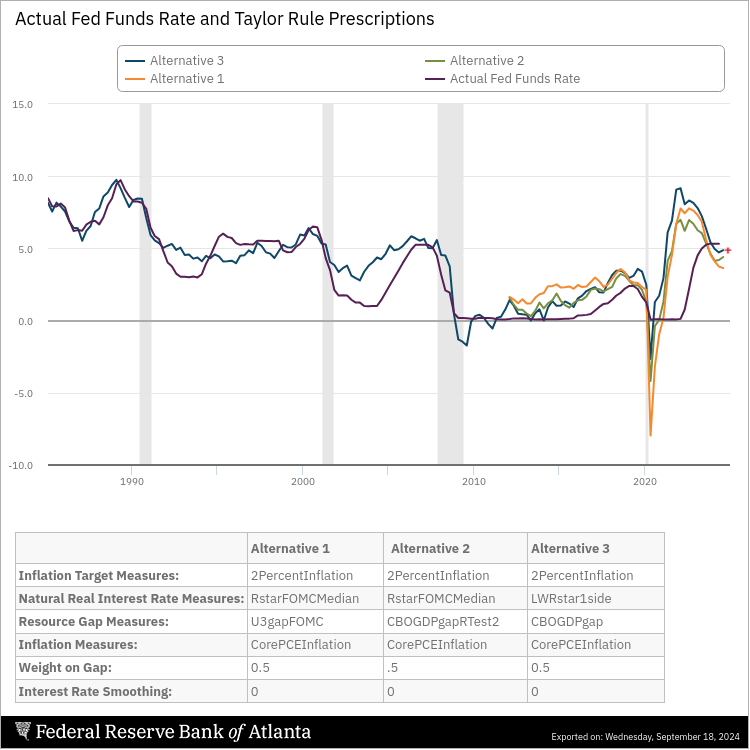

On the press convention for at this time’s FOMC assembly, there was quite a lot of discuss how the 50bps drop was dramatic. That centered on the change, fairly than the extent…Think about what some measures of the Taylor rule (which refers back to the stage of the Fed funds price) point out.

Supply: Atlanta Fed, accessed 18 Sep 2024. Crimson + by writer, indicating present Fed funds price at 4.83%. No smoothing included, so consider this as a “static” Taylor rule.

I believe Different 1 as a FAIT-like Taylor rule (with no smoothing), Different 2 as a extra conventional Taylor rule utilizing an output hole, whereas Different 3 makes use of a estimated r*.

By this measure, we’re “catching up” with the place we needs to be. One can mess around with the measures (within the Atlanta Fed’s nice Taylor rule utility) to get a barely completely different image (e.g., assume the r* is 2%). Nonetheless, I believe Different 3 is fairly cheap.