Robinhood and Revolut are contemplating stablecoin launches, as Markets in Crypto-Property (MiCA) regulation might disrupt Tether’s market domination within the EU.

Nonetheless, neither agency has made concrete assurances, and there are different opponents.

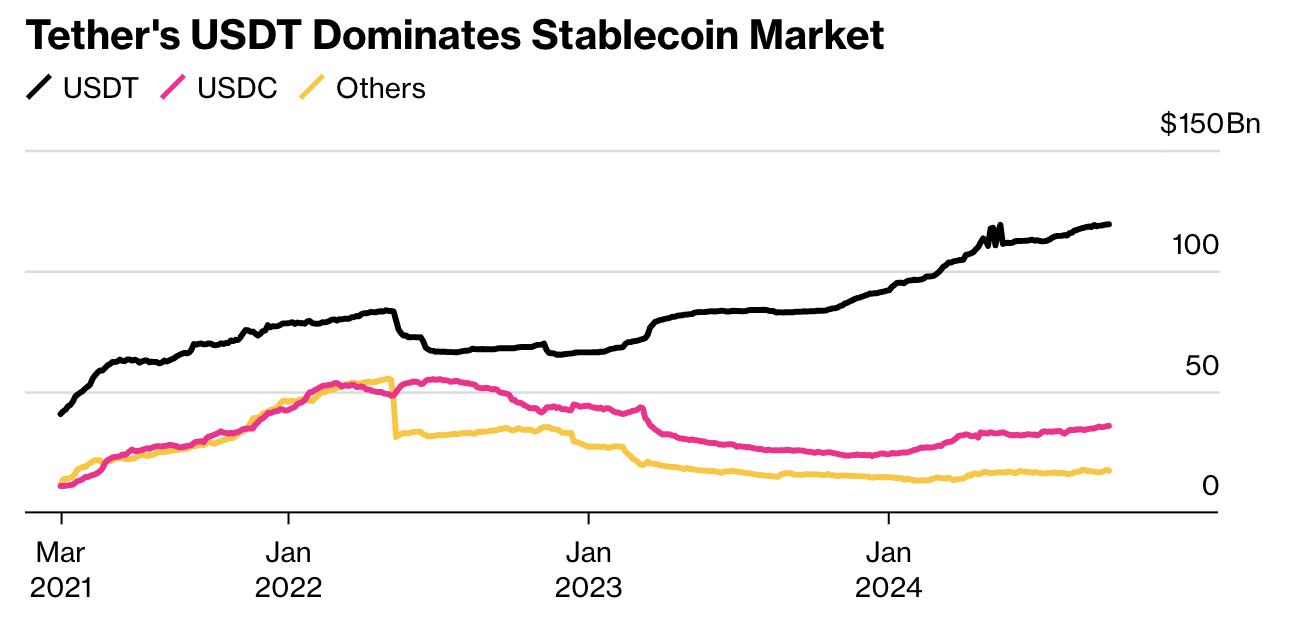

Tether’s Market Domination

Bloomberg experiences that Robinhood and Revolut, two large fintech corporations, are contemplating getting into the stablecoins market. The 2 corporations hope to loosen Tether’s overwhelming dominance within the stablecoin market. Neither firm has formally made agency commitments on the topic, and no staff have spoken on the report.

Learn Extra: A Information to the Greatest Stablecoins in 2024

Nonetheless, the timing may be very ripe. Robinhood and Revolut wouldn’t be the one main capital corporations trying into stablecoins.

On Thursday, Ethena Labs launched a brand new stablecoin backed by the BlackRock USD Institutional Digital Liquidity Fund (BUIDL). This stablecoin is designed to emulate the soundness of conventional stablecoins by tying its worth to BUIDL, a fund that features US {dollars}, short-term US Treasury payments, and repurchase agreements.

MiCA: A Big Alternative

The explanation for this excessive degree of curiosity is easy. MiCA, the EU’s new complete crypto laws, is about to take impact quickly, and it contains stringent guidelines for stablecoins.

Circle already possesses the related licensing to function within the EU, nevertheless it hasn’t severely challenged Tether’s dominance in over two years. If Tether can’t meet compliance, your entire EU market can be ripe for brand spanking new competitors. That’s a prize too tempting to disregard, particularly for enormous corporations like Robinhood and Revolut.

“Many businesses have looked at the likes of Circle and Tether and the figures they’ve posted. It sounded like a beautiful business model, and there are many out there that might want to replicate tha,” Thomas Eichenberger, Chief Product Officer at Sygnum, stated.

In spite of everything, Bloomberg famous, Tether employed round 100 folks when it banked $5.2 billion in revenue earlier this 12 months. In asset beneath administration (AUM), it’s comparatively gargantuan.

Stablecoins are a rising market worldwide, particularly in rising economies. Growing numbers of shoppers are utilizing stablecoins as a store-of-value or on a regular basis purchases. Their use in serving to customers evade US sanctions has additionally gathered massive curiosity.

Even earlier than the precise alternative of MiCA, the opportunity of breaking Tether and Circle’s duopoly has attracted buyers. PayPal launched its personal stablecoin for this precise objective a 12 months in the past, and in the present day, it’s approaching $1 billion. Tether has almost $120 billion, although. If your entire EU has the possibility to outcompete it, there will likely be no scarcity of contestants.

Learn Extra: What Is Markets in Crypto-Property (MiCA)?

Nonetheless, Robinhood and Revolut haven’t made any agency commitments but. To reap the benefits of MiCA, nonetheless, they’ll must act quick. Many exchanges within the EU have partially delisted Tether stablecoins, however there are some holdouts.

Tether will function in a authorized gray space, and in any occasion Circle is already compliant. A really wide selection of outcomes is feasible.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.