No obvious recession as of August 2024 information (my interpretation – see the opposing views right here). Utilizing year-ago monetary information, what would have probit regressions have indicated? It issues which variables you utilize, and whether or not you embrace the 2020 recession.

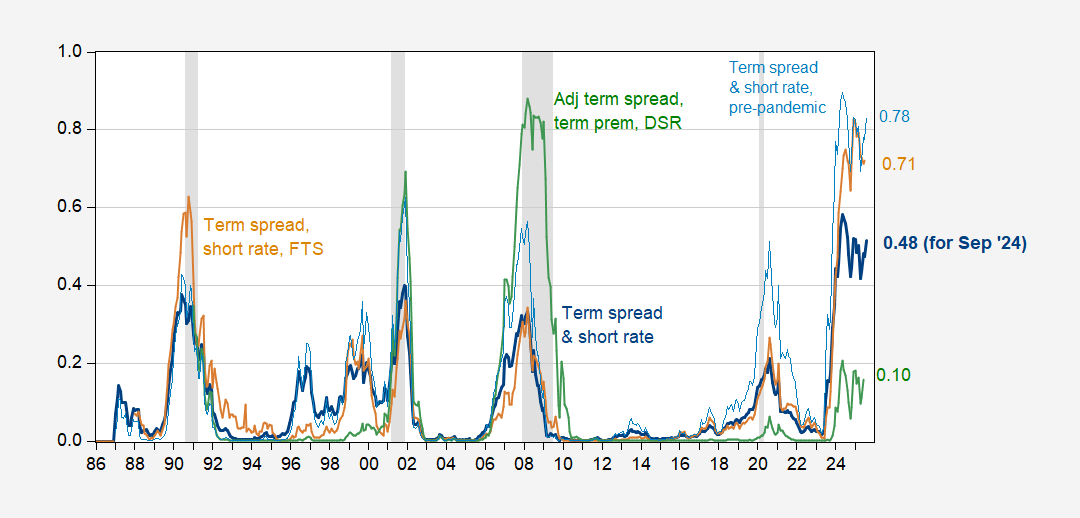

Determine 1: 12 months forward probit regression estimated chances, utilizing 10yr-3mo time period unfold and quick charge (daring darkish blue), identical utilizing pattern ending earlier than pandemic (mild blue), time period unfold, quick charge and international time period unfold (tan), term-premium adjusted 10yr-3mo time period unfold and time period premium and debt-service ratio (inexperienced). Pattern 1986-2024M08, assuming no recession has begun by 2024M08. NBER outlined peak-to-trough recession dates shaded grey. Numbers point out estimated chances for September 2024. Supply: writer’s calculations.

Dialogue of use of international time period unfold, a la Ahmed-Chinn (JMCB, 2024) right here; and use of debt-service ratio a la Chinn-Ferrara (2024) right here. Breaking out the time period premium mentioned right here.

Be aware that the chances related to the time period unfold/quick charge specification rely critically on the pattern used, specifically whether or not the 2020 recession is included within the time period unfold & quick charge specification. Utilizing solely time period unfold information as much as 2018M12 (so recession/no recession dummies as much as 2019M12) and predicting out-of-sample yields a recession chance of 78% in September (this month). Incorporating the 2020 recession into the pattern leads to solely a 48% chance for this month (peak at 58% in Might). If one thinks the 2020 recession wouldn’t have occurred with out the pandemic, then one may fairly argue for throwing that information out.

So… the recession should still come (or has already come and we don’t realize it).