Since July, crypto whales have distributed Ethereum (ETH) in massive volumes. This promoting strain affected the value, which cratered from over $3,500 at the moment to $2,140 within the first week of September.

Nevertheless, these identical whales appear to have provided ETH a breath of contemporary air with large-scale accumulation. On this on-chain evaluation, BeInCrypto explores what this might imply for traders because the market adjusts to a extra bullish atmosphere.

Ethereum Stakeholders Purchased 70,000 Cash

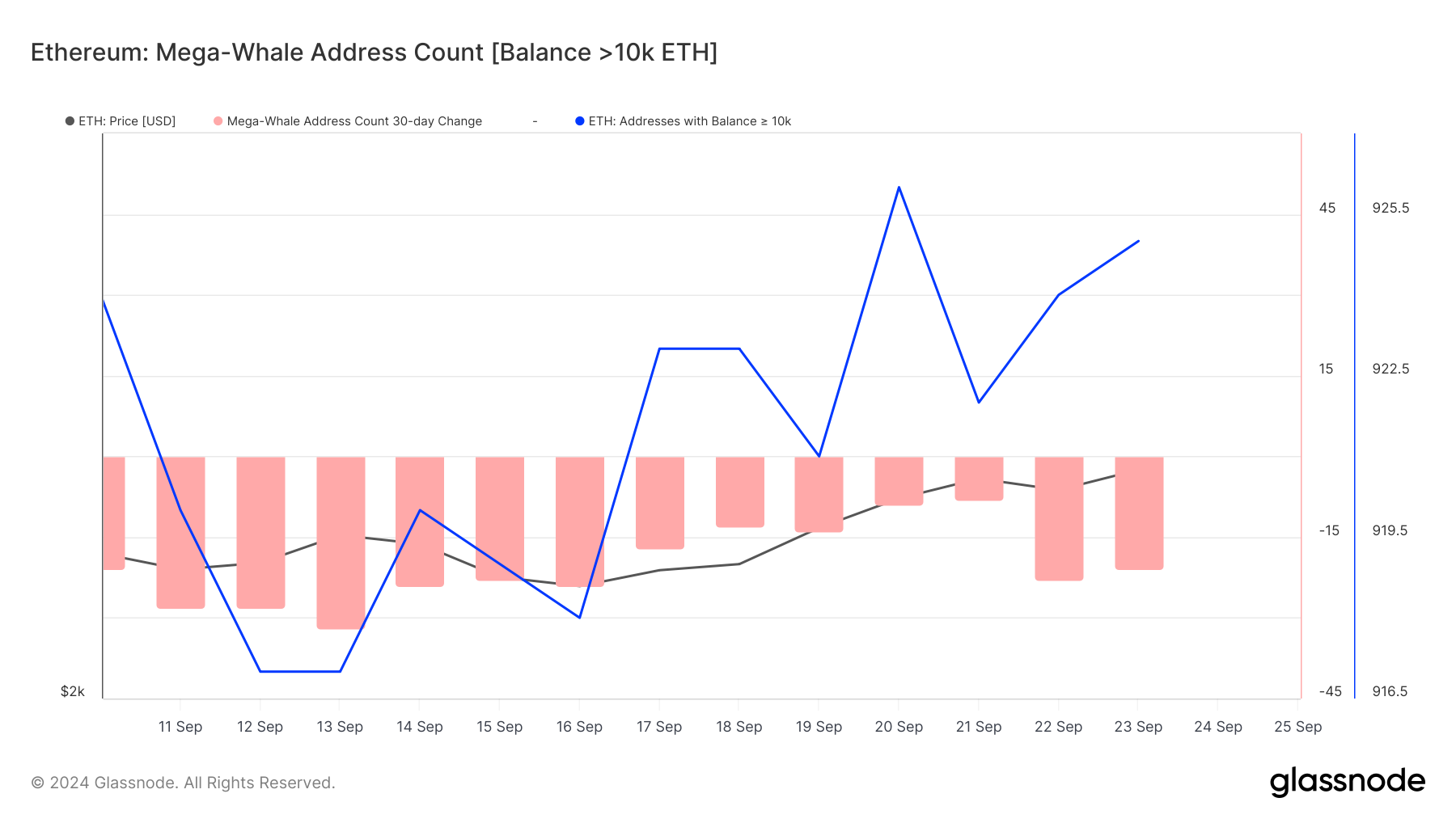

In keeping with Glassnode, the variety of Ethereum addresses holding at the very least 10,000 ETH was 918 on September 16. As of this writing, that determine has elevated to 925, indicating that Ethereum mega whales have collected at the very least 70,000 cash within the final seven days. At present costs, the acquisition quantities to over $185 million.

A lower in whale holdings is often a bearish signal for a cryptocurrency, and it often results in a worth lower. Subsequently, this vital accumulation means that Ethereum’s worth may proceed to understand.

Not too long ago, the value elevated from $2,295 to $2,640, fueling hypothesis that the cryptocurrency might be eyeing July highs.

Learn extra: Ethereum Restaking: What Is it and How Does it Work?

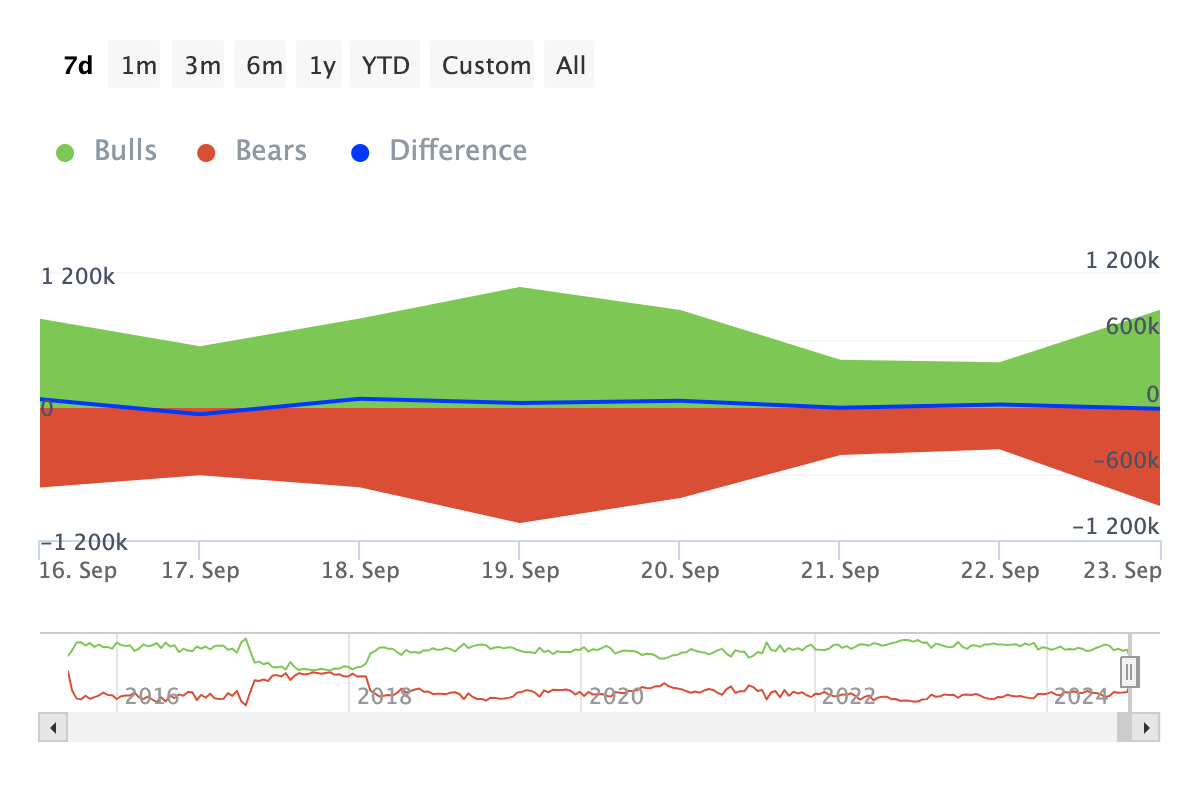

Whereas it is perhaps too quickly to conclude, the Bulls and Bears indicators appear to help an additional hike. Bulls are addresses that purchased at the very least 1% of the whole buying and selling interval inside a particular timeframe. Bears, then again, are people who offered an analogous quantity.

In keeping with IntoTheBlock, bulls have collected extra ETH than bears within the final seven days. As such, reasonably than succumb to a worth plunge, Ethereum’s worth may proceed its recently-found rally.

Roy Hui, Founder & CEO of Ethereum Layer-2 blockchain LightLink Chain, additionally appears to agree with the sentiment.

“Despite the challenges, ETH still boasts the largest number of developers, projects, users, and overall adoption in the space. The network effect where the value of a network increases with the square of its nodes is critical, and I believe ETH is currently undervalued,” Hui informed BeInCrypto.

ETH Value Prediction: Time for $3,037

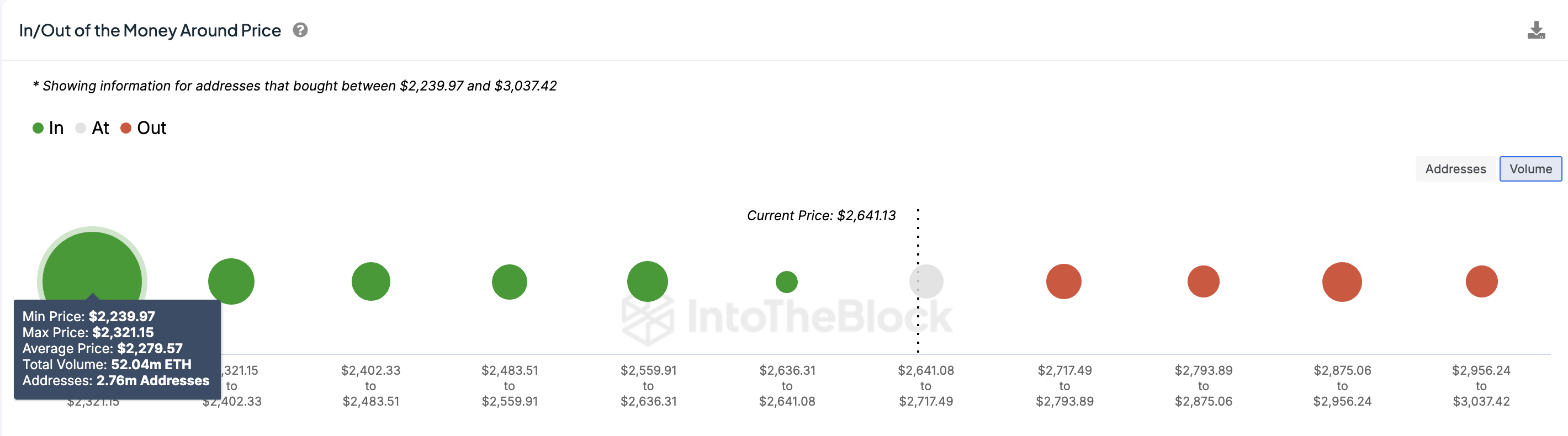

When it comes to Ethereum’s short-term outlook, the In/Out of Cash Round Value (IOMAP) reveals that 2.7 million addresses bought 52 million ETH round $2,279. This quantity is greater than the mixed variety of cash collected between $2,717 and $3,037.

Typically, the upper the quantity at a worth vary, the stronger the help or resistance. Subsequently, $2,279 seems to be a robust help degree for Ethereum.

Learn extra: How To Purchase Ethereum (ETH) With a Credit score Card: Full Information

Based mostly on this standing, ETH’s worth may break previous $2,717 as soon as shopping for strain intensifies once more. If that occurs, a rally past $3,037 might comply with.

Nevertheless, if Ethereum mega whales determine to remain on the sidelines or the Ethereum Basis begins distributing, the prediction is perhaps invalidated, and ETH’s worth might decline beneath $2,500.

Disclaimer

In step with the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.