China is contemplating injecting one trillion yuan (about $142 billion) into its largest banks to assist help its slowing economic system. This capital increase is aimed toward strengthening the banks’ capability to lend and stimulate progress, because the nation grapples with weaker financial efficiency.

The deliberations come shortly after the US Federal Reserve applied a 50 foundation factors charge minimize.

China Plans $1 Billion Capital Injection To Banks

Bloomberg reported the deliberations, citing individuals accustomed to the matter. Primarily based on the report, China will supply the funding from new sovereign bonds. As soon as it occurs, it would mark the primary time for the reason that international disaster in 2008 that Beijing has injected such a hefty sum into huge banks.

These plans come because the Chinese language economic system continues to wrestle. Accordingly, banks have already applied interventions, resembling important mortgage charge reductions and slashing key coverage charges.

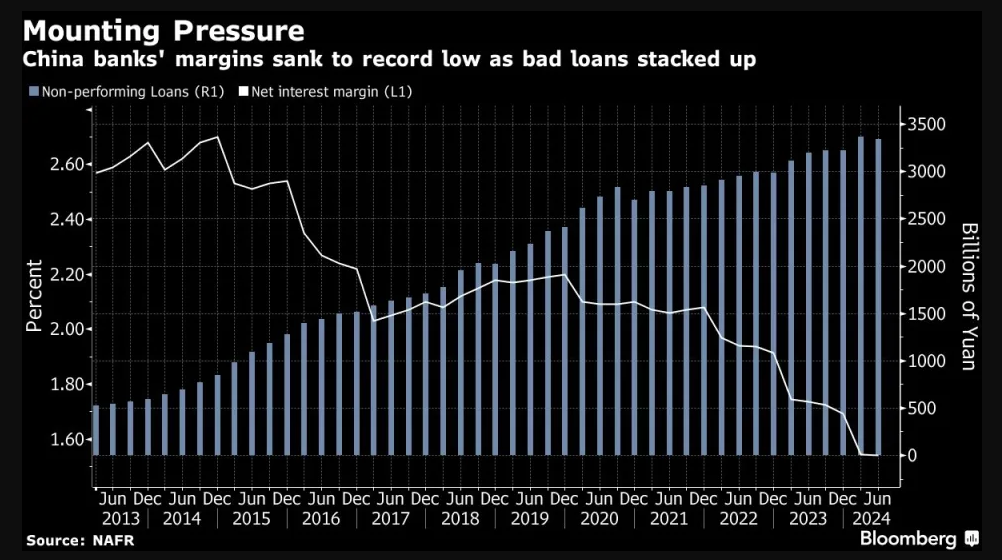

Whereas these interventions have seen the highest six banks construct their capital ranges past necessities, the Industrial & Industrial Financial institution of China Ltd. and the Financial institution of China Ltd., which had been introduced in as lenders to help the economic system, now endure document low margins, dwindling earnings, and rising unhealthy debt.

Learn extra: The best way to Shield Your self From Inflation Utilizing Cryptocurrency

Accordingly, the final notion is that the $1 billion capital injection will go a great distance in rising the banks’ capability to help the nation’s economic system.

“This is a different type of stimulus. If done through special bond issuance it is a fiscal stimulus and can stabilize the banks as property prices continue to decline. It will ensure that the banks’ lending capability won’t be affected,” Bloomberg reported, citing Develop Funding Group head economist Hao Hong.

Chinese language regulators have additionally been calling on the nation’s huge banks to help the struggling economic system. They enchantment for cheaper loans to dangerous debtors, which may play properly for risk-on belongings like Bitcoin (BTC).

Certainly, cheaper and, subsequently, simpler loans, which basically means lowered rates of interest, may assist stimulate spending and funding. This elevated liquidity can profit riskier belongings like Bitcoin and shares, which frequently see beneficial properties when borrowing prices drop.

Su Zhu, the founding father of the now-defunct Three Arrows Capital, additionally famous the doable implication of fiscal support. He insinuated that crypto costs may gain advantage from the capital injection.

Learn extra: Bitcoin (BTC) Value Prediction 2024/2025/2030

These remarks and bouts of optimism come as Bitcoin’s value has a monitor document of being intently tied to international liquidity. This, in line with economist Lyn Alden, suggests that the Chinese language stimulus package deal may encourage a worth surge for crypto.

In the meantime, it’s unimaginable to miss China’s crypto ban in 2021 after a hostile stance towards digital belongings courting again to 2013. Triggers ranged from monetary crime, financial instability, and capital flight from its markets as customers bypassed typical restrictions. Towards this backdrop, some query whether or not the $1 billion fiscal support may have an effect on crypto.

“What does China injecting money in their banks have to do with Bitcoin? They are not allowed to buy Bitcoin with that money afaik [as far as I know],” one X consumer stated.

Nevertheless, there’s reportedly an rebellion towards this ban, with Chainalysis reporting a $75.4 billion wager on Bitcoin from Chinese language merchants. Over-the-counter crypto brokers in China proceed to document rising inflows, reaching as much as $20 billion quarterly. Within the final 9 months, they noticed a complete of $75.4 billion in inflows.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.