One of many attention-grabbing issues concerning the present debate over whether or not we’re about to enter a recession or not is the multitude of indicators that completely different folks glom onto — with none expressed formal rationale for choosing one over the opposite. See this listing of individuals within the recession camp, right here.

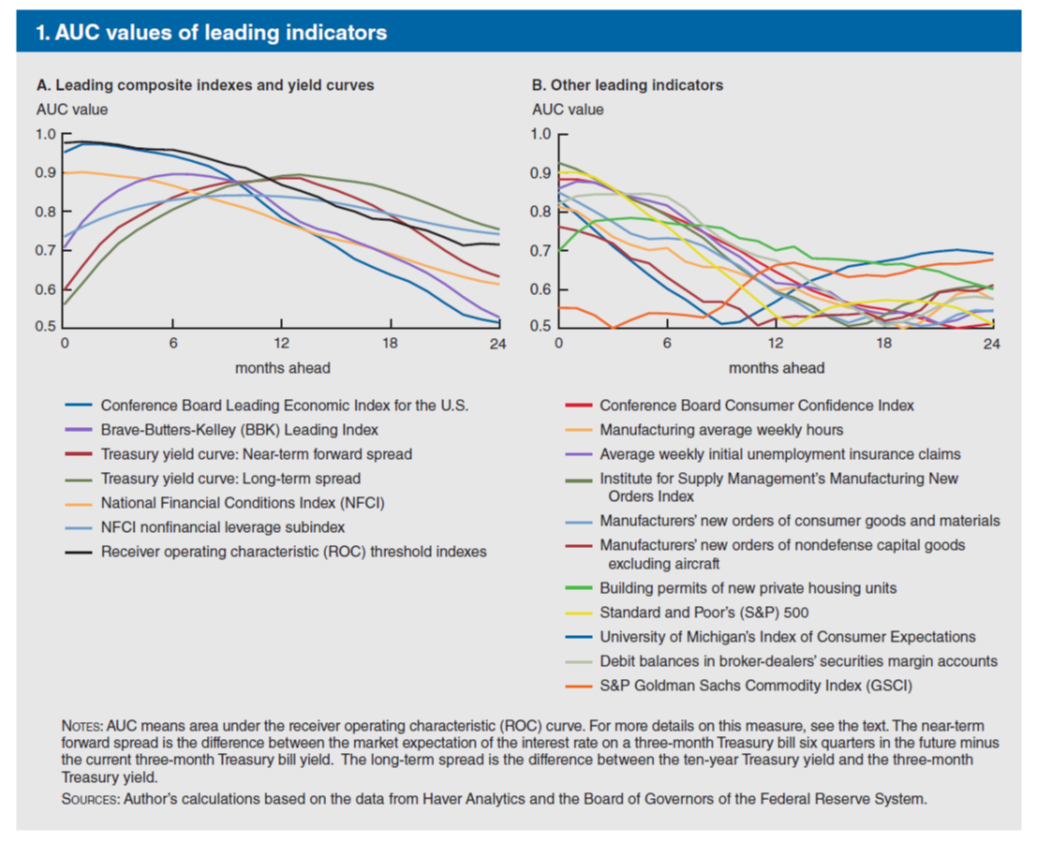

That’s why I discovered this (pre-pandemic) systematic comparability of the predictive content material of indicators, by David Kelley of curiosity. The important thing determine is reproduced beneath.

The Convention Board’s Main Financial Index is greatest at very brief horizons. A literal studying of the August studying signifies we’ve been in a recession for some time. That being mentioned, the 10yr-Fed funds unfold is among the elements of the index, and one of many primary drivers of the change over the past six months. If one is skeptical of this unfold, one may be skeptical of this studying (the opposite primary drivers have been client expectations of enterprise situations, and ISM new orders).

The 10yr-3mo unfold (used on this publish) is greatest at horizons of a 12 months.

From the conclusion:

The outcomes of this text present that at horizons roughly one 12 months forward and longer, the long-term Treasury yield unfold has traditionally been probably the most correct out there “predictor” of recessions. That mentioned, main indexes have been higher than particular person main indicators or monetary information at signaling recessions within the close to time period. The ROC threshold indexes constructed right here have additionally carried out properly as recession predictors within the close to time period as a result of they’re additionally successfully main indexes that mix the data within the inputs to offer a extra correct measurement of coming financial exercise.

Notice these are predictors. They’re not indicators of whether or not we’re in a recession (e.g., Sahm rule).