US and different currencies, particularly the yen. International merchants can make the most of these differentials utilizing DeFi, and open up new earnings.

“With a rate cut likely around the corner, DeFi yields look attractive again. This could be the catalyst to reboot crypto credit markets and revive interest in DeFi and Ethereum,” claimed Bernstein’s analysts.

Learn Extra: Bitcoin Crash, US Elections, Emergency Charge Minimize: Polymarket Merchants’ High Bets

These predictions have spurred Bernstein so as to add Ethereum-based liquidity protocol Aave to its portfolio. Particularly, the agency added Aave on the expense of two by-product protocols, GMX and Synthetix, which had been eliminated.

This clearly alerts two market developments that Bernstein anticipates. Initially, lending markets and worldwide liquidity might show the important thing to long-term positive aspects. Second, it’s betting Ethereum and protocols constructed on its blockchain regardless of current poor efficiency.

Up to now, quite a lot of components are nonetheless within the air. Charge cuts may very well be between 25 and 75 factors, in the event that they even happen in any respect. Nonetheless, Bernstein’s daring predictions may also help construct optimism within the area.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.